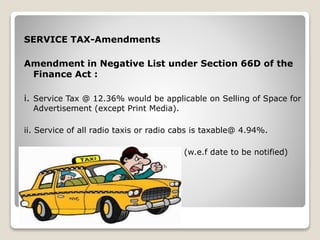

The document outlines recent amendments to service tax under the Finance Act, including new taxable services such as advertisement space and radio taxi services, along with various exemptions and changes in the scope of taxation. It details adjustments in service tax rates, abatement rules, reverse charge mechanisms, and Cenvat credit rules, effective from specified dates. Additionally, it covers updates to central excise provisions, including mandatory e-payment and changes in customs duty regulations.

![AMENDMENT IN CENTRAL EXCISE RULES, 2002:

E-payment is being made mandatory for all assessees .

Assistant Commissioner or the Deputy Commissioner allow

an assesses to pay duty by any other way.

[w.e.f. 01.10.2014]

(Notification No. 19/2014, Central Excise (N.T.))](https://image.slidesharecdn.com/indirecttax-budget2014-sma-140728011129-phpapp01/85/Budget-2014-Indirect-Tax-Provisions-23-320.jpg)

![AMENDMENT IN CENTRAL EXCISE VALUATION

(DETERMINATION OF PRICE OF EXCISABLE GOODS)

RULES, 2000:

• Proviso to Rule 6 of the Valuation Rules - where price is not

the sole consideration for sale and goods are sold at a price

less than cost and profit, value shall be transaction value.

[w.e.f. 11.07.2014]

(Notification No. 20/2014, Central Excise (N.T.))](https://image.slidesharecdn.com/indirecttax-budget2014-sma-140728011129-phpapp01/85/Budget-2014-Indirect-Tax-Provisions-24-320.jpg)