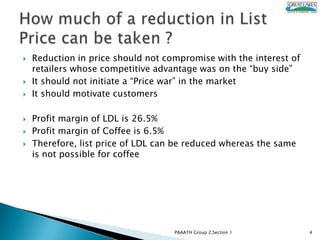

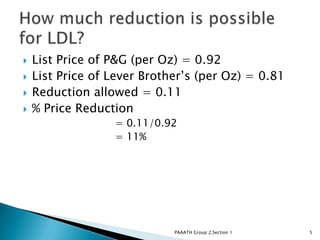

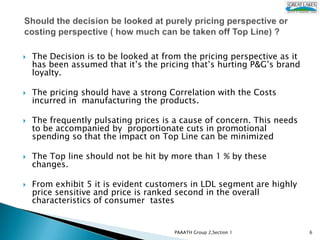

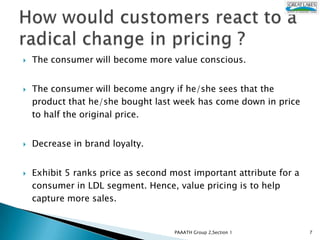

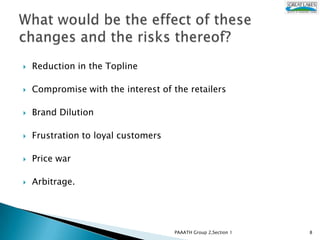

The document discusses value pricing and reducing list prices for P&G products. It analyzes profit margins for LDL (26.5%) and Coffee (6.5%) and determines LDL's price can be reduced while Coffee needs cost reductions. A 11% price reduction is calculated. Risks of frequent price changes include reduced topline, retailer compromise, and customer frustration/brand dilution. The approach for LDL should be price reduction while Coffee focuses on cost cuts.