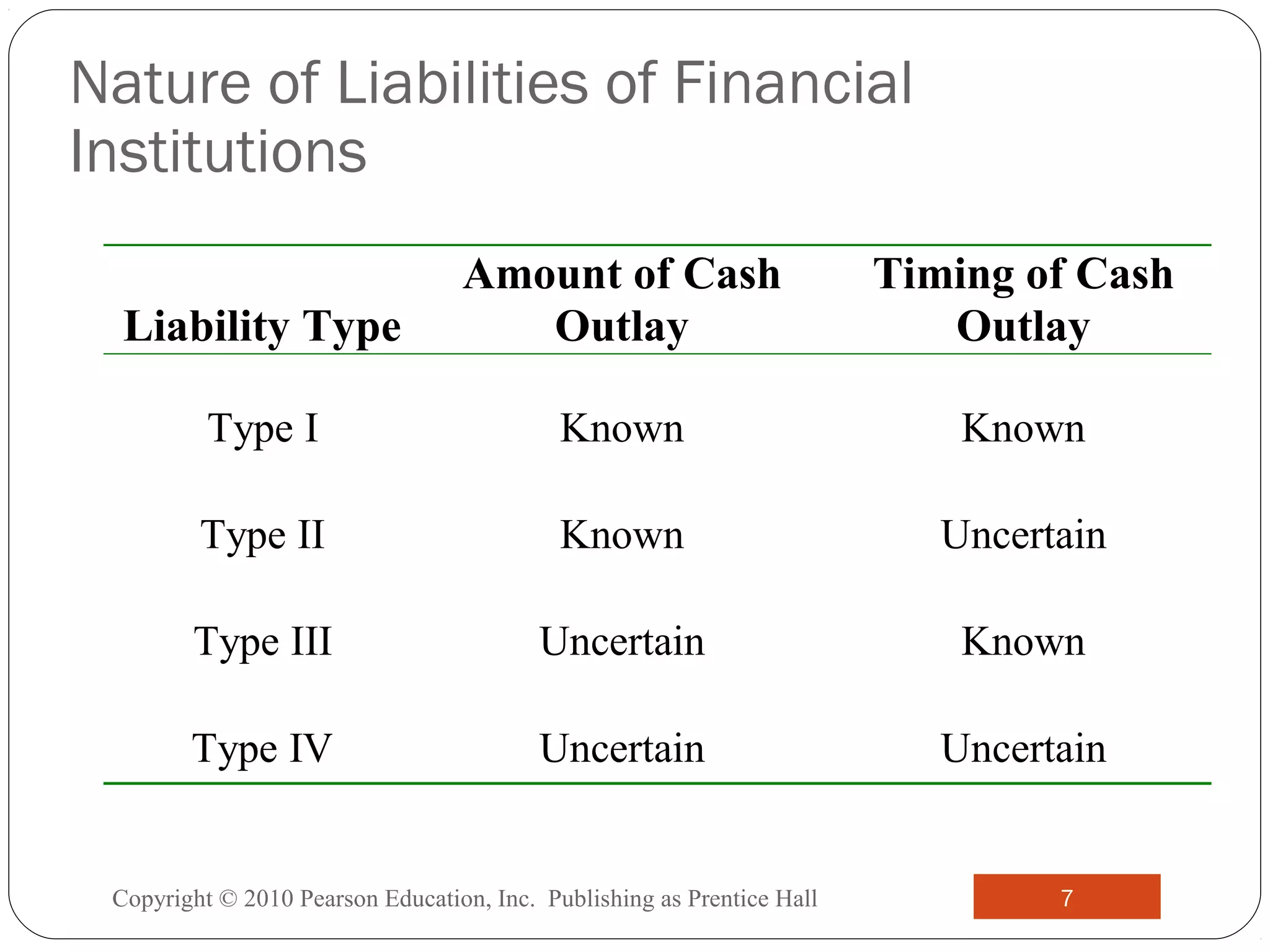

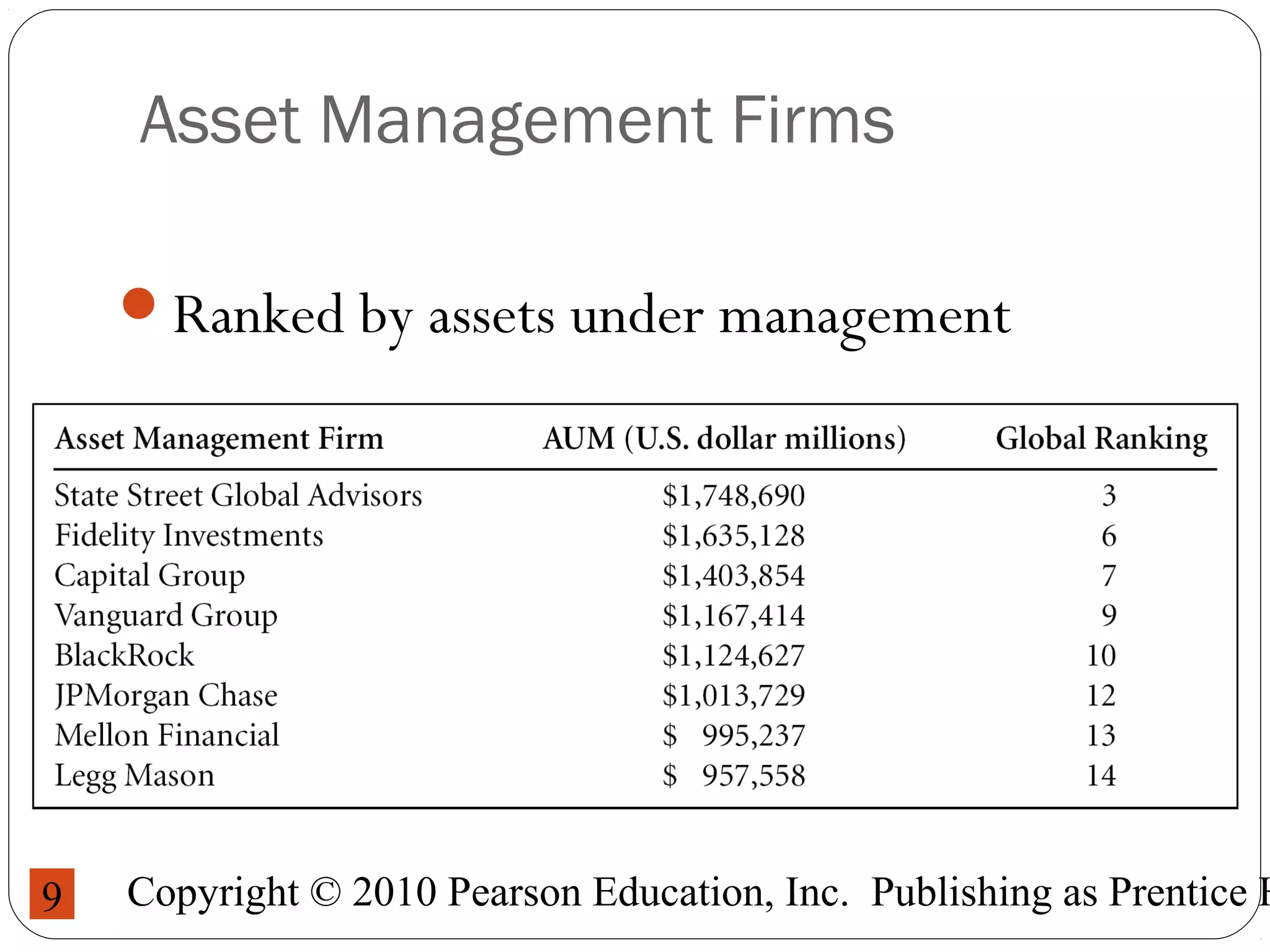

The document discusses the services and roles of financial institutions and intermediaries, including asset management, portfolio management, and risk reduction. It also elaborates on asset/liability management, various types of investment, especially hedge funds, and outlines regulatory concerns. Additionally, it addresses the fee structures and compensation across different types of funds managed.