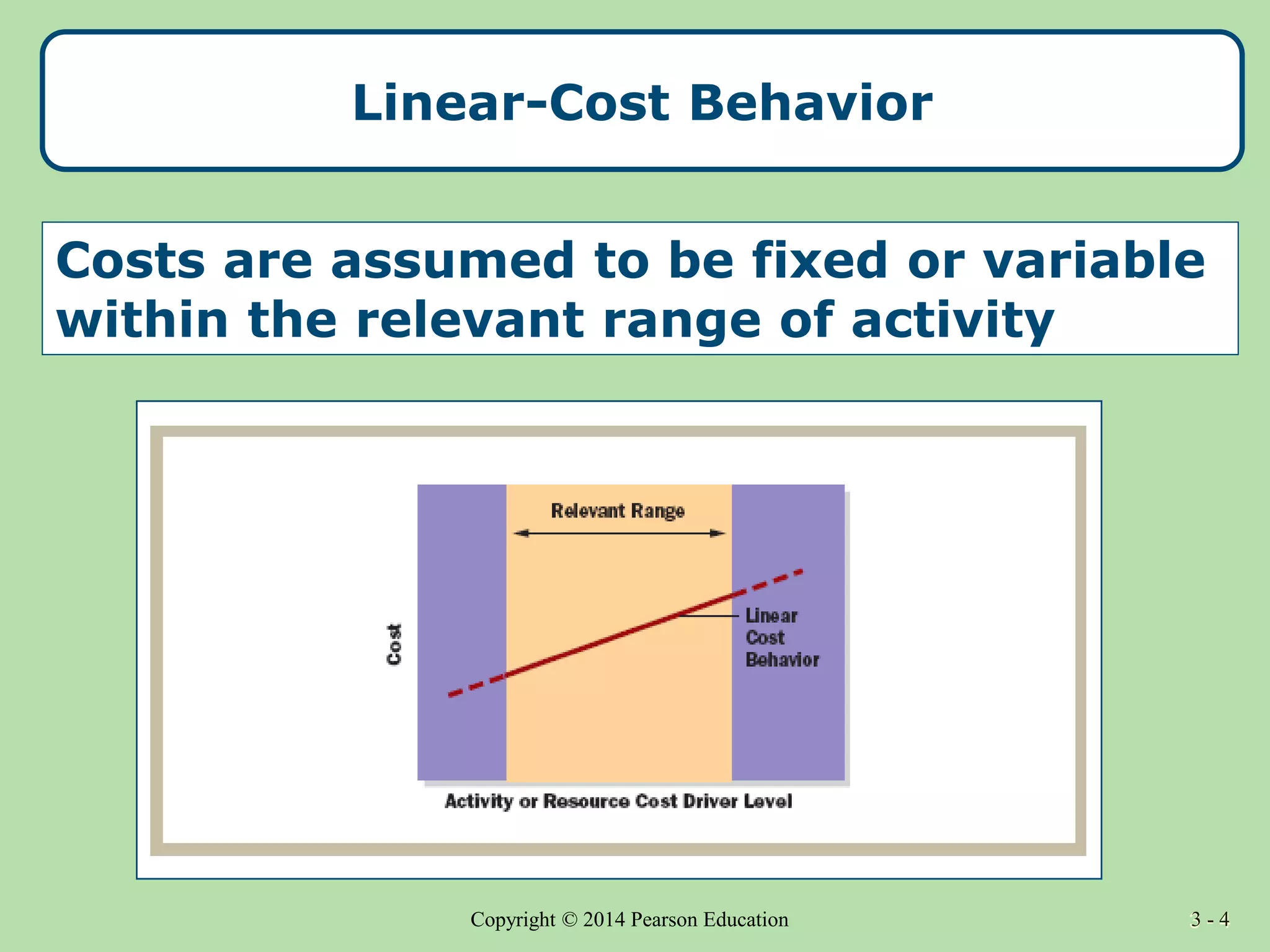

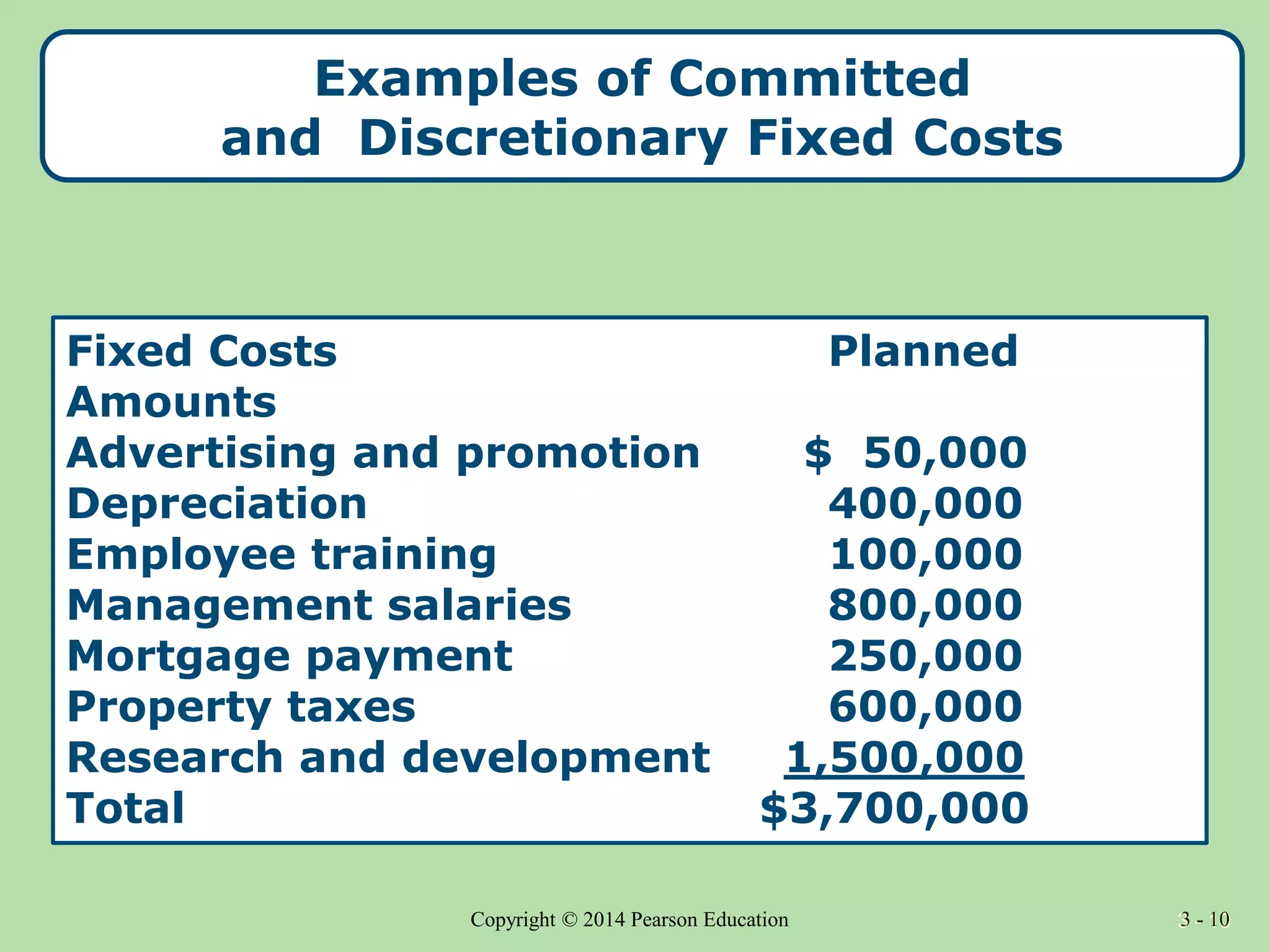

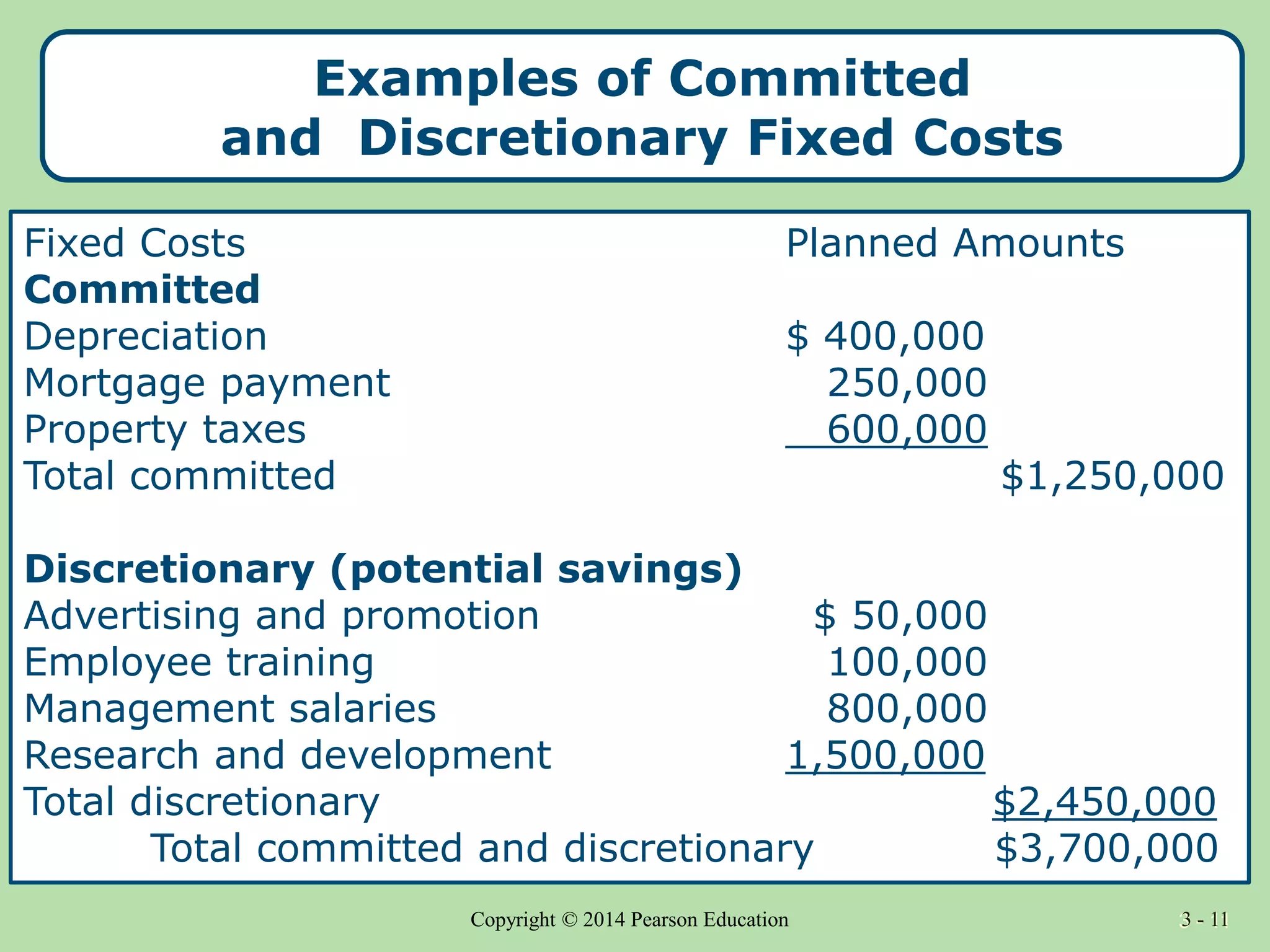

