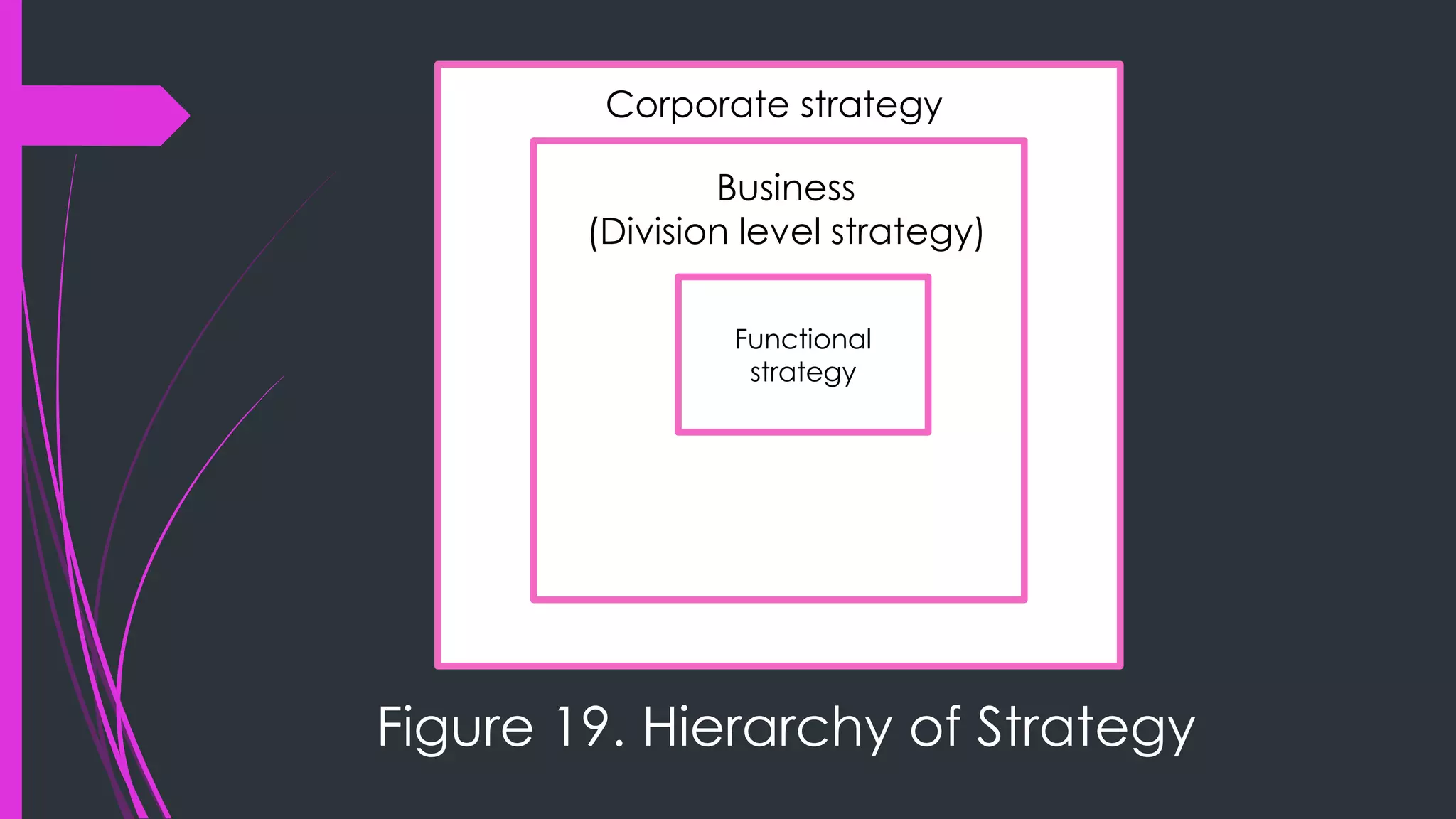

This document discusses various strategies and concepts related to corporate level strategy. It begins by defining different categories of business organizations such as sole proprietorships, partnerships, and corporations. It then discusses the nature of corporate level strategy and key issues like directional, portfolio, and parenting strategies. Some strategic choices at the corporate level are also outlined, including business closure, acquisition, and reorganization. Integration and diversification options are presented, including vertical and horizontal integration as well as related and unrelated diversification. The final sections cover internationalization strategies and strategic alliance options.