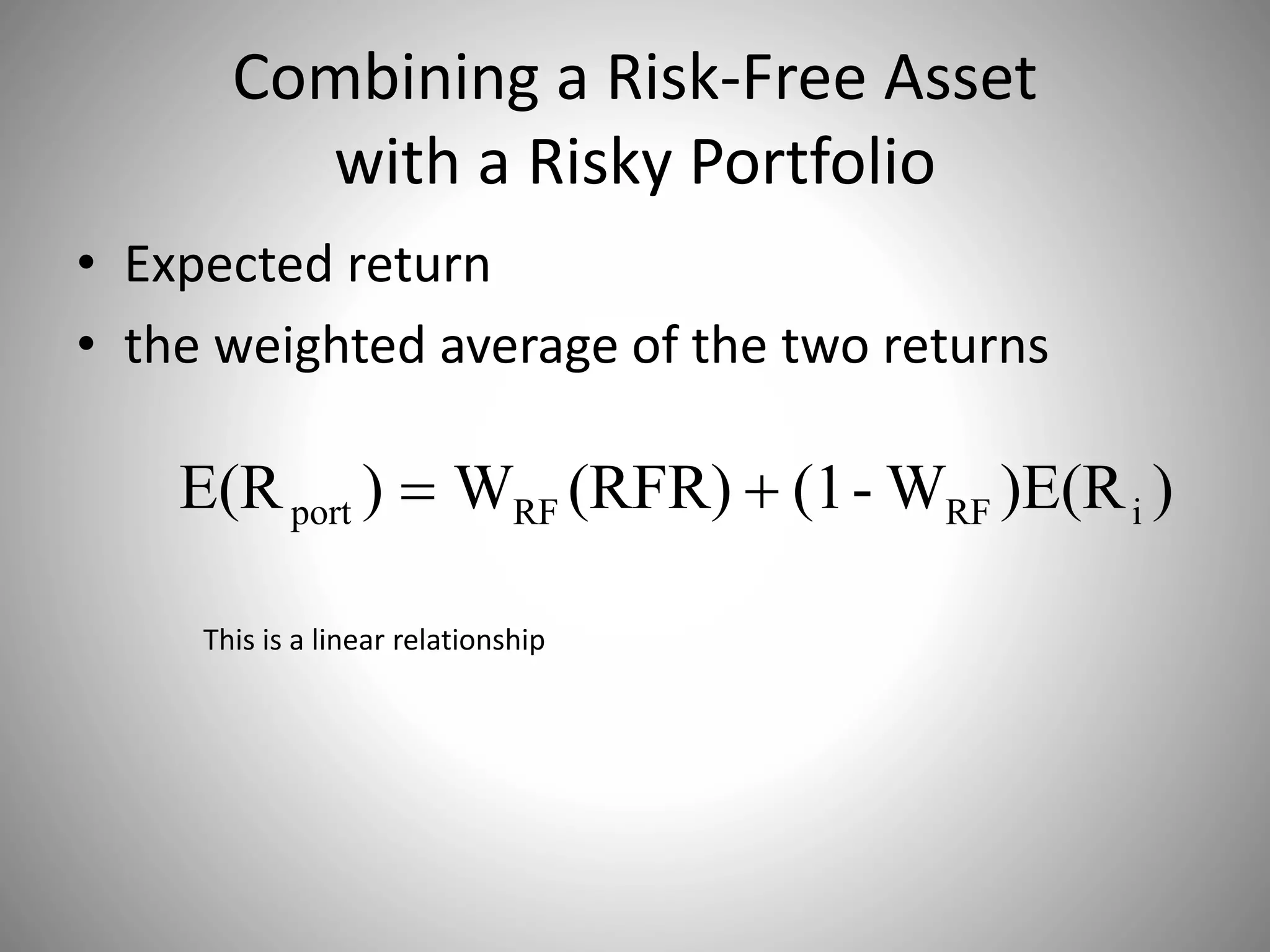

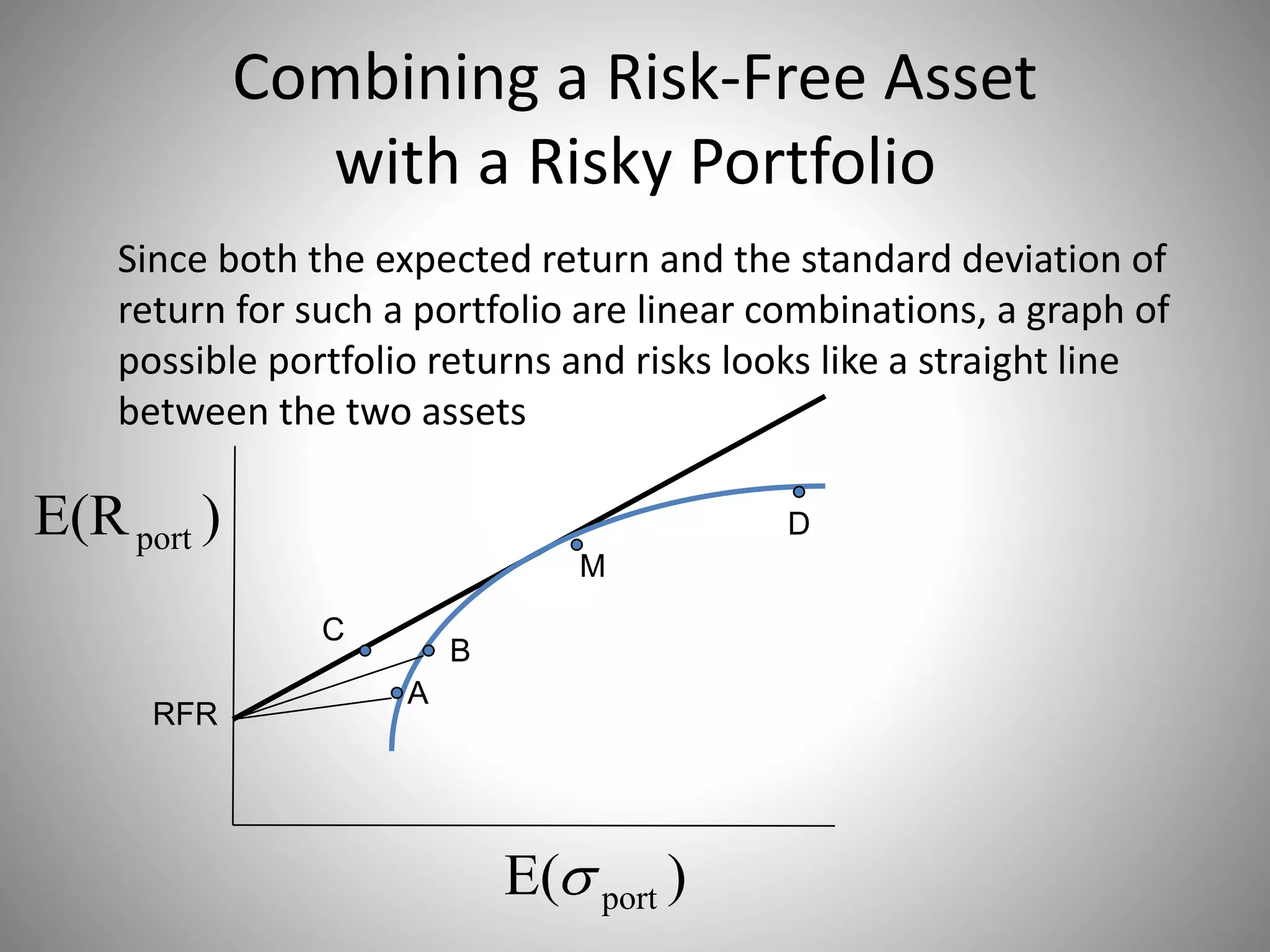

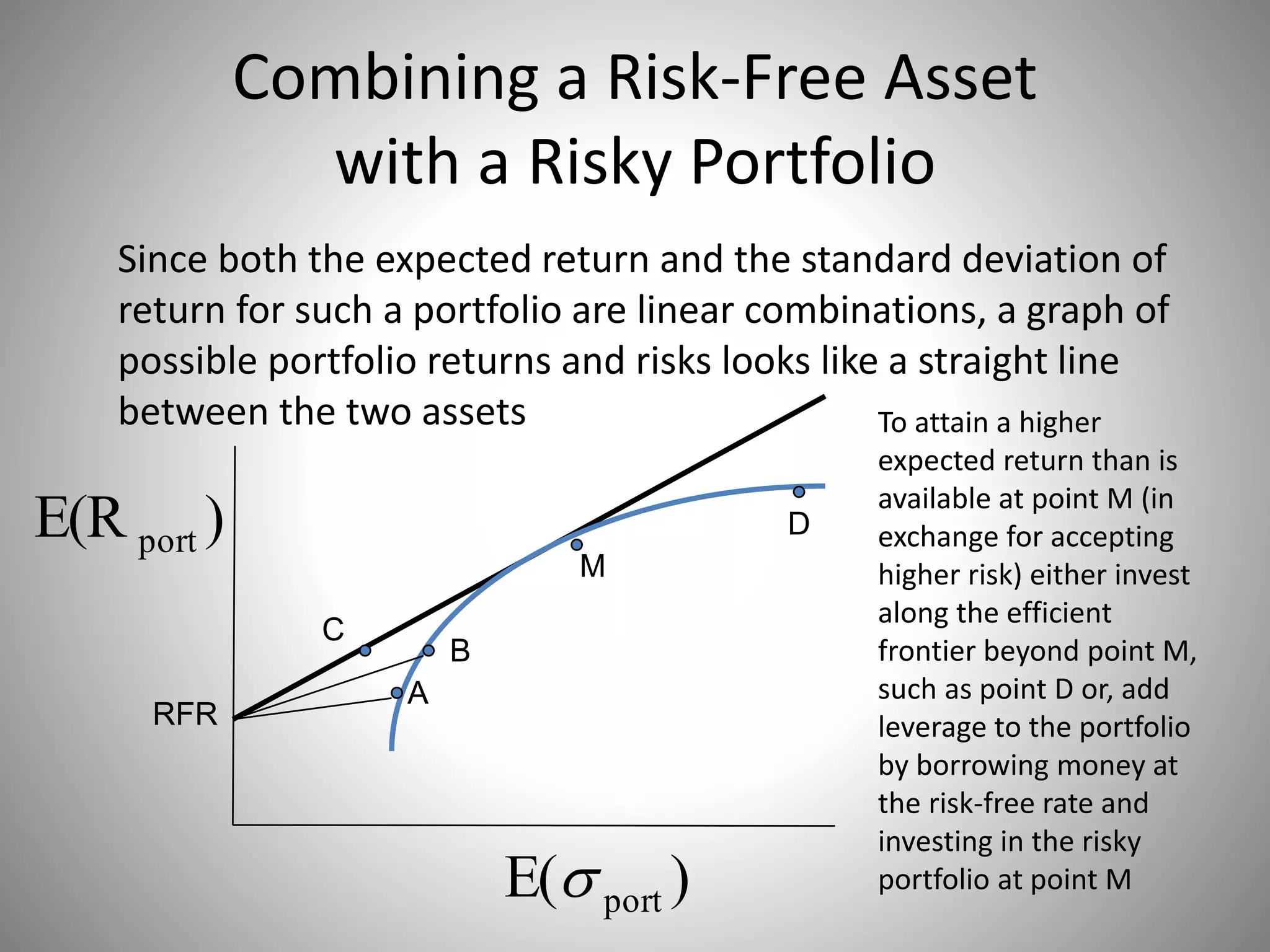

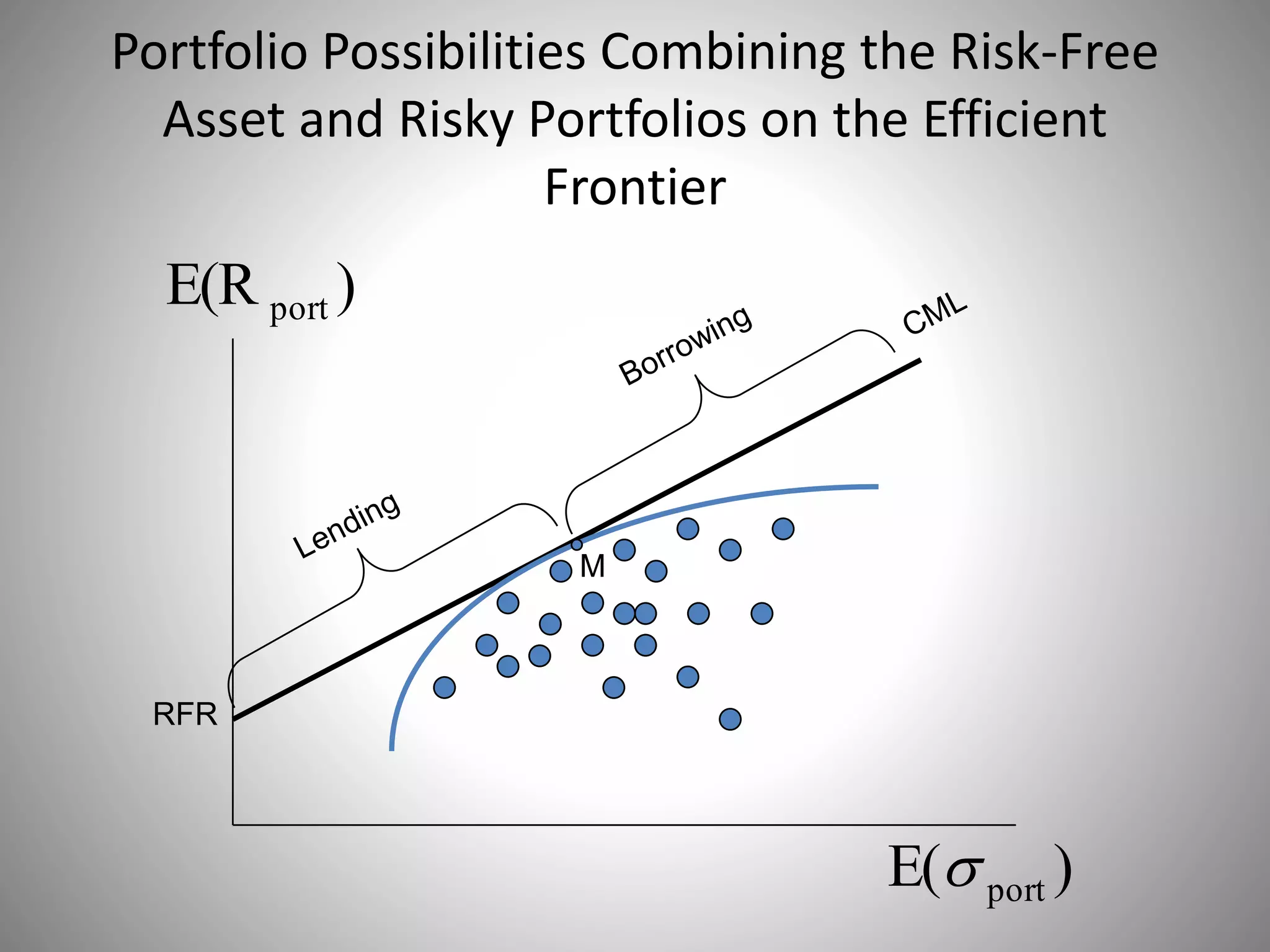

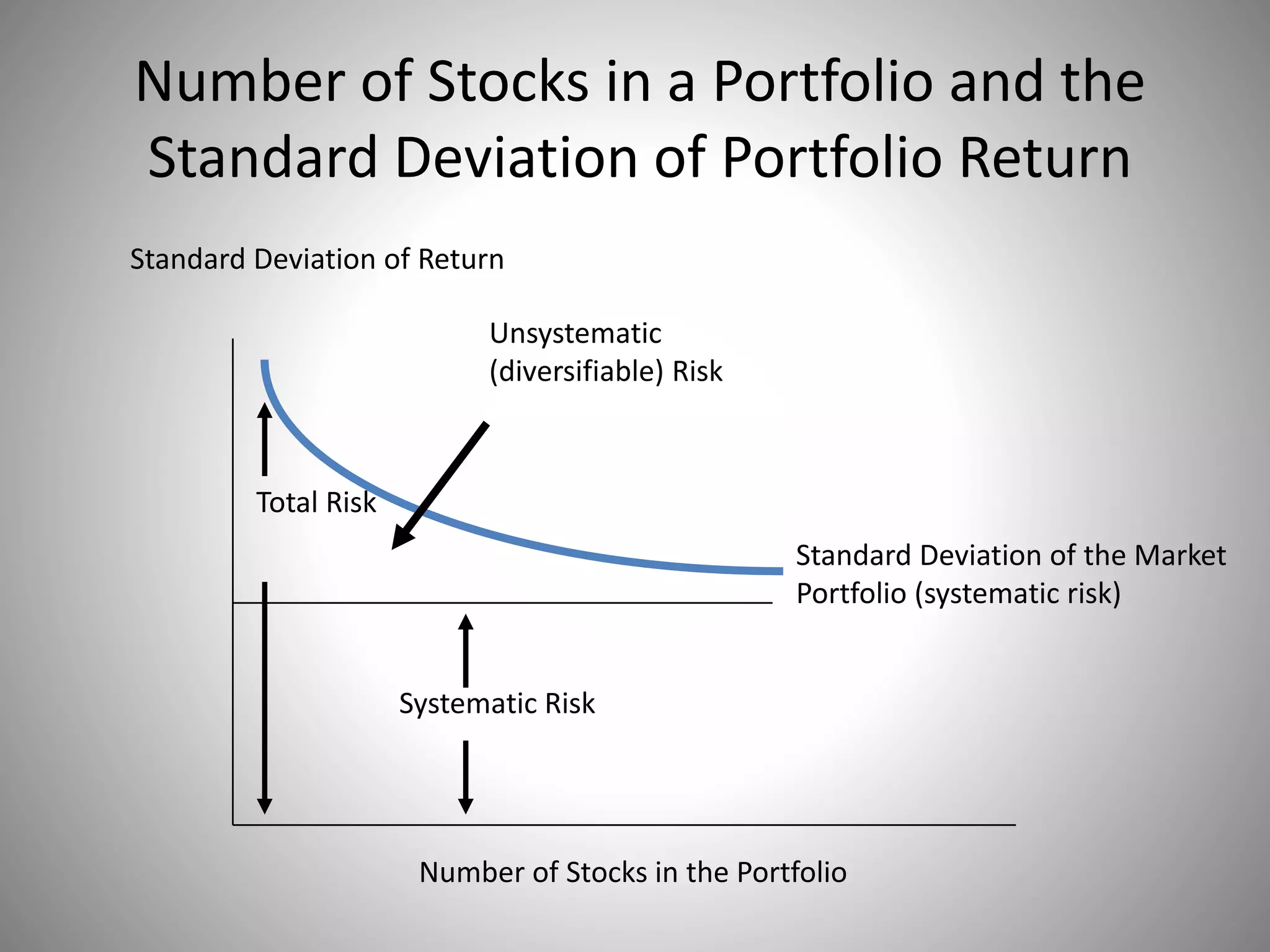

