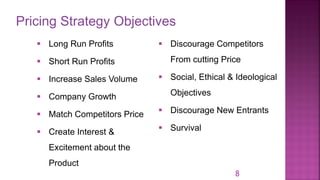

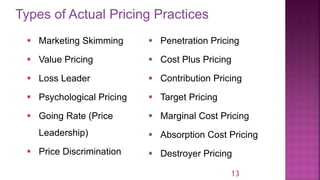

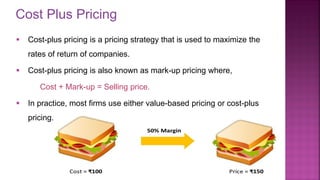

The document outlines various pricing practices and strategies used by companies in the context of complex modern markets. It discusses theoretical pricing approaches for different market structures, practical factors influencing pricing, and strategies like price discrimination, penetration pricing, and loss leader pricing. Success in pricing requires understanding customer perception, competition, and company objectives to maximize profitability while adapting to market conditions.