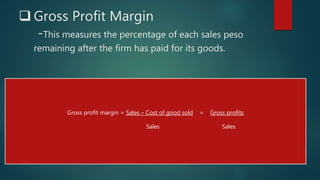

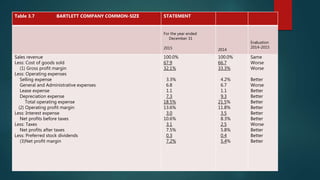

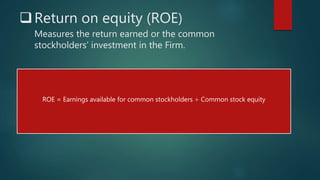

The document discusses profitability ratios which help analysts assess a firm's profits in relation to sales, assets, or investment. It highlights key ratios from common-size income statements: gross profit margin, operating profit margin, and net profit margin, along with other metrics like earnings per share, return on total assets, and return on equity. Formulas for each ratio are provided, emphasizing their importance for understanding financial performance.