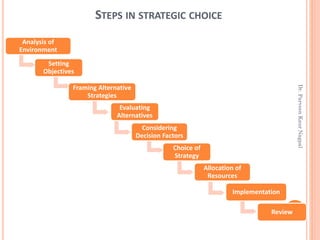

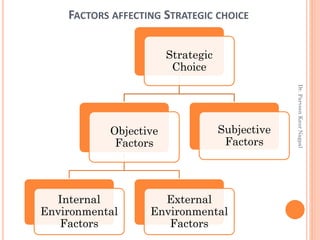

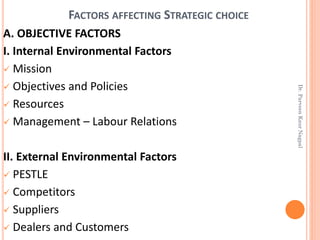

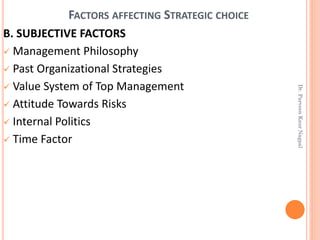

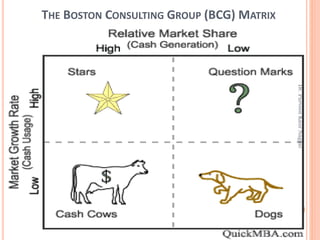

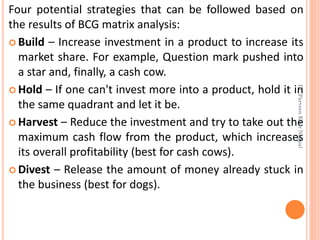

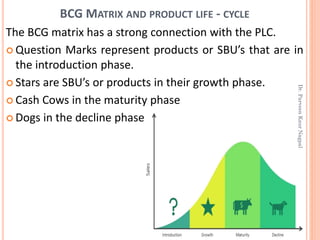

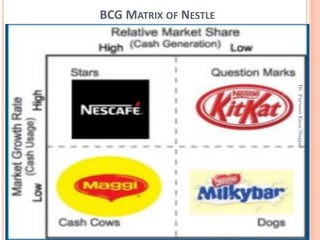

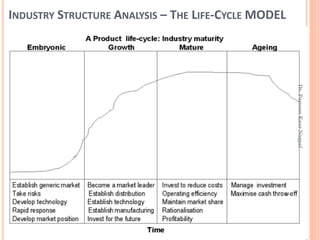

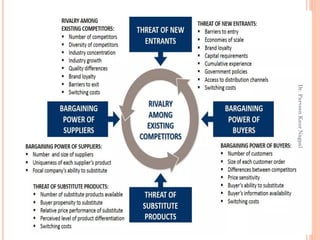

The document discusses the processes and tools for strategic analysis and implementation, including internal and external analyses like SWOT and PESTLE. It explains strategic choice, highlighting factors affecting it and methods such as the Boston Consulting Group (BCG) matrix and GE planning grid to guide decision-making in resource allocation. Additionally, it covers industry life cycles and Porter's Five Forces model for evaluating competitive positioning within an industry.