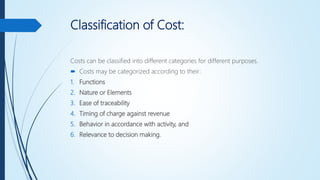

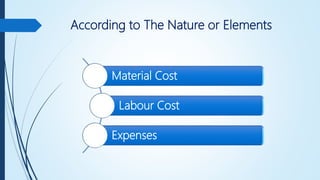

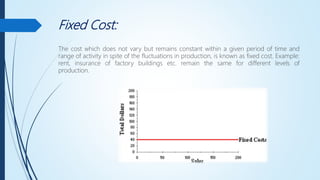

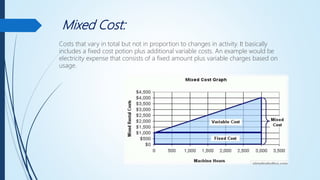

This document provides an overview of cost classification. It defines cost and outlines several ways costs can be classified, including by function, nature/elements, ease of traceability, timing, behavior, and relevance to decision making. Specifically, it discusses classifying costs as manufacturing vs non-manufacturing, material vs labor vs expenses, direct vs indirect, variable vs fixed vs mixed. Examples are provided for each classification.