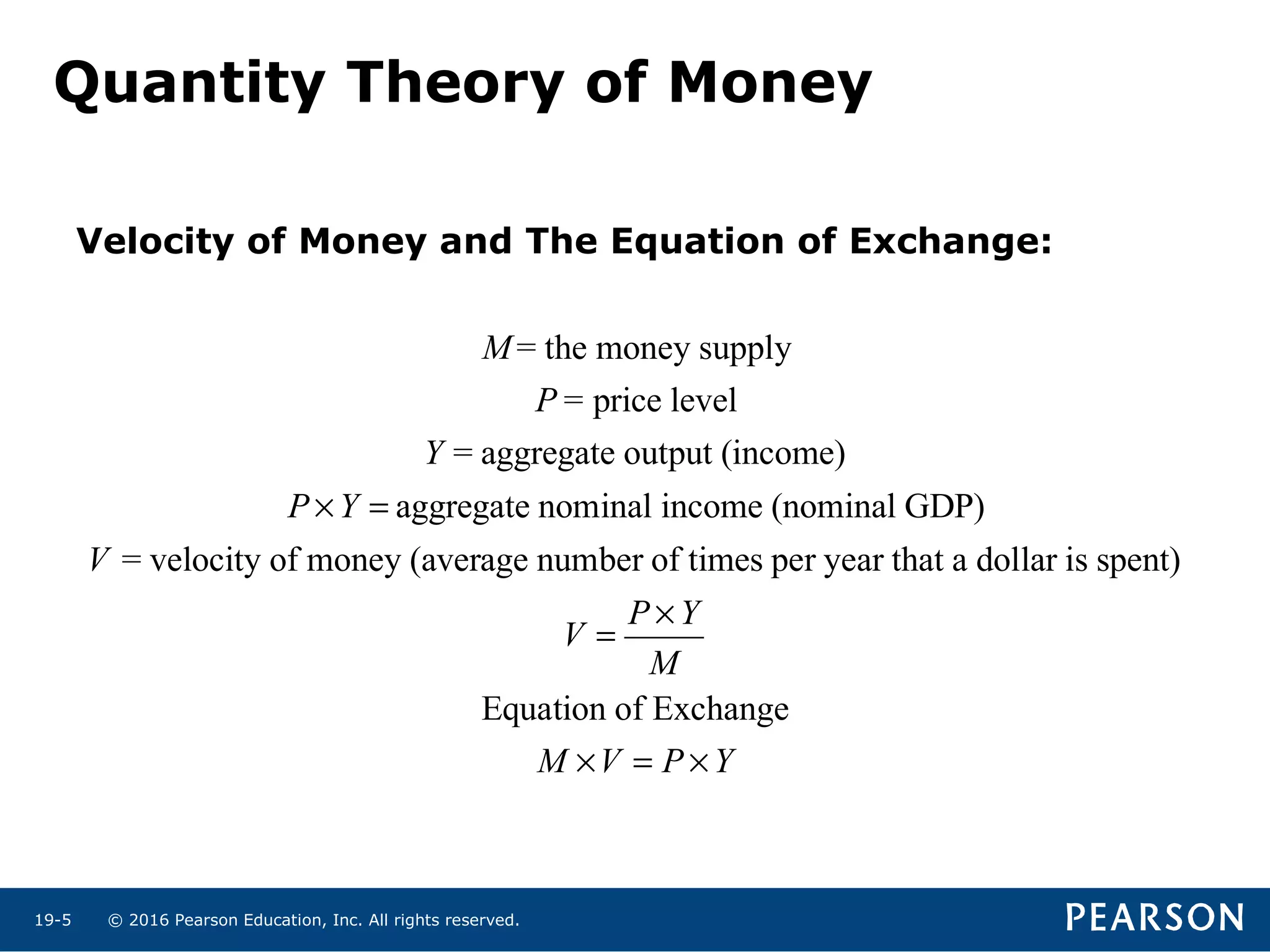

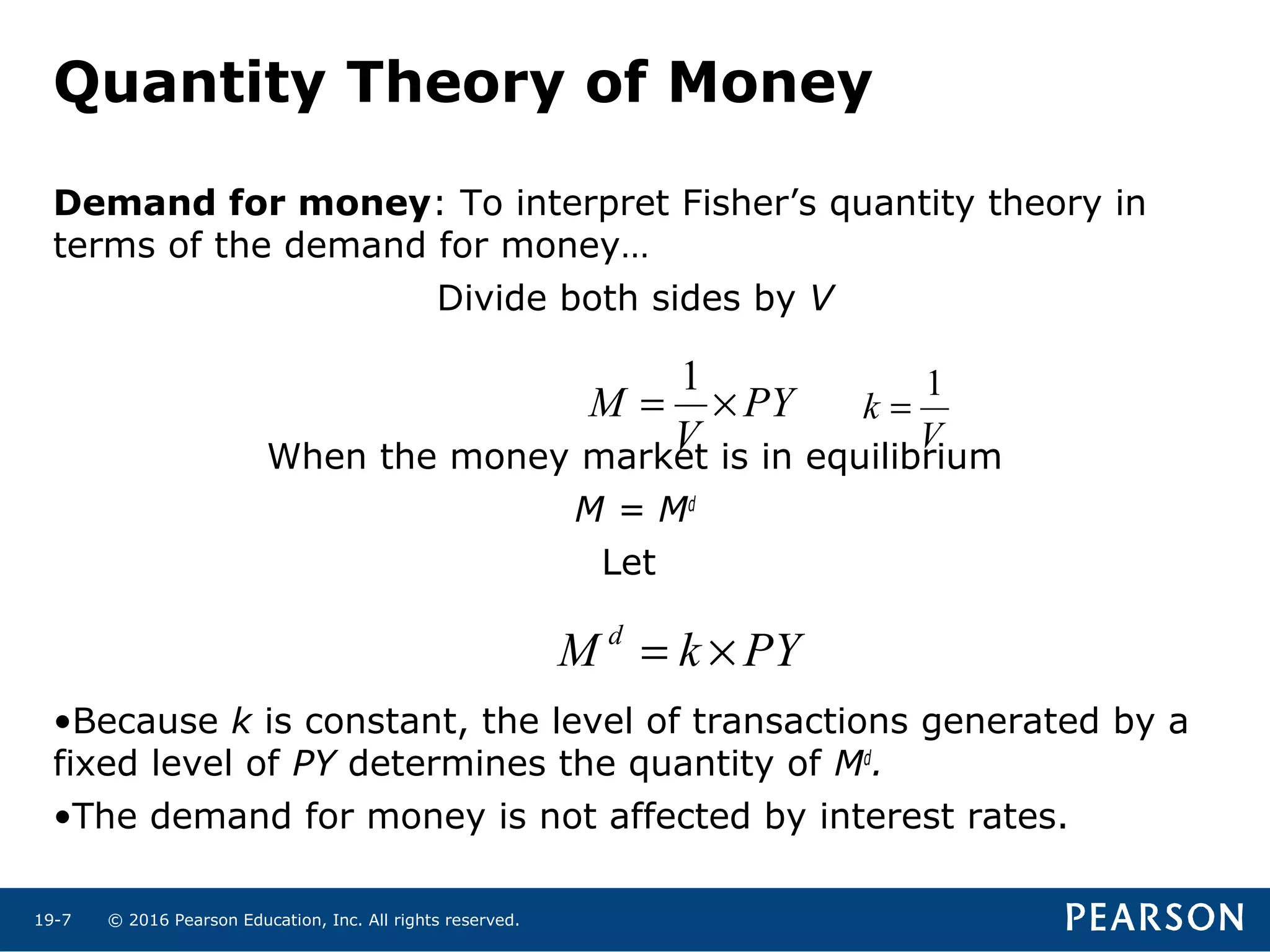

