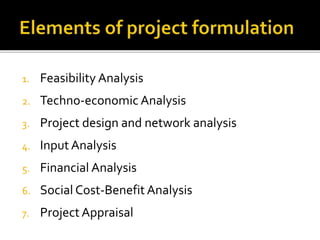

The document discusses the process of project formulation, which involves systematically developing and investigating project ideas to determine if they should be invested in. It involves experts from various fields conducting feasibility analyses from technical, market, financial, and social perspectives. If the analyses show a project is feasible, a detailed project report is created that serves as the work plan for implementation and helps obtain necessary approvals and funding. Project formulation helps decide whether to accept or reject a project idea before significant resources are invested.