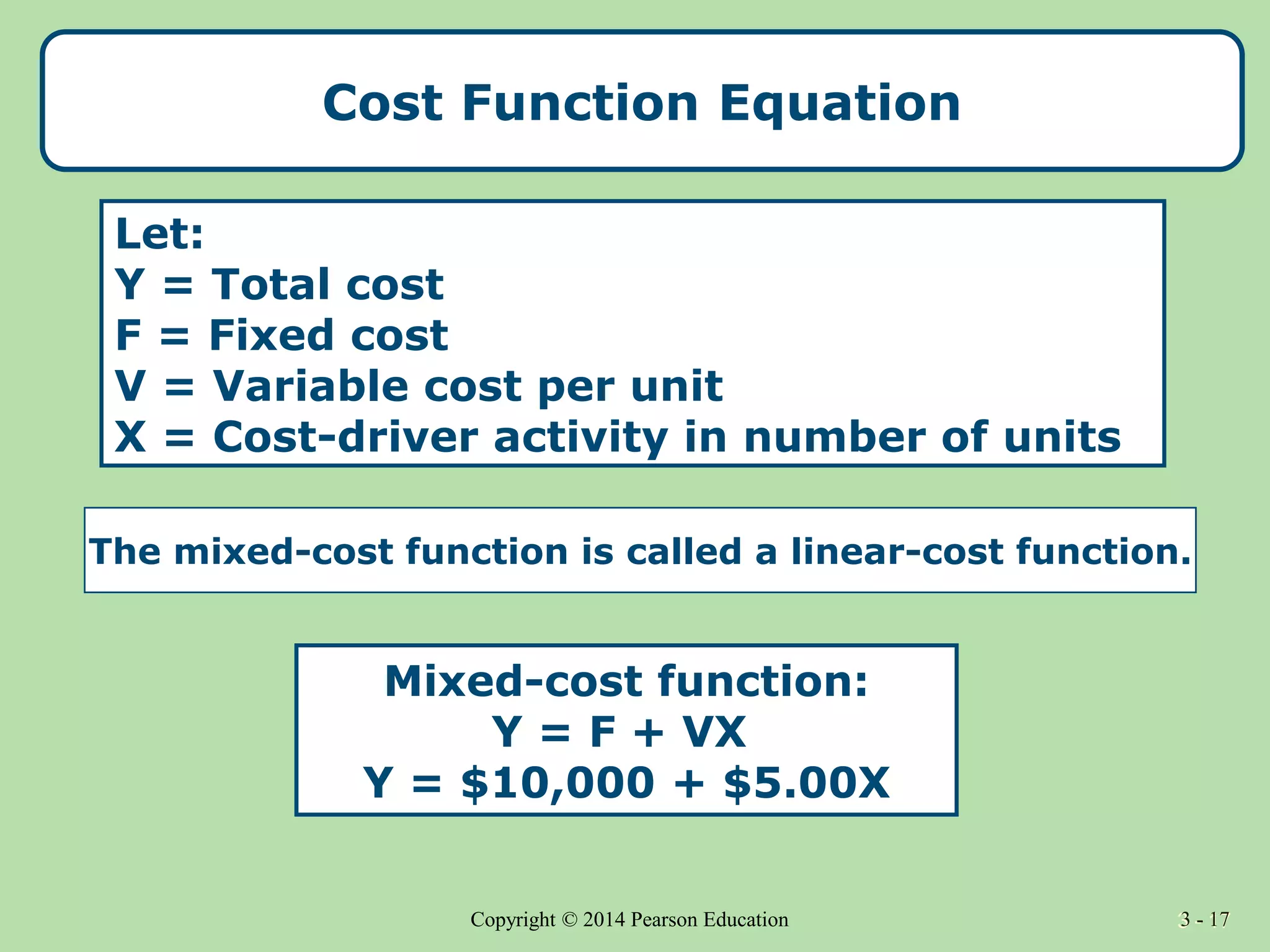

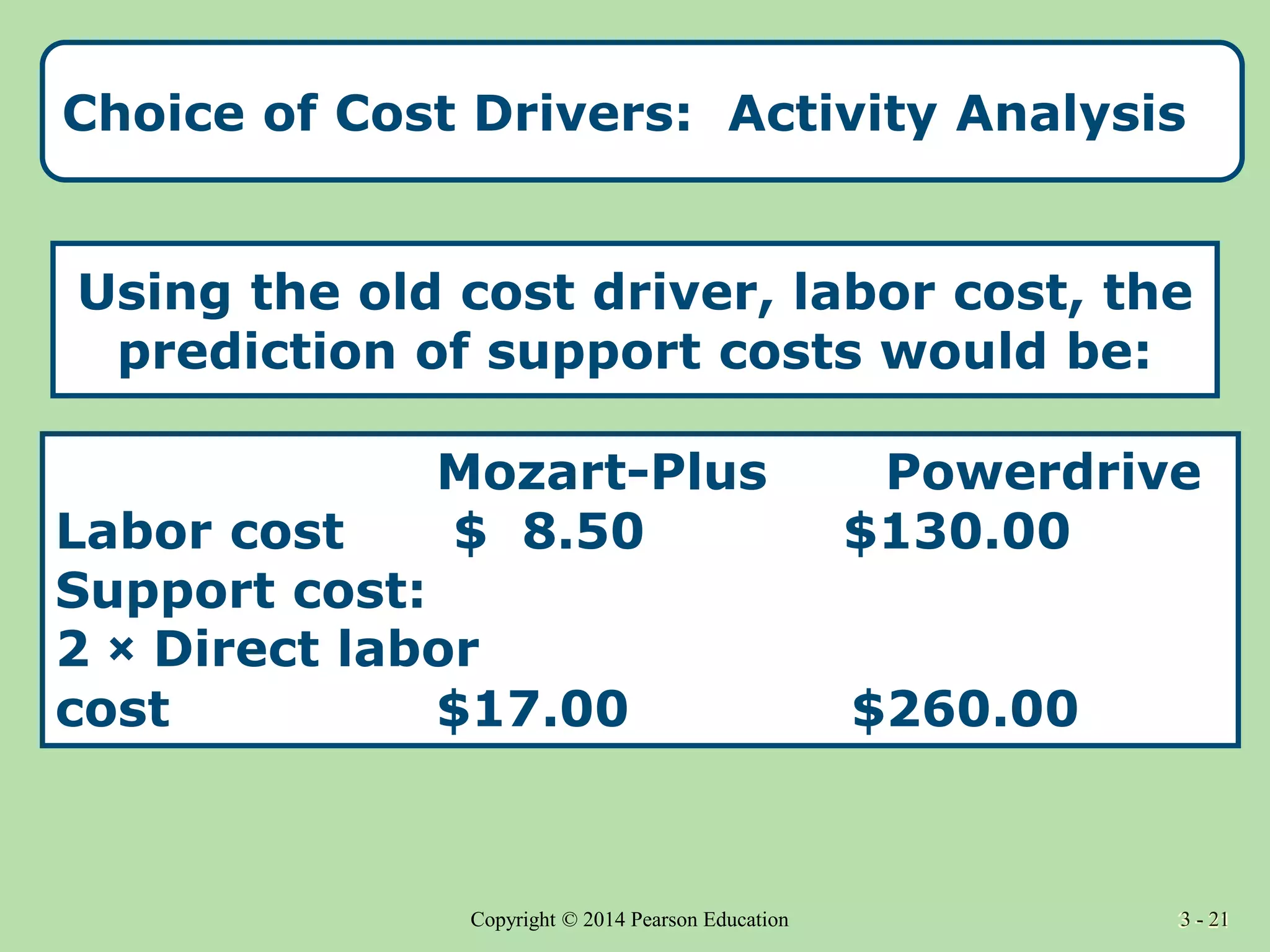

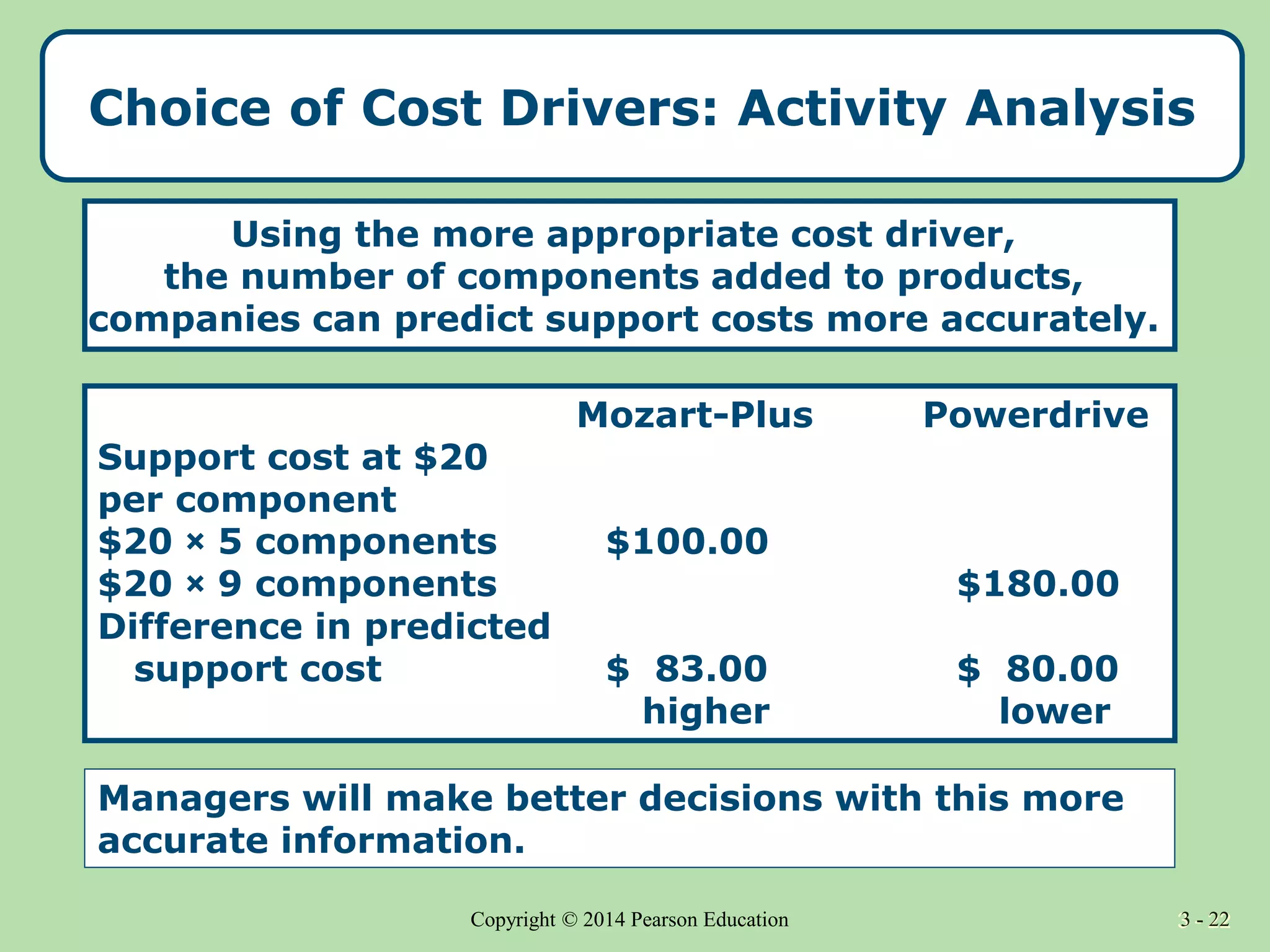

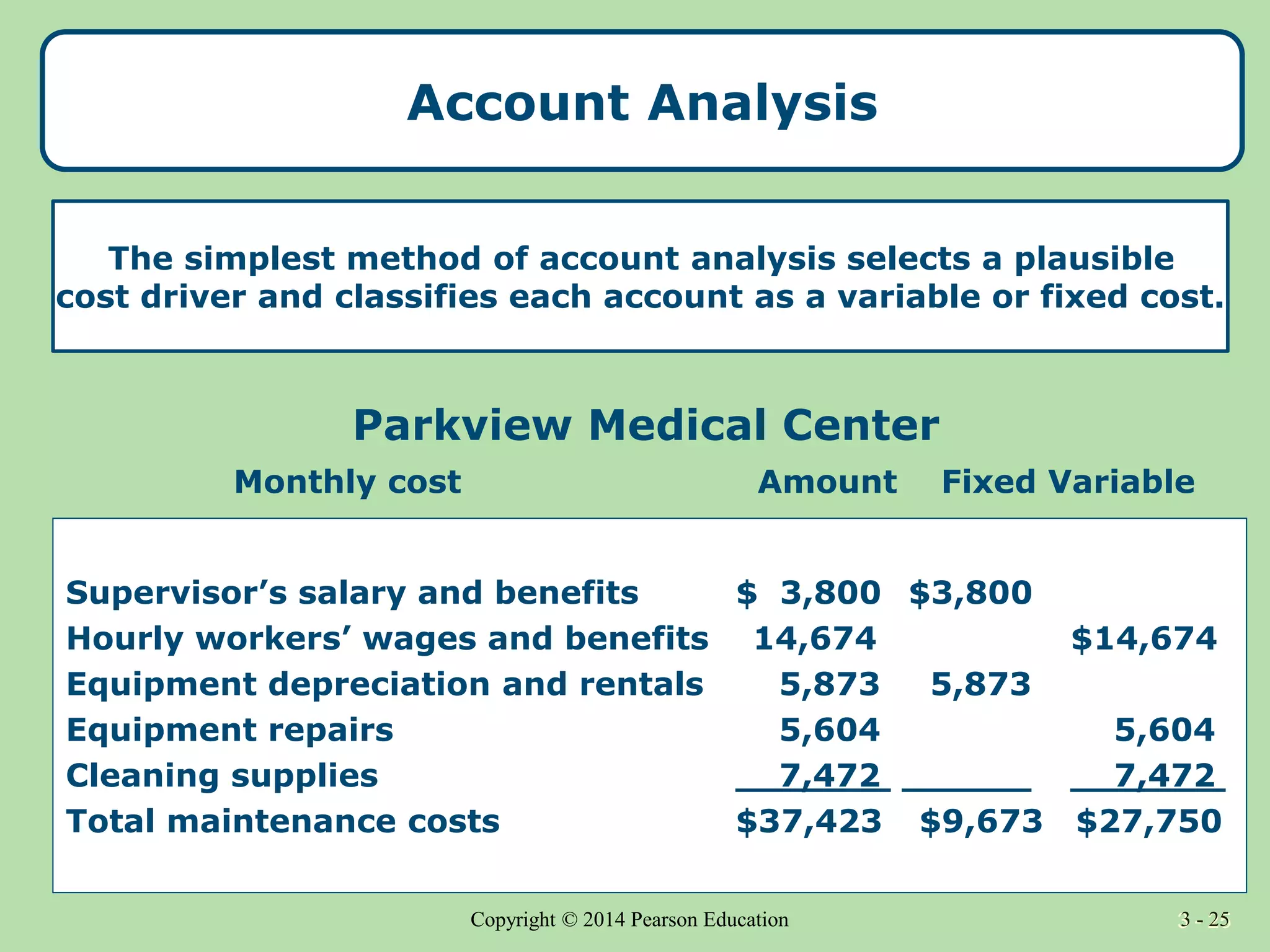

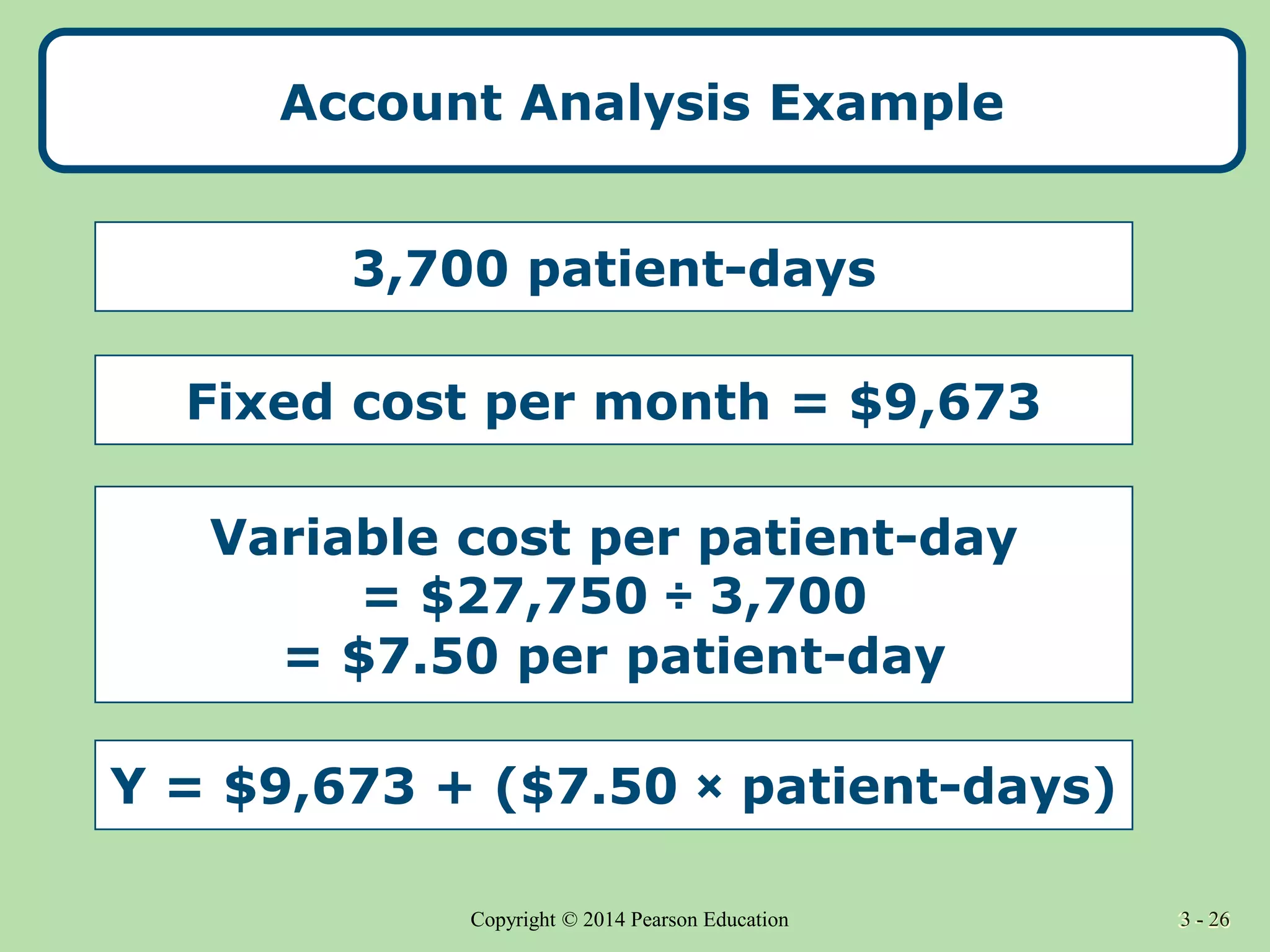

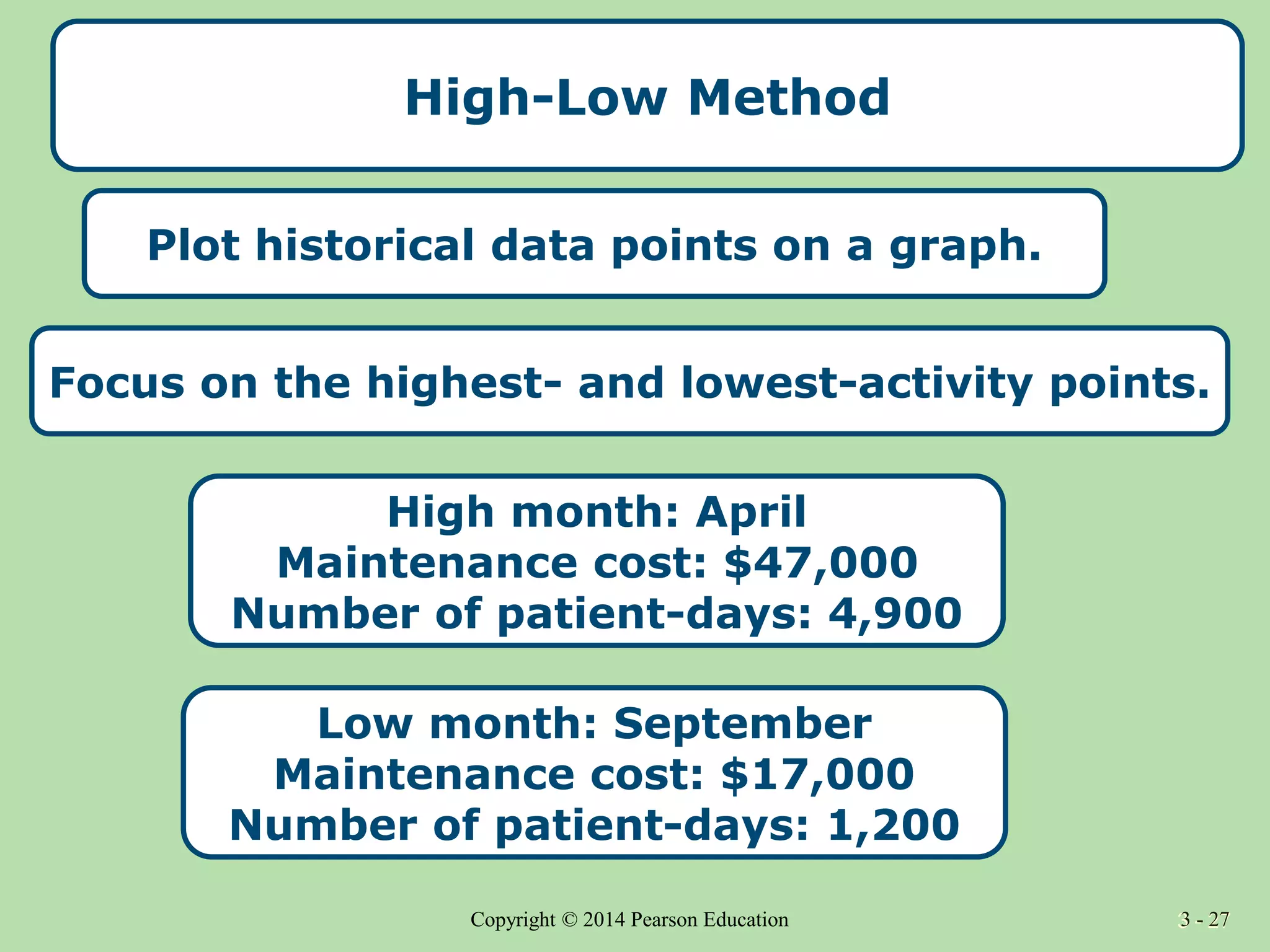

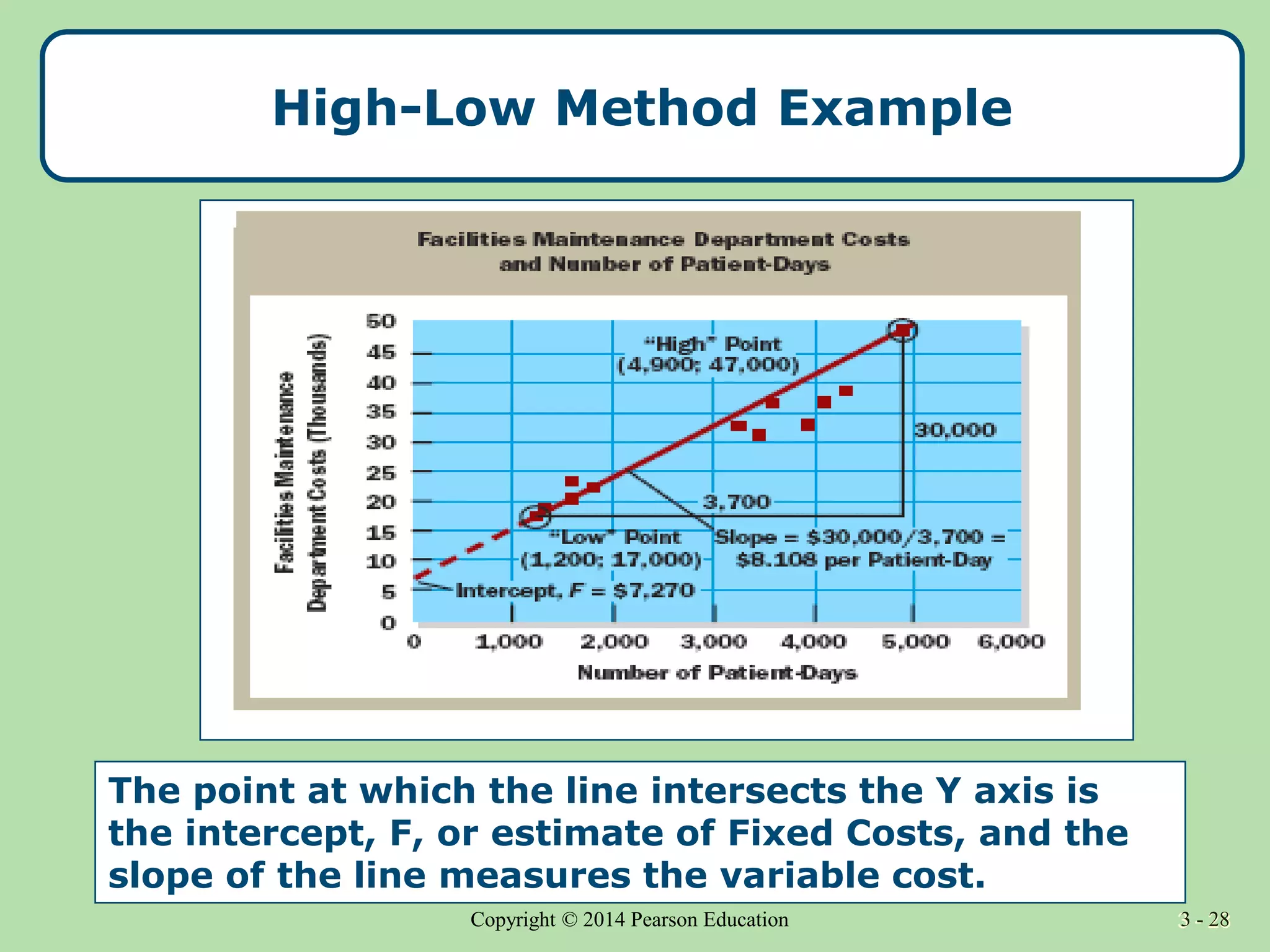

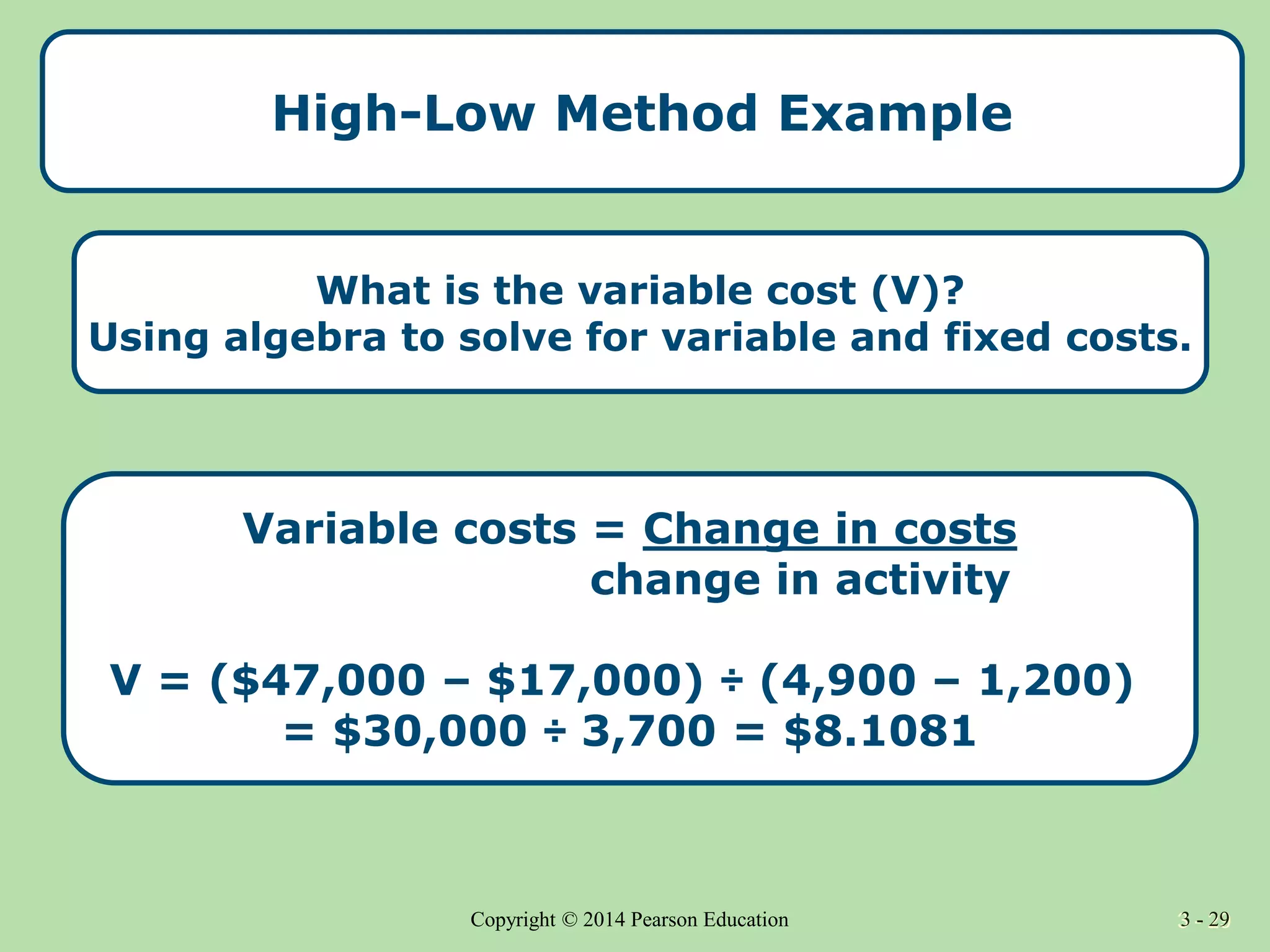

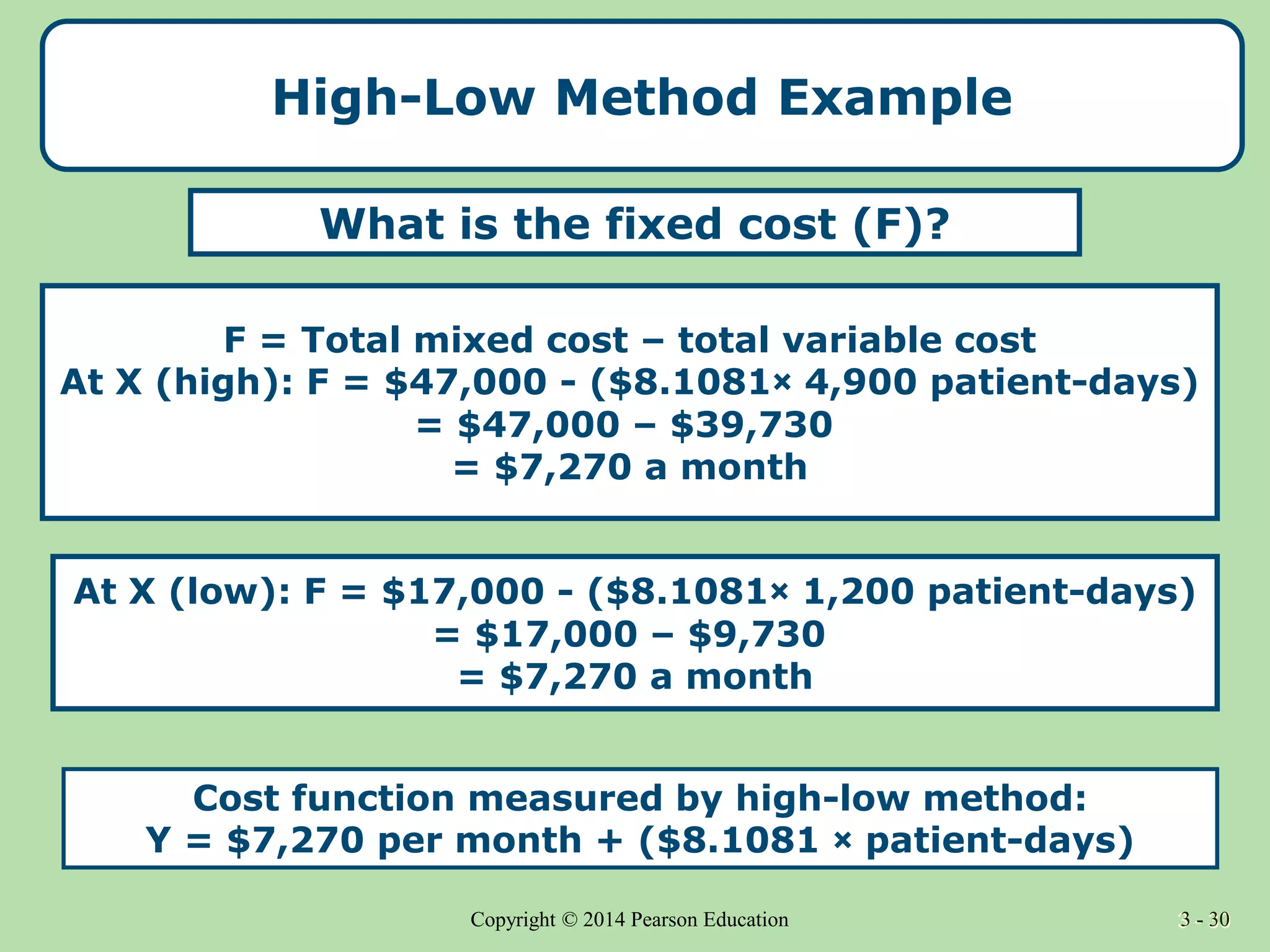

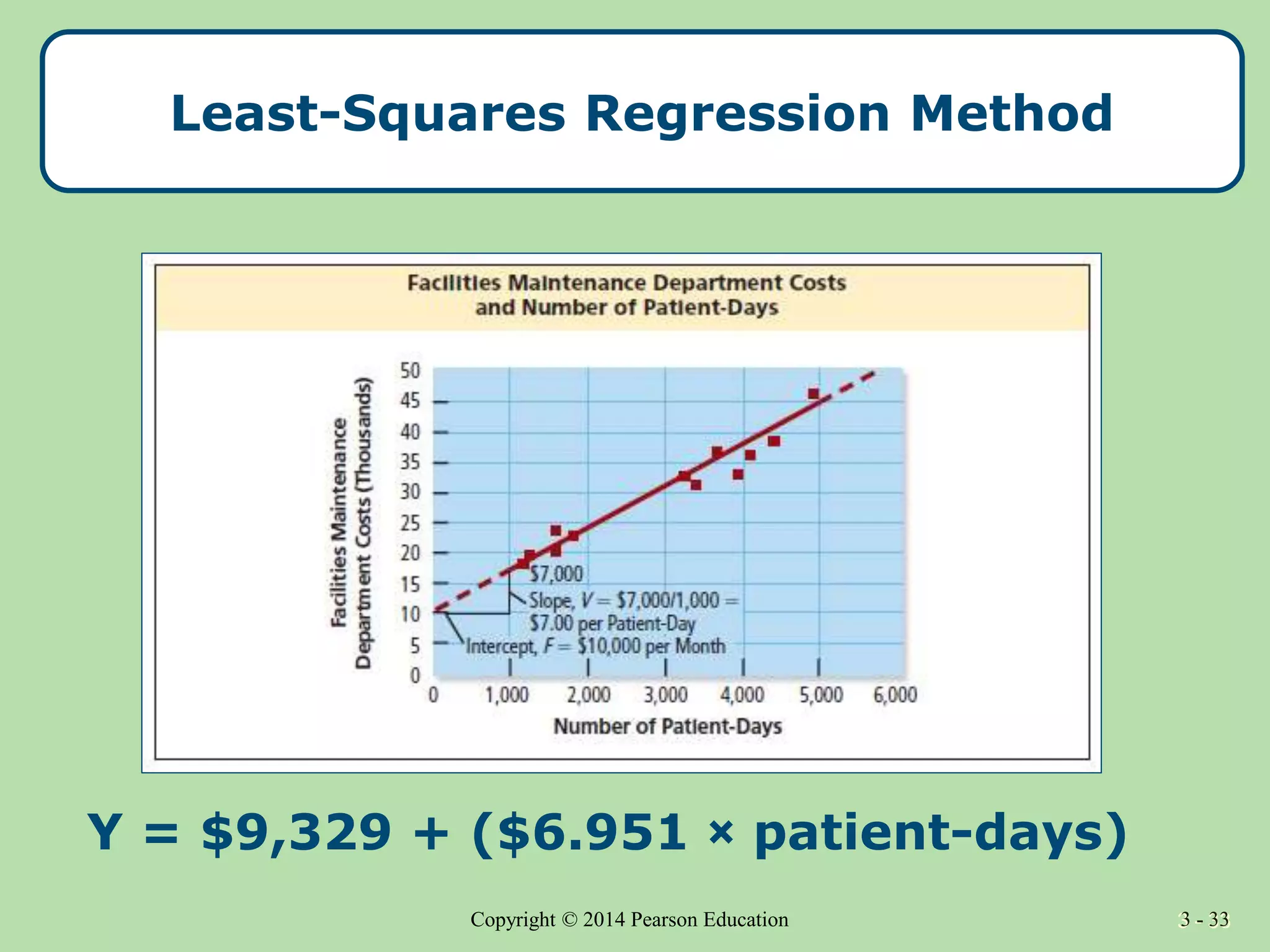

This document provides an overview of cost behavior and cost functions. It discusses how management can influence cost behavior through decisions around processes, capacity, technology, and incentives. It also explains how to measure cost functions using various methods like engineering analysis, account analysis, high-low analysis, and regression analysis. The document emphasizes that understanding cost behavior and developing accurate cost functions allows managers to better plan, control costs, and make decisions.