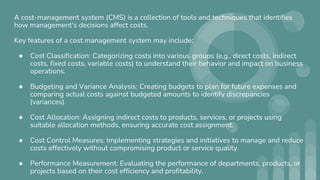

The document outlines key concepts of managerial accounting, focusing on cost behavior measurement, cost drivers, and management's influence on costs. It details types of cost functions, methods for measuring costs, and the importance of cost management systems, including activity-based costing. The document emphasizes how various costs impact decision-making within an organization, including fixed, variable, and opportunity costs.