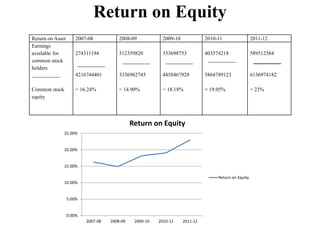

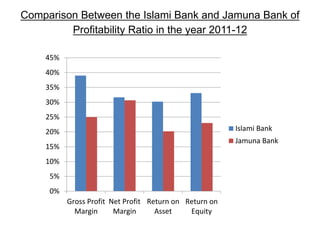

The document presents profitability ratio analyses for Islami Bank Bangladesh Ltd. and Jamuna Bank Ltd. over multiple years. It includes the gross profit margin, net profit margin, return on assets, return on equity, and earnings per share for both banks from 2007-2008 to 2011-2012. Graphs show that for most ratios and years, Islami Bank performed better than Jamuna Bank, with higher gross profit margins, net profit margins, returns on assets and equity, and earnings per share.