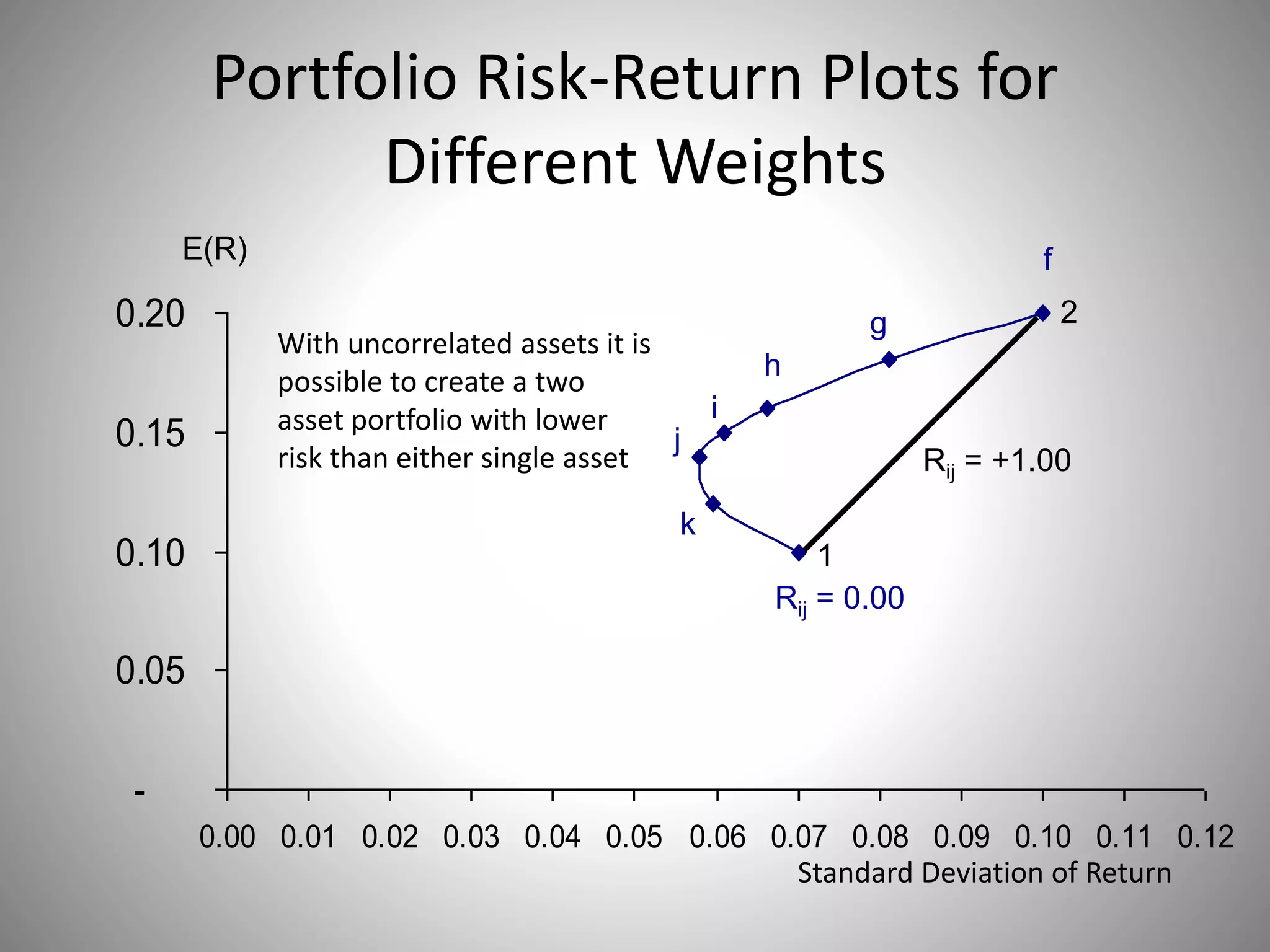

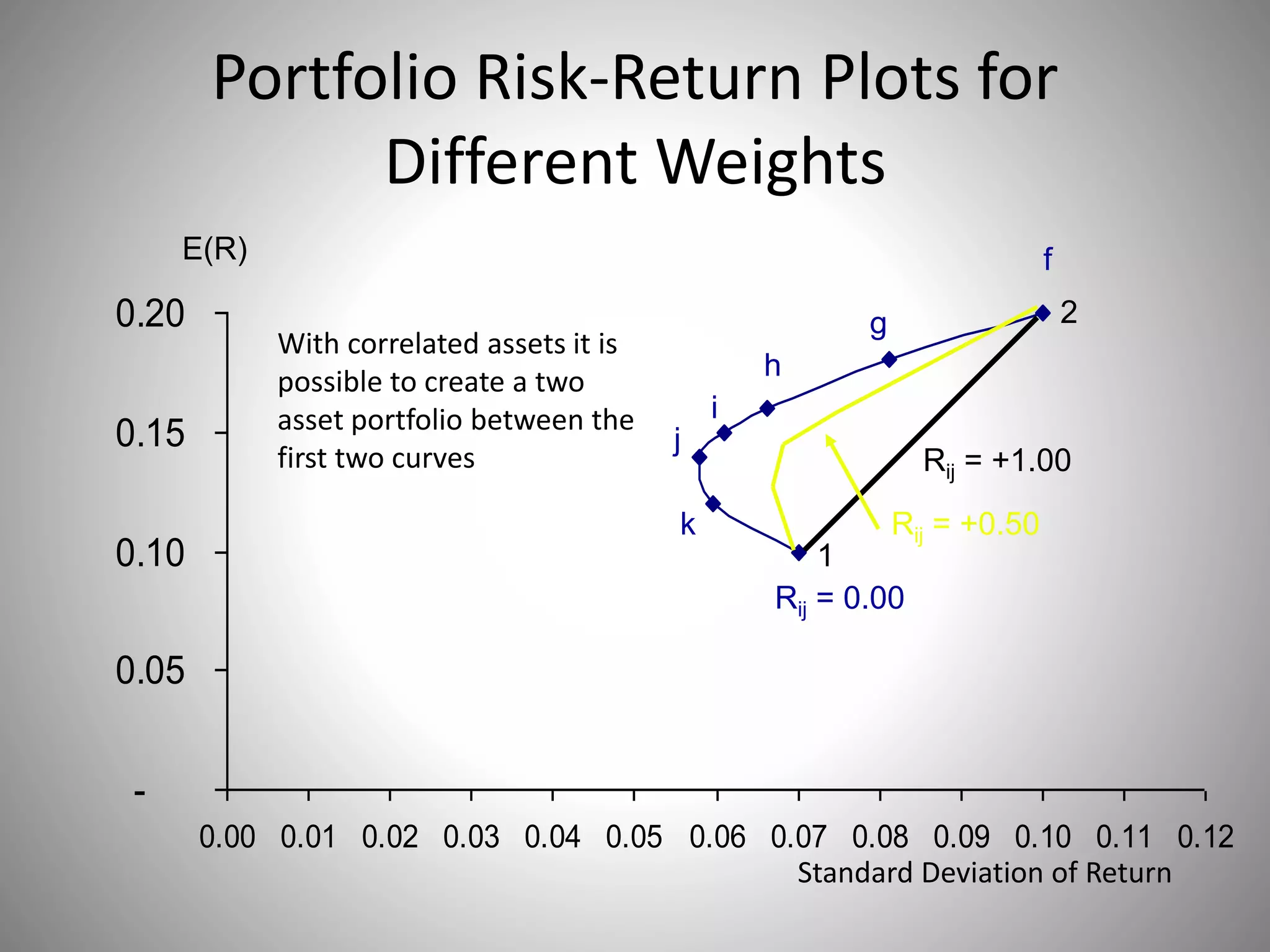

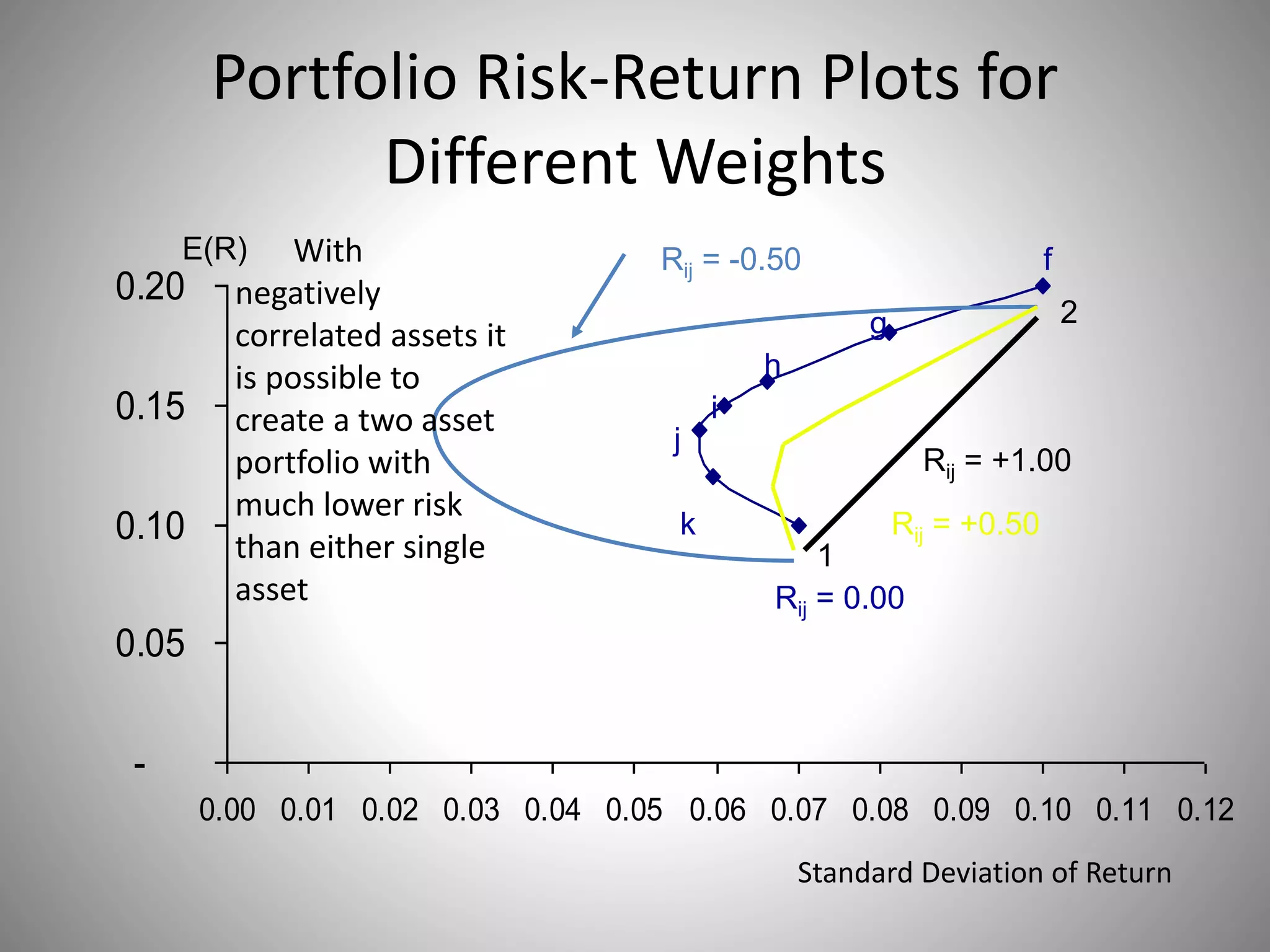

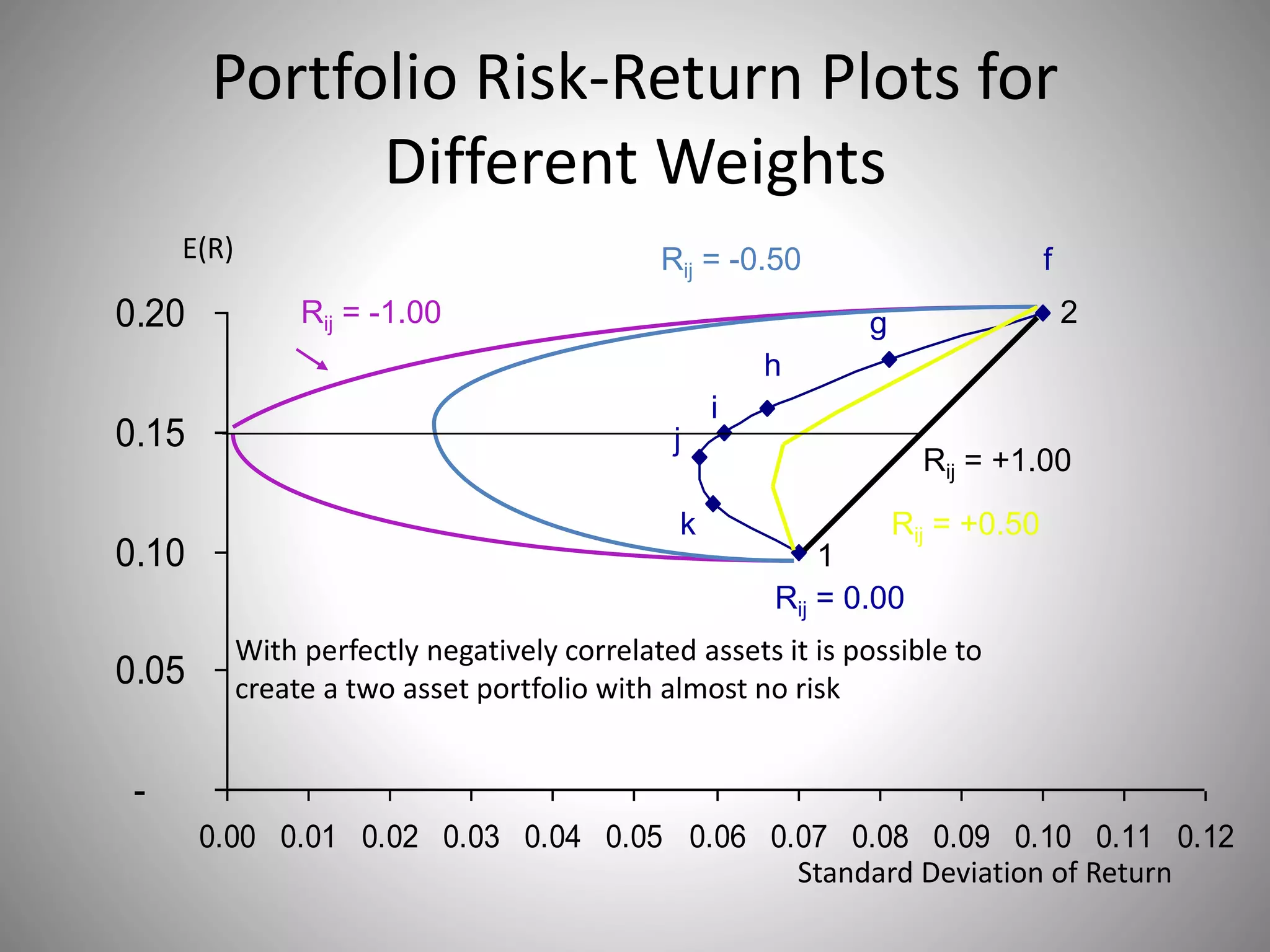

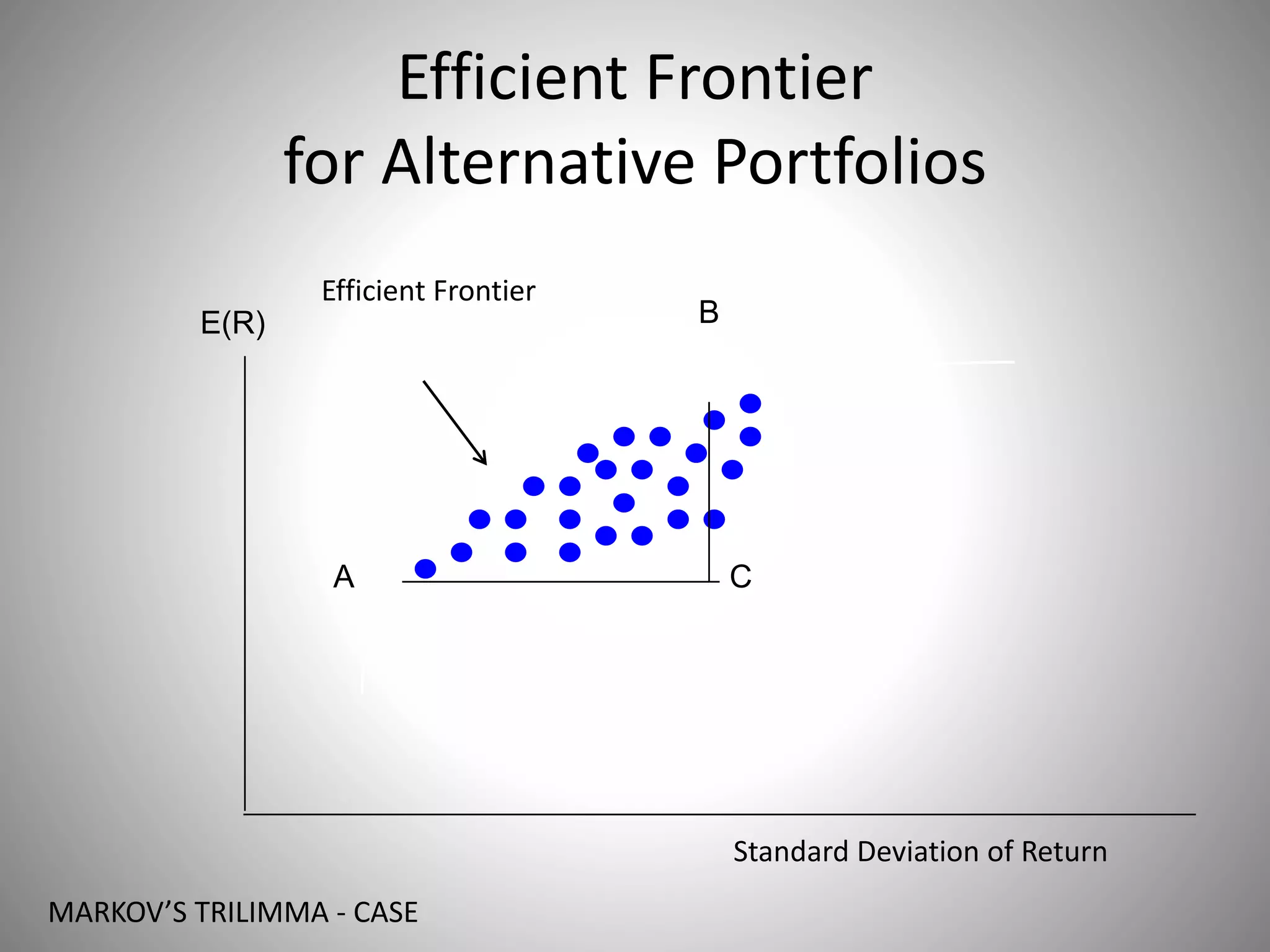

