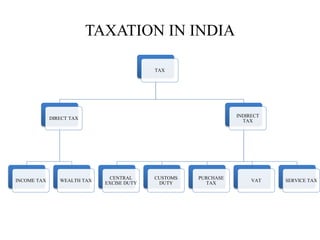

- The document discusses taxation laws in India, including the meaning of tax, types of taxes (direct and indirect), and reasons taxes are levied.

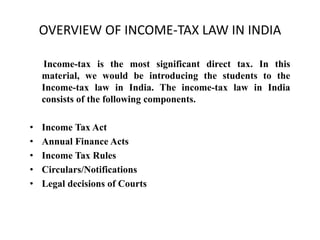

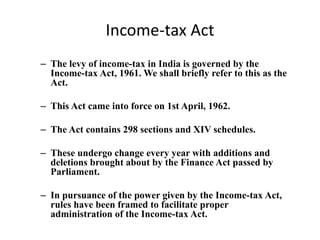

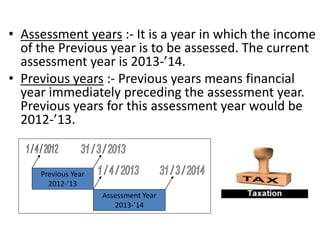

- It provides an overview of the taxation system in India, including the major direct and indirect taxes. It also summarizes key aspects of income tax law in India such as the Income Tax Act of 1961, Finance Acts, Income Tax Rules, and case laws.

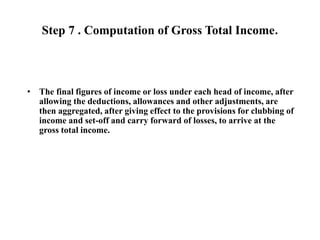

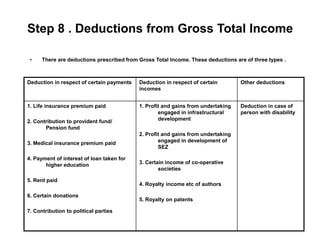

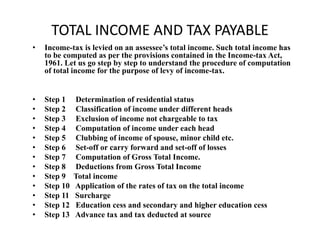

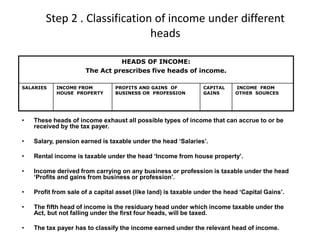

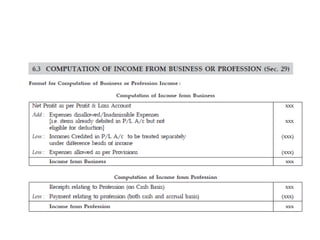

- The document outlines the process for computing total income for tax purposes, which involves determining residential status, classifying income under different heads, excluding non-taxable income, computing income under each head, applying rules for clubbing of family income and loss set-off, and determining deductions to arrive at

![Continued…….

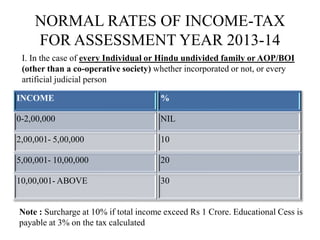

INCOME %

0- 250,000 NIL

250,001- 5,00,000 10

500,001- 10,00,000 20

10,00,001-ABOVE 30

III. In the case of every individual, being a resident in India, who is of the

age of 60 years or more but below the age of 80 years at any time during the

previous year. [Senior citizen]

Note : Surcharge at 10% if total income exceed Rs 1 Crore. Educational Cess is payable at

3% on the tax calculated.](https://image.slidesharecdn.com/ppt-1taxation-140408093922-phpapp01/85/Ppt-1-taxation-18-320.jpg)

![Continued…….

INCOME %

0- 5,00,000 NIL

5,00,001- 10,00,000 20

10,00,001- ABOVE 30

IV. In the case of every individual, being a resident in India, who is of the age

of 80 years or more at any time during the previous year. [Very senior citizen]

Note : Surcharge at 10% if total income exceed Rs 1 Crore. Educational Cess is payable

at 3% on the tax calculated](https://image.slidesharecdn.com/ppt-1taxation-140408093922-phpapp01/85/Ppt-1-taxation-19-320.jpg)

![PROFITS AND GAINS OF BUSINESS

OR PROFESSION

• BUSINESS [Sec. 2(13)]

Definition of “Business” includes any trade, commerce or manufacture or

any adventure or concern in the nature of trade, commerce or manufacture.

• PROFESSION [Sec. 2(36)]

Profession involves an exercise of intellect and skill based on learning and

experience.](https://image.slidesharecdn.com/ppt-1taxation-140408093922-phpapp01/85/Ppt-1-taxation-26-320.jpg)

![CAPITAL GAINS

• 1. Capital Asset: [Section 2(14)]

• Includes :

• Property of any kind, whether or not connected with business or profession

• Excludes :

• (a) Stock in trade

• (b) Personal Effects

• (c) Rural Agricultural Lands in India

• (d) 6 ½ % Gold Bonds 1977; 7% Gold Bonds 1980 & National Defence

Gold Bonds, 1980.

• (e) Special Bearer Bonds, 1991

• (f) Gold Deposit Bonds issued under Gold Deposlt Scheme 1999](https://image.slidesharecdn.com/ppt-1taxation-140408093922-phpapp01/85/Ppt-1-taxation-28-320.jpg)

![INCOME FROM OTHER SOURCES

• (i) Dividend [Sec. 56 (2) (i)]

• (ii) Any winnings from lotteries, crossword puzzles, races including horse races, card games

and other games of any sort or form, gambling or betting of any form or nature whatsoever-

[Sec. 56(2)

• (iv) Income by way of interest on securities, if it is not chargeable as Profits and gains of

business i.e. where securities are held as investments- Sec. 56(2)(id).

• (v) Income from machinery, plant or furniture belonging to the assessee let on hire, if the

income is not chargeable to income-tax under the head, Profits and gains of Business or

Profession - Sec. 56(2)(ii).

• (vi) Income from letting of machinery, plant or furniture, if such income is not chargeable

under the head “Profits and gains of Business or Profession”- Sec. 56(iii)

• (viii) Gifts aggregating to more than ` 50,000 in a year on or after 1st Day of April, 2006 -

Sec. 56(vi)

• (ix) Taxation of property acquired without consideration or for an inadequate

consideration as ‘income](https://image.slidesharecdn.com/ppt-1taxation-140408093922-phpapp01/85/Ppt-1-taxation-29-320.jpg)