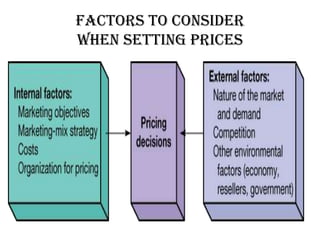

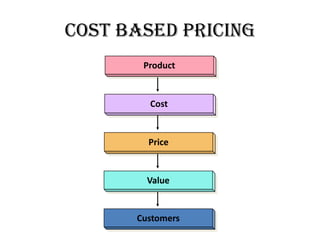

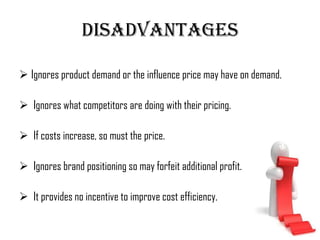

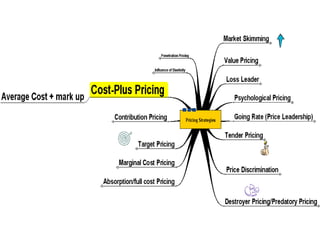

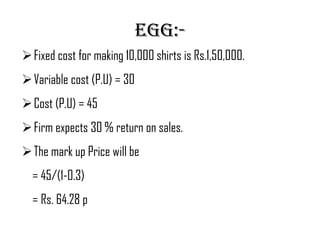

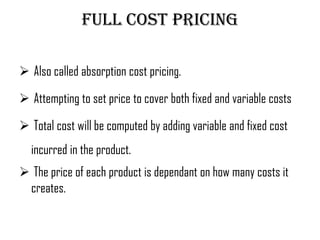

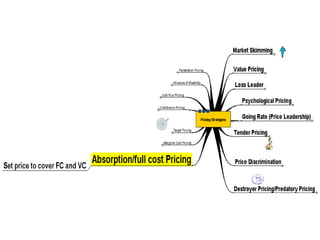

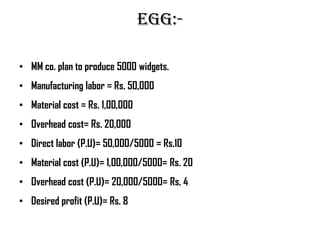

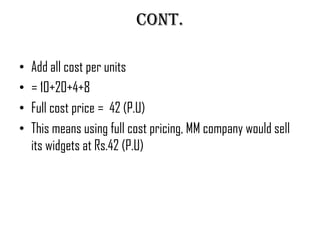

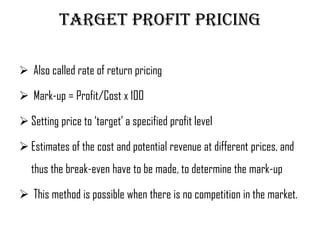

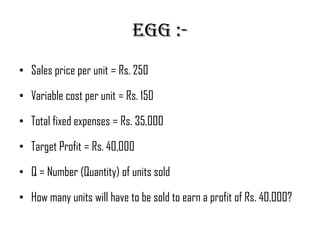

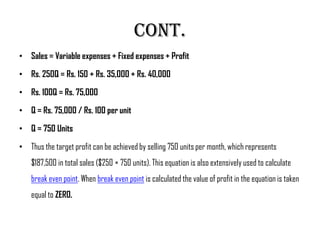

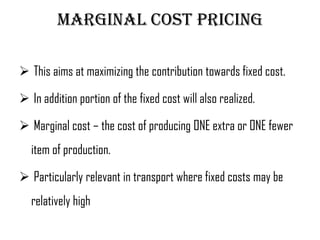

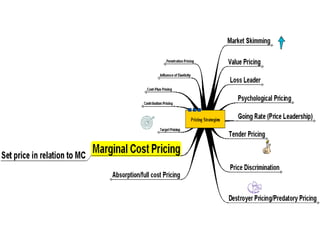

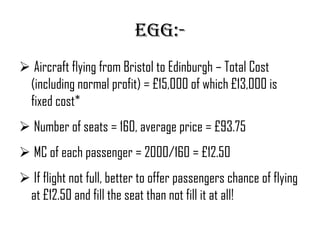

This document discusses cost based pricing. Cost based pricing sets the price of a product based on the costs to produce it, including direct costs, indirect costs, and an additional amount for profit. The key advantages are that it is simple and flexible to adjust prices as costs change. However, it ignores factors like demand, competition, and brand positioning. There are different types of cost based pricing like cost plus pricing, full cost pricing, and target profit pricing.