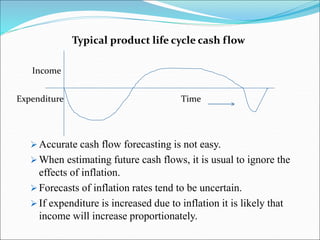

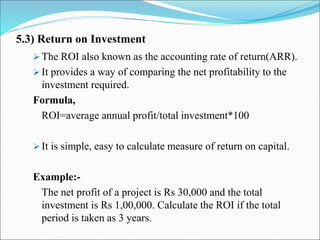

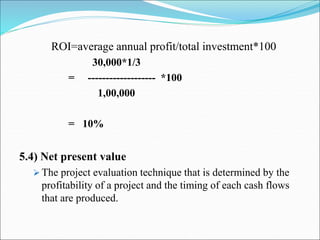

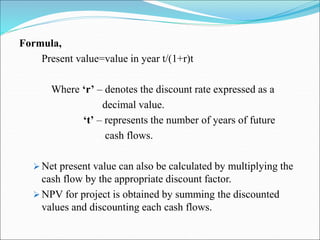

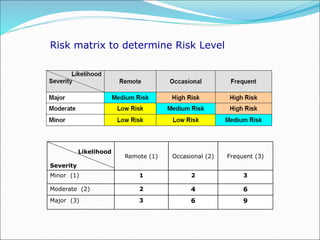

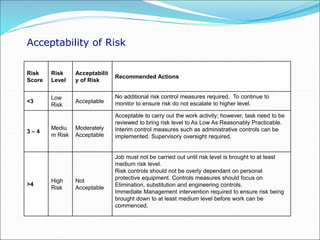

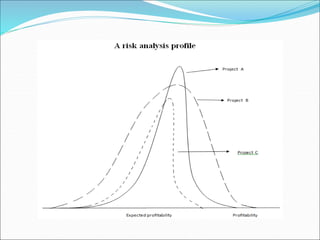

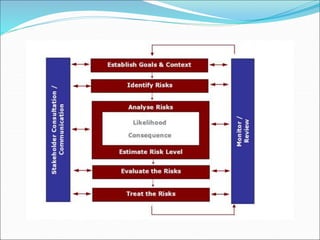

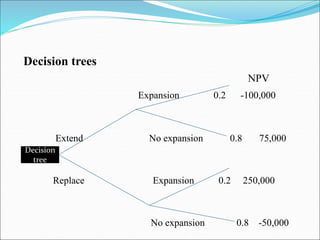

This document discusses project evaluation methods including strategic, technical, and economic assessments. It describes assessing projects based on objectives, required functionality, infrastructure limitations, and more. It also covers cost benefit analysis techniques like net present value, internal rate of return, payback period and cash flow forecasting. Finally, it discusses risk evaluation including identification, analysis, cost benefit analysis, sensitivity analysis, and using decision trees to evaluate outcomes and strategies.