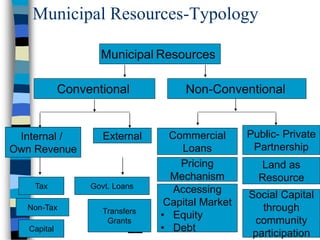

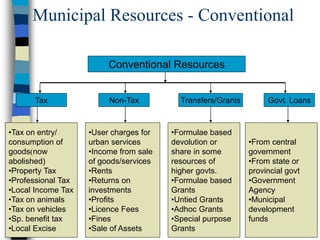

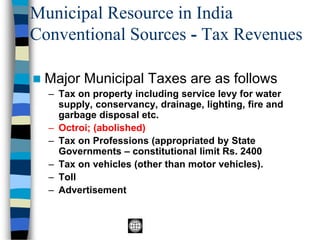

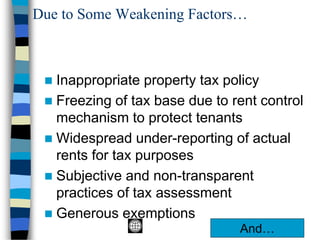

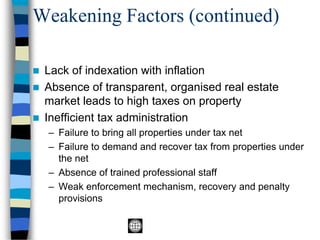

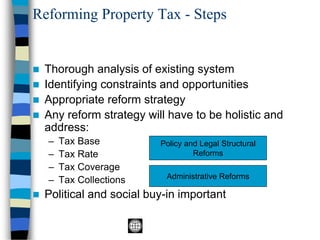

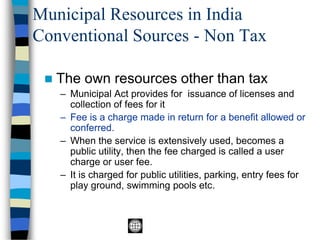

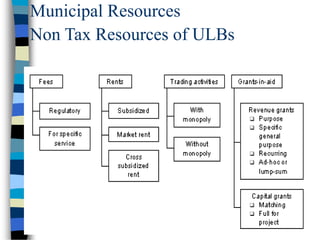

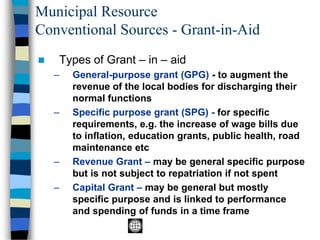

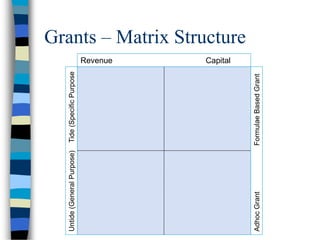

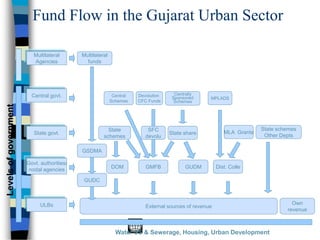

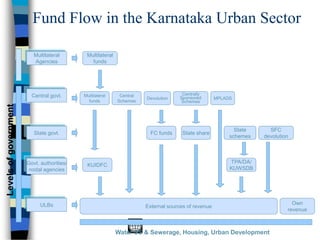

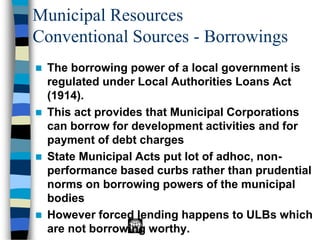

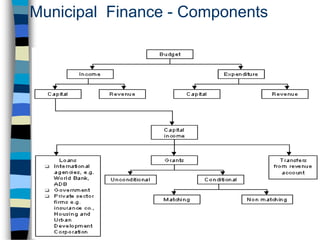

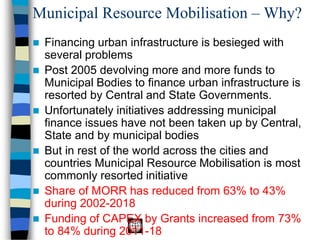

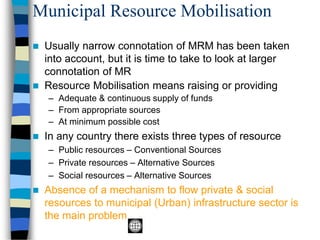

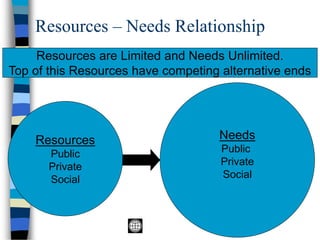

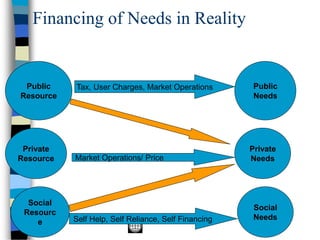

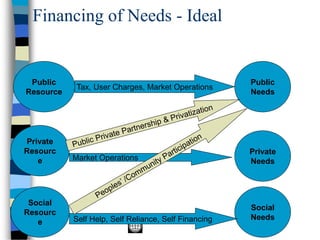

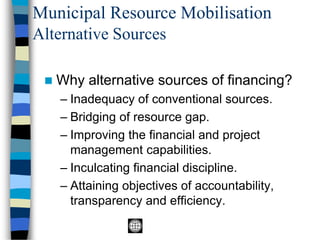

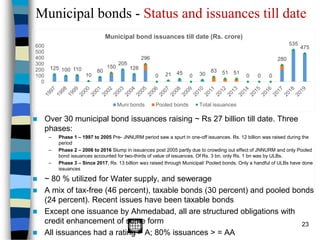

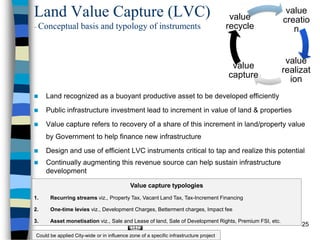

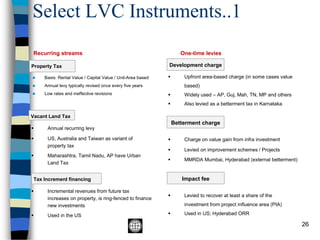

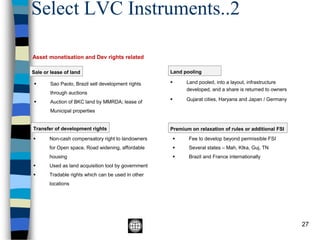