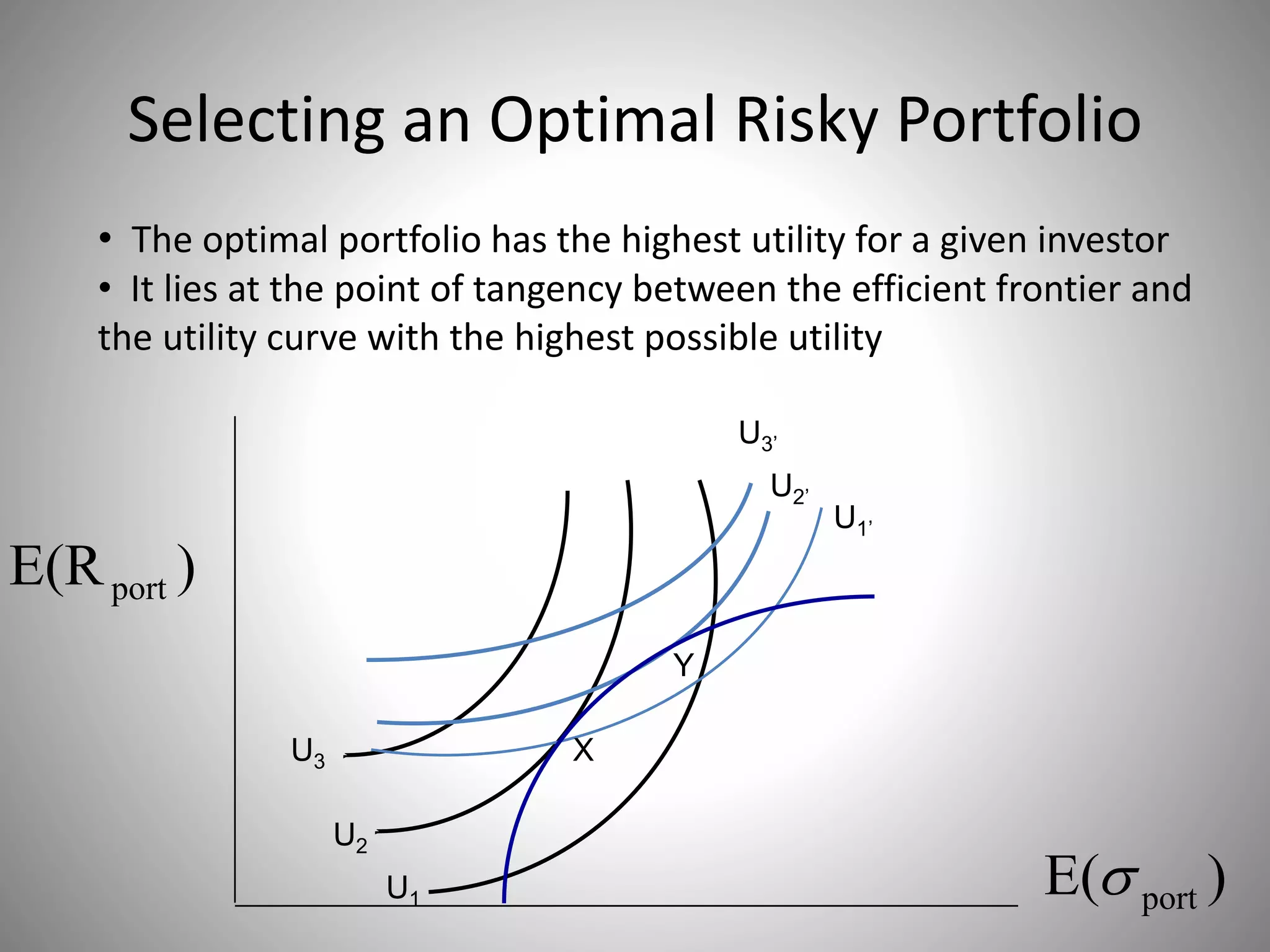

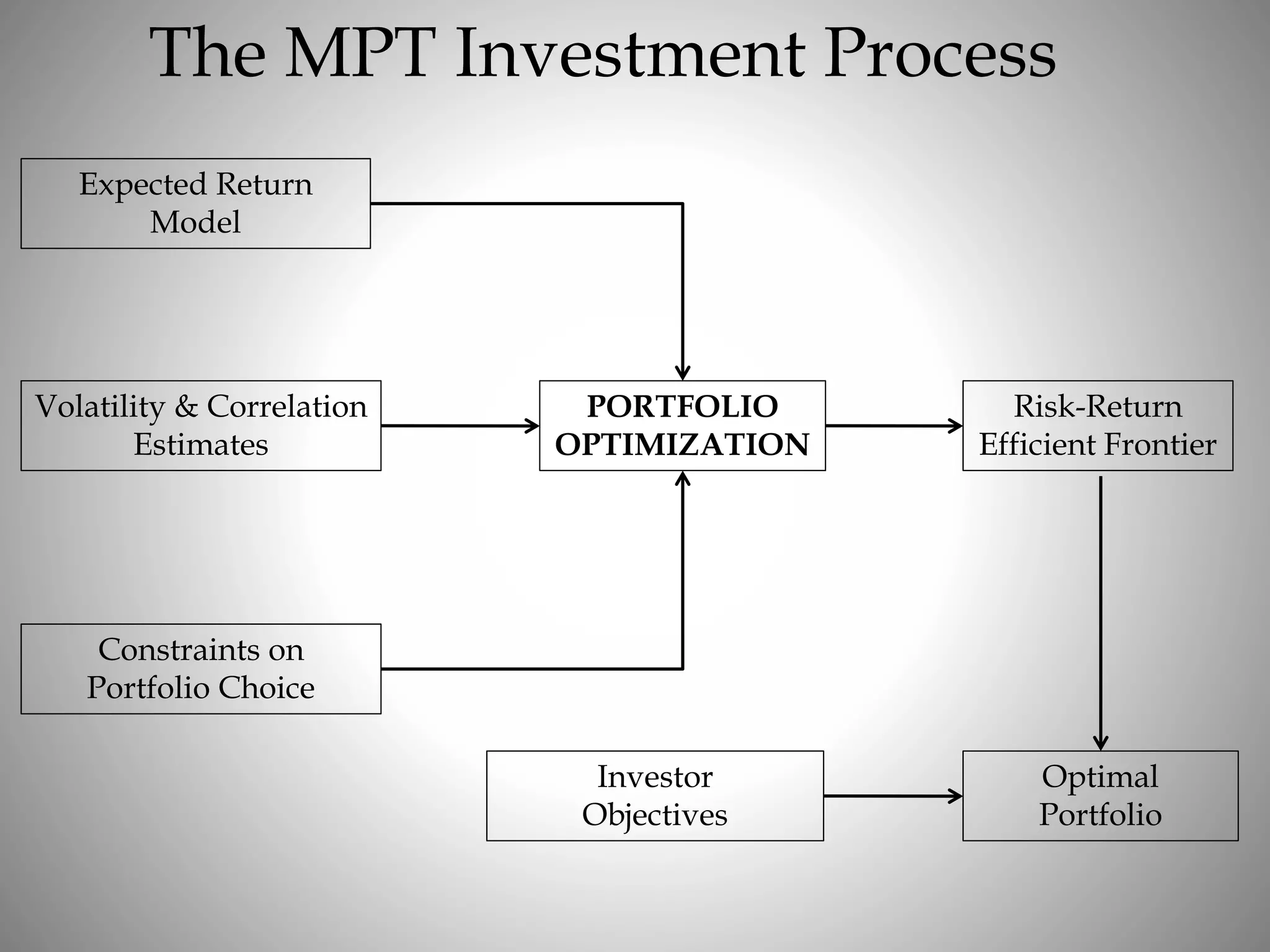

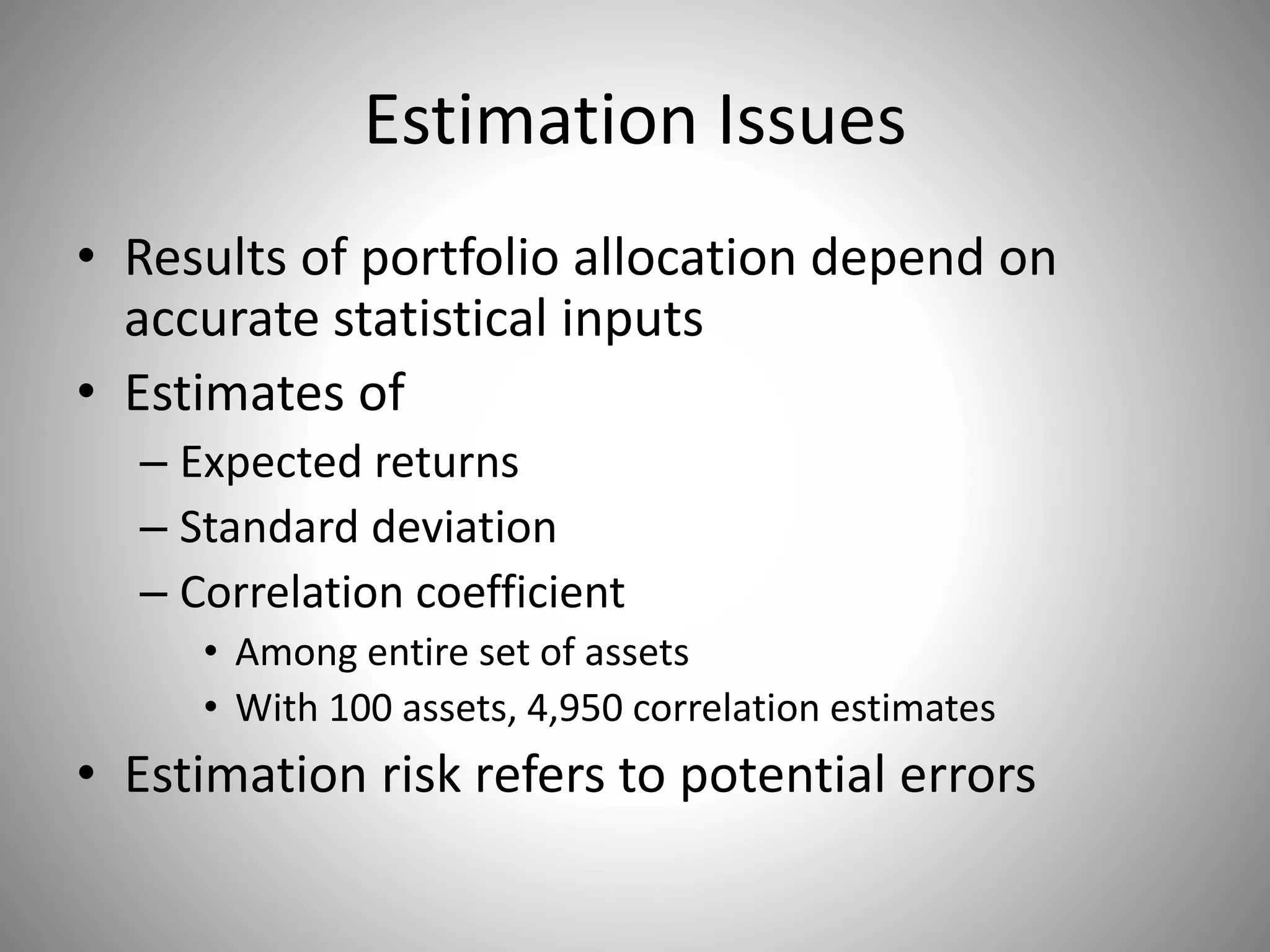

Modern portfolio theory (MPT) provides a framework for constructing investment portfolios to maximize expected return based on a given level of market risk. MPT assumes investors aim to maximize returns for a given level of risk. It uses variance as a measure of risk and covariance to capture how asset returns move together. The efficient frontier graph shows the set of optimal portfolios that offer the highest expected return for a given level of risk. Individual investors select the portfolio on the efficient frontier that maximizes their utility based on their risk tolerance. MPT emphasizes diversification and the benefits of holding inefficiently priced assets.

