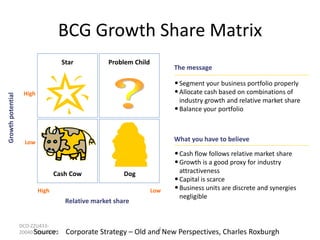

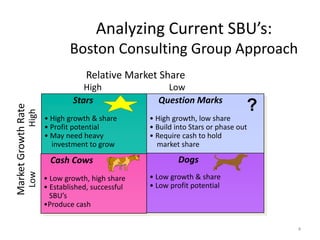

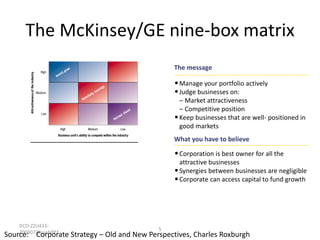

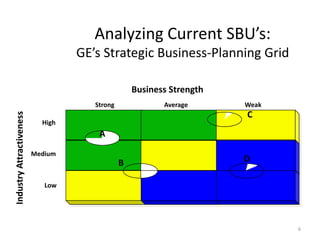

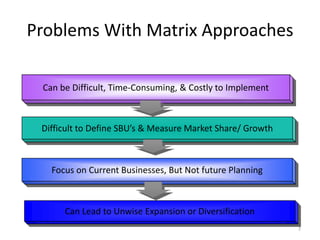

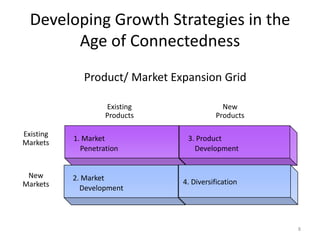

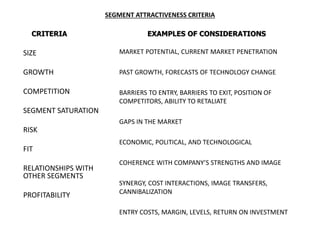

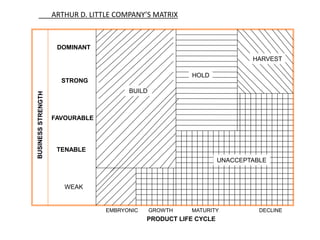

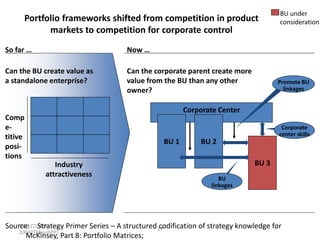

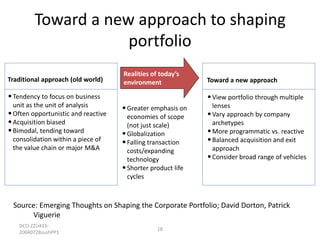

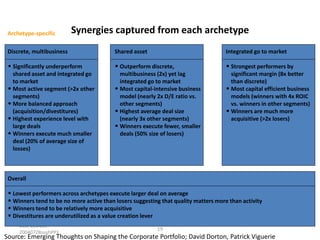

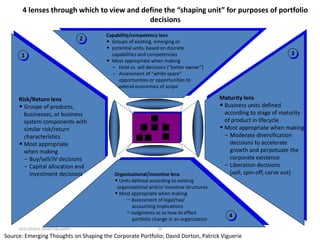

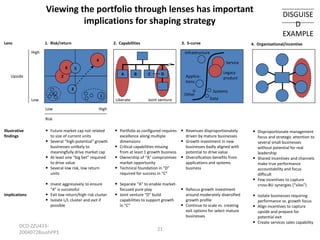

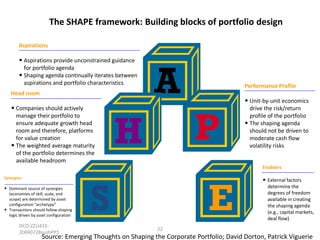

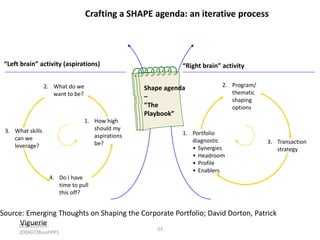

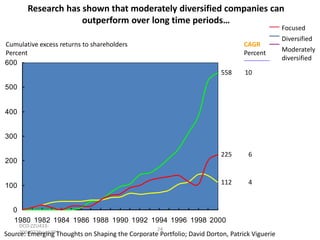

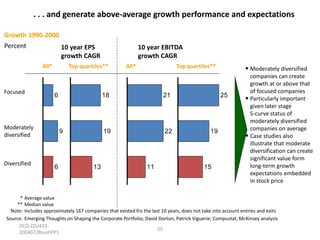

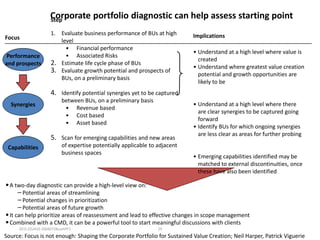

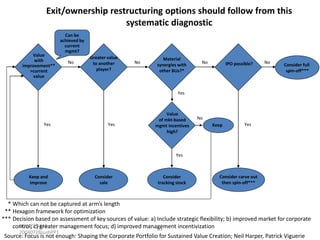

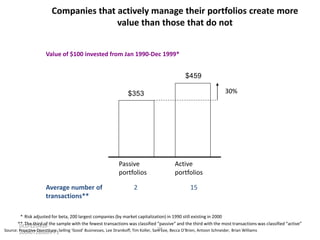

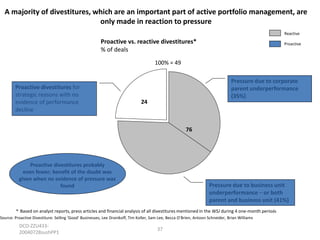

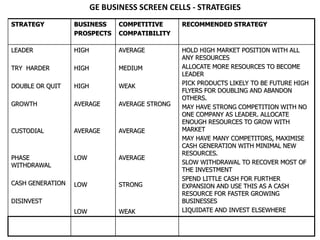

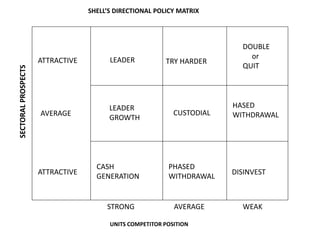

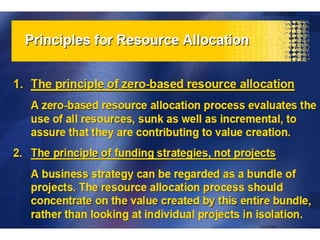

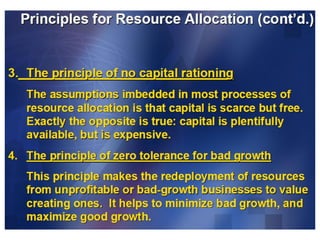

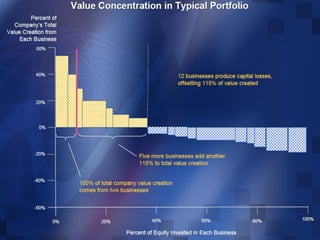

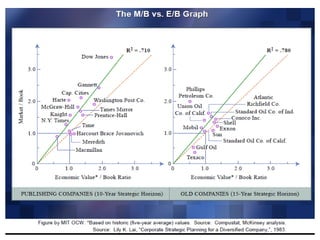

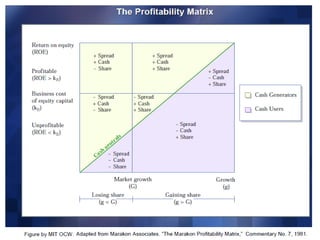

Portfolio management involves analyzing a company's current business portfolio, known as strategic business units (SBUs), to determine which should receive more or less investment and developing strategies to add new products or businesses. Common tools for analyzing SBUs include the Boston Consulting Group growth-share matrix and McKinsey's nine-box matrix, which assess businesses based on factors like market growth and share. However, these tools have limitations and don't support future planning. A company must also consider how to connect with customers through market segmentation, targeting, and positioning. Developing the right portfolio requires balancing factors like risk, return, capabilities, maturity, and organizational structure. [END SUMMARY]