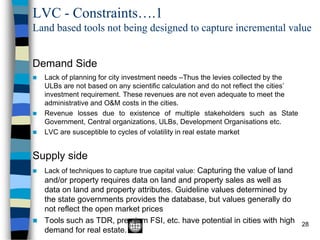

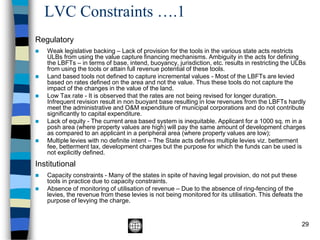

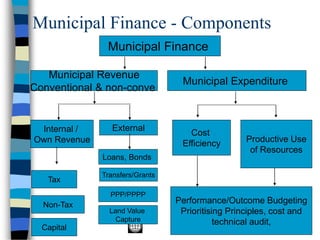

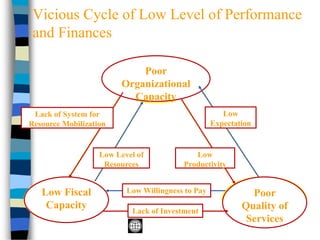

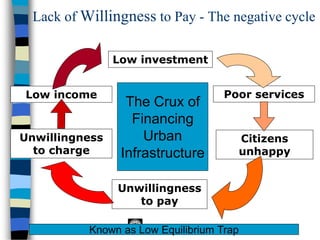

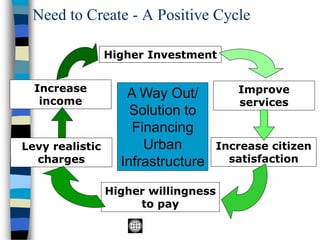

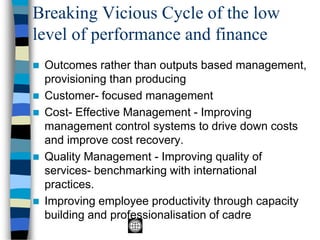

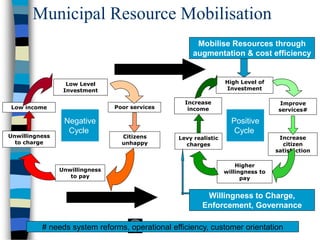

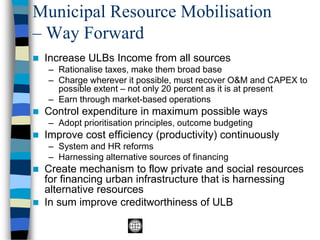

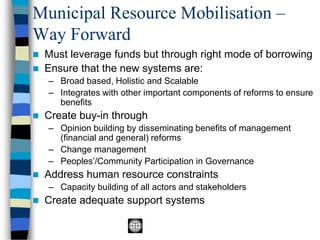

The document discusses municipal resource mobilization strategies in India, emphasizing the importance of diversifying revenue sources beyond conventional tax revenues and grants. Key issues such as ineffective property tax policies, inadequate financing mechanisms, and the need for structural reforms are highlighted to improve local urban governance and infrastructure financing. It also explores alternative financing options like municipal bonds, public-private partnerships, and land value capture to enhance municipal revenue and efficiency.