![Covariance of Returns

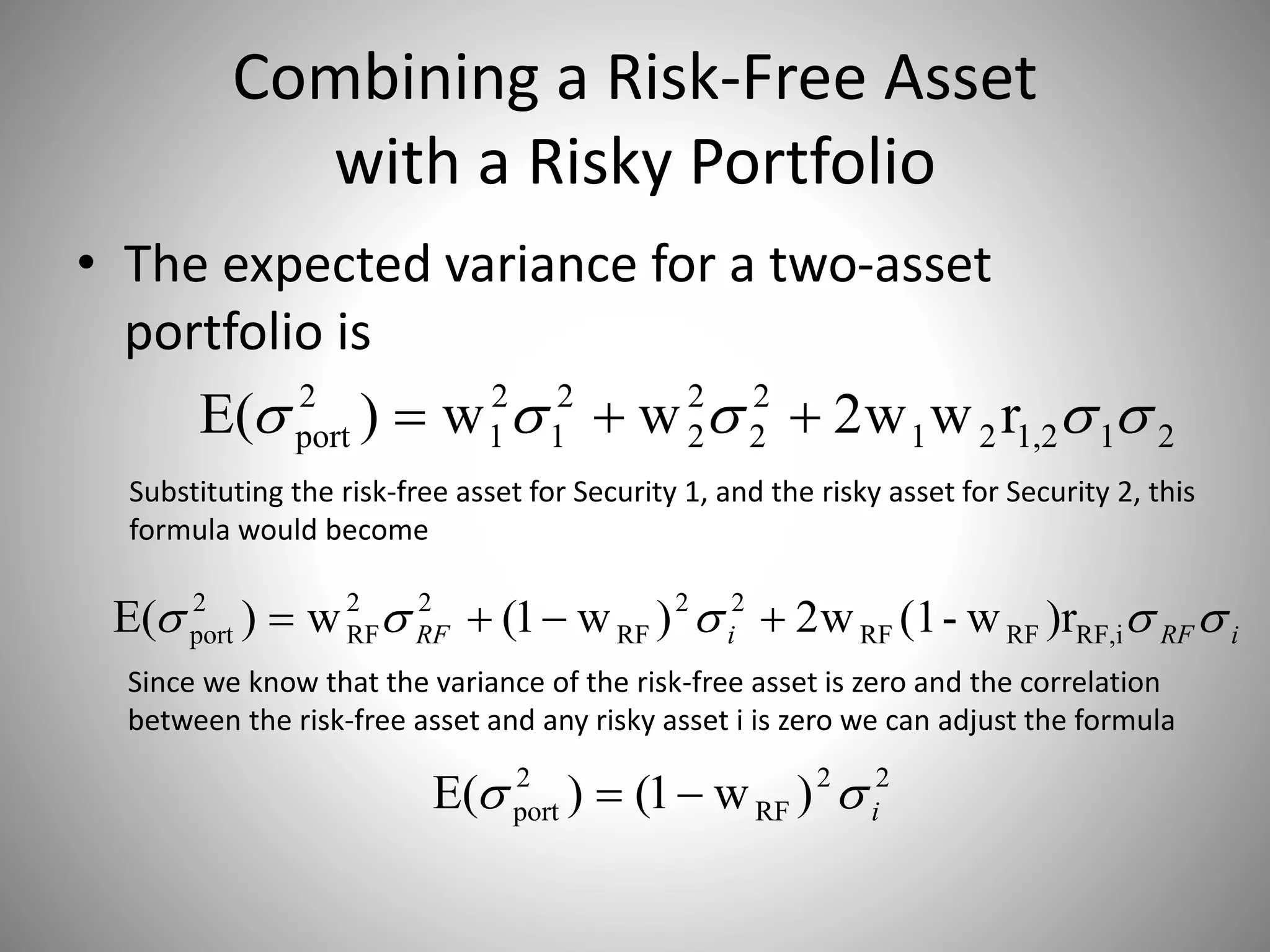

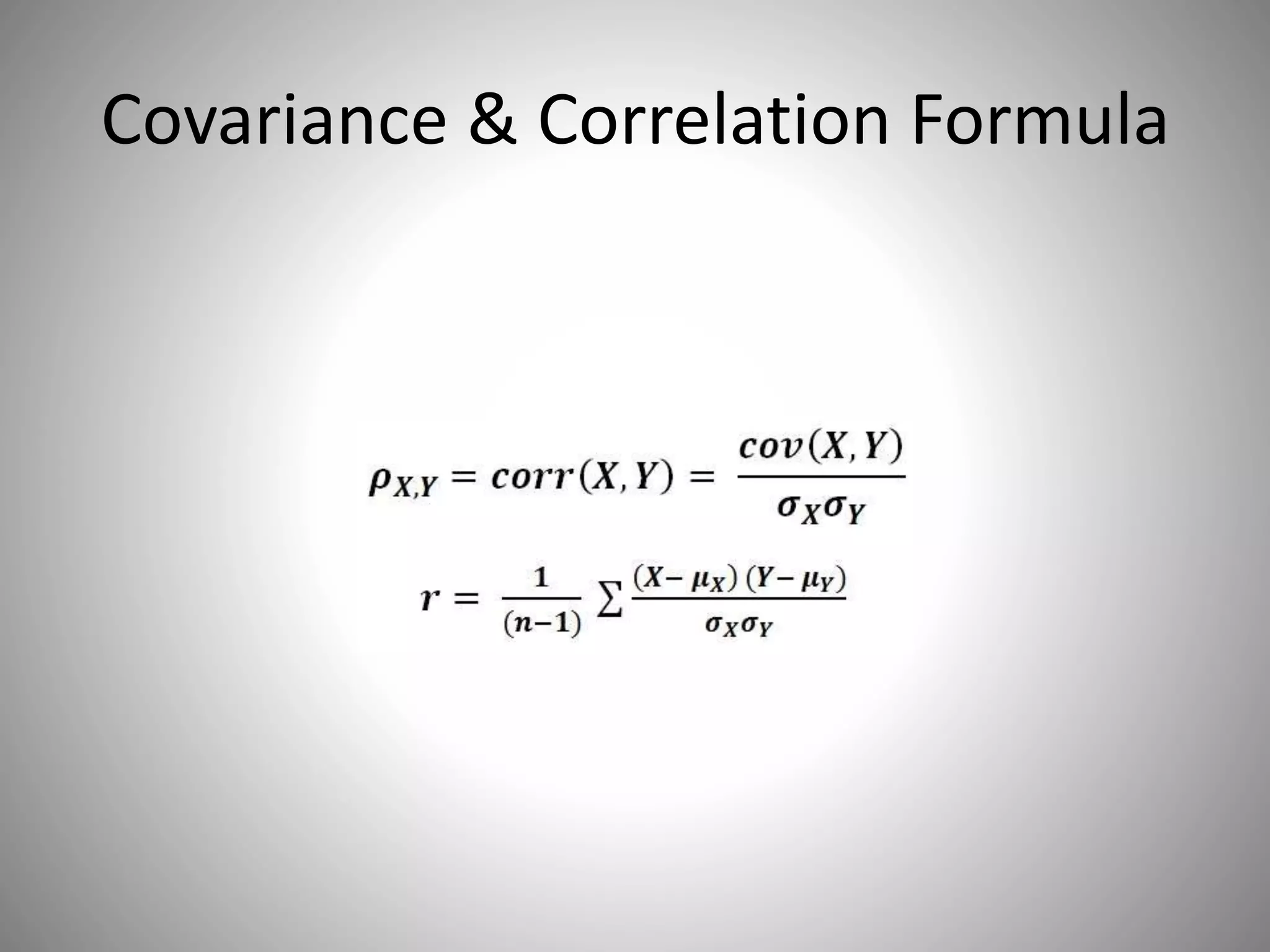

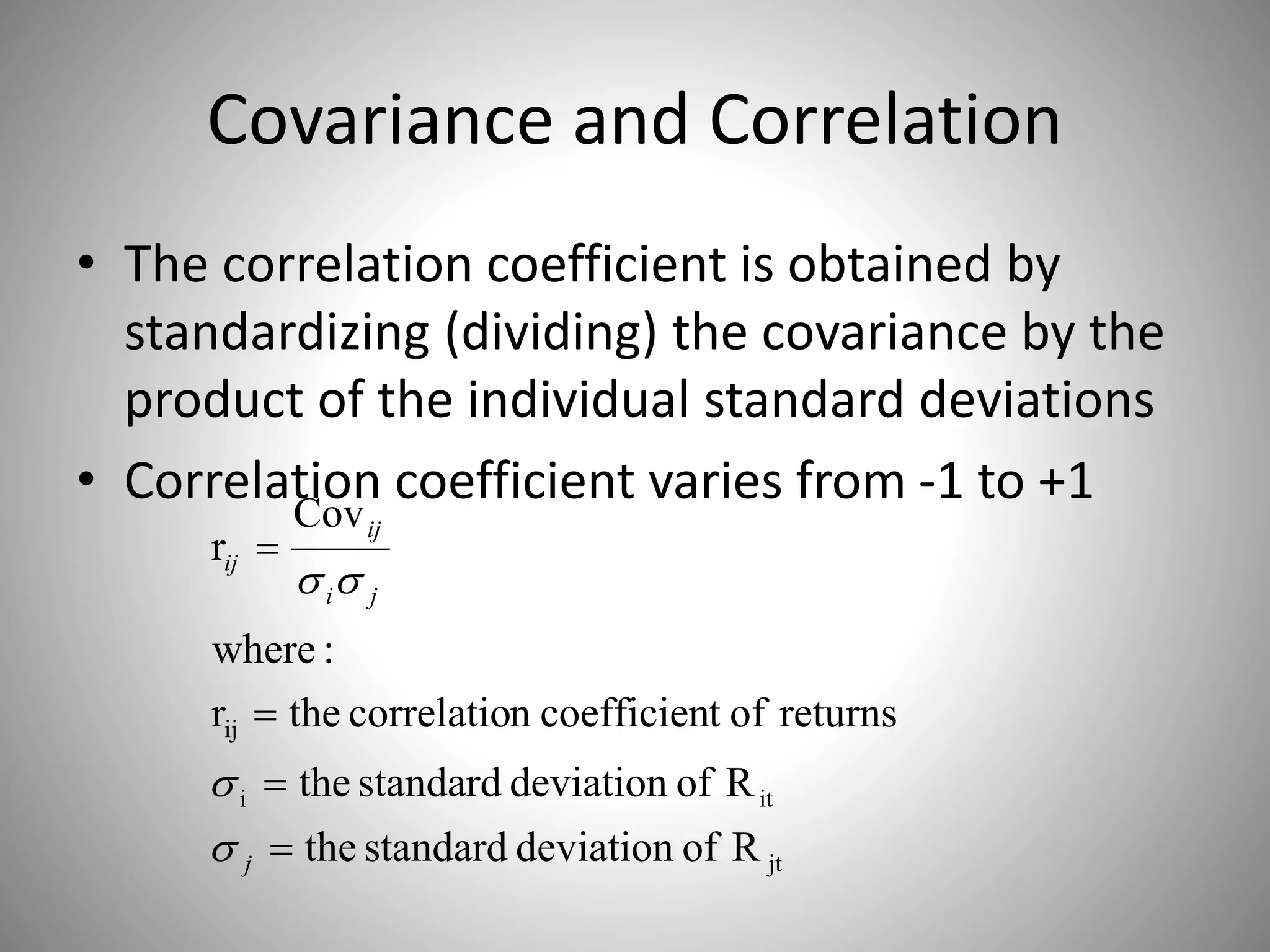

• A measure of the degree to which two variables “move

together” relative to their individual mean values over time

• For two assets, i and j, the covariance of rates of return is

defined as:

• Covij = E{[Ri - E(Ri)][Rj - E(Rj)]}](https://image.slidesharecdn.com/d6b00153-ab54-4962-86db-959cf7357237-160904175544/75/Security-Analysis-and-Portfolio-Management-36-2048.jpg)

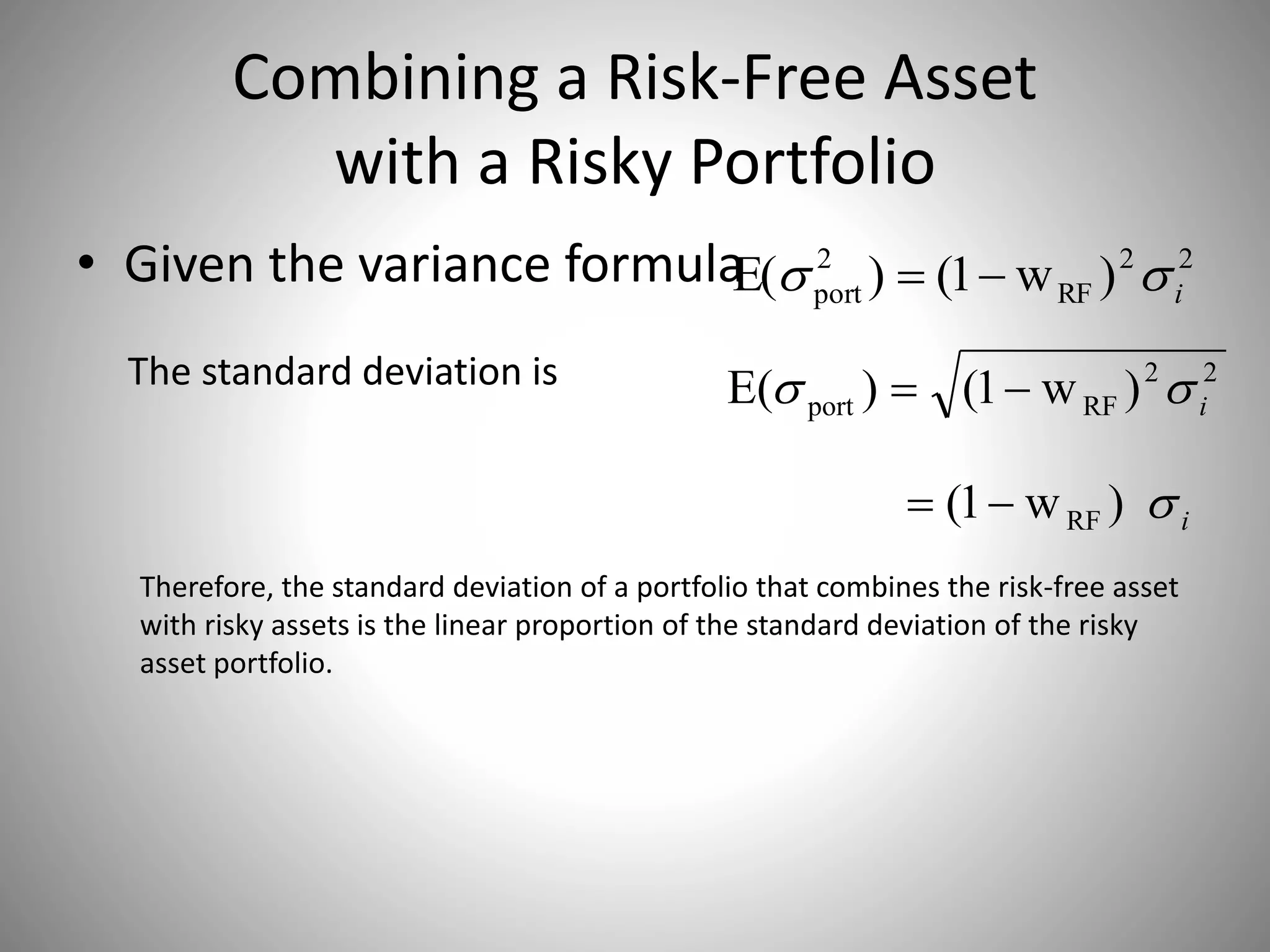

![Risk-Free Asset

• Covariance between two sets of returns is

n

1i

jjiiij )]/nE(R-)][RE(R-[RCov

Because the returns for the risk free asset are certain,

0RF Thus Ri = E(Ri), and Ri - E(Ri) = 0

Consequently, the covariance of the risk-free asset with any risky asset or portfolio will

always equal zero. Similarly the correlation between any risky asset and the risk-free asset

would be zero.](https://image.slidesharecdn.com/d6b00153-ab54-4962-86db-959cf7357237-160904175544/75/Security-Analysis-and-Portfolio-Management-58-2048.jpg)