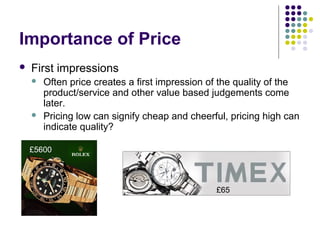

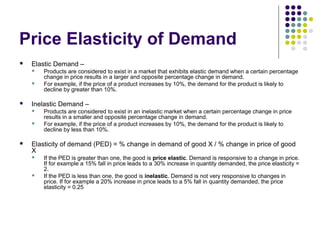

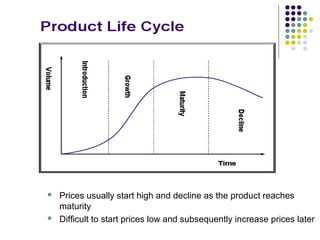

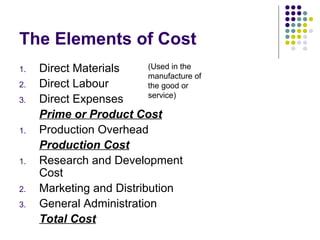

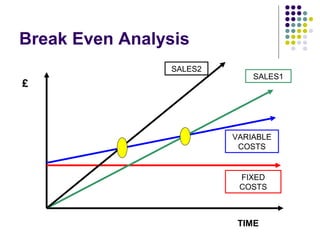

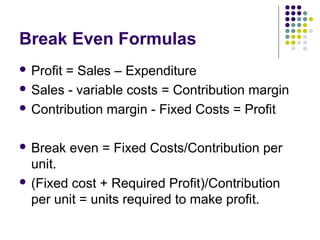

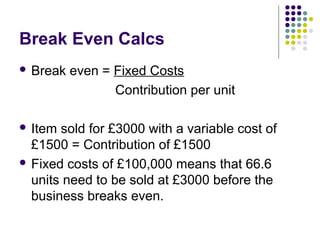

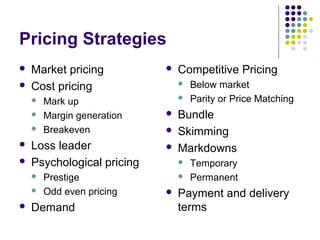

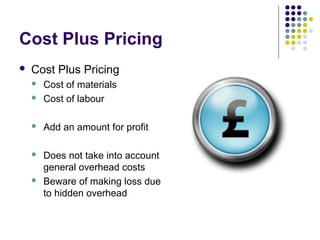

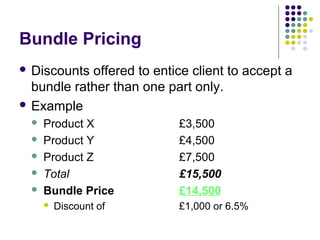

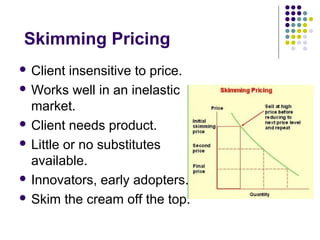

The document outlines essential factors and strategies to consider when setting prices for products or services, emphasizing the importance of understanding costs and market positioning. It discusses various pricing strategies, such as market pricing, cost-plus pricing, and psychological pricing, and highlights the need to analyze demand elasticity. Additionally, it covers breakeven analysis and the impact of pricing choices on perceived quality and customer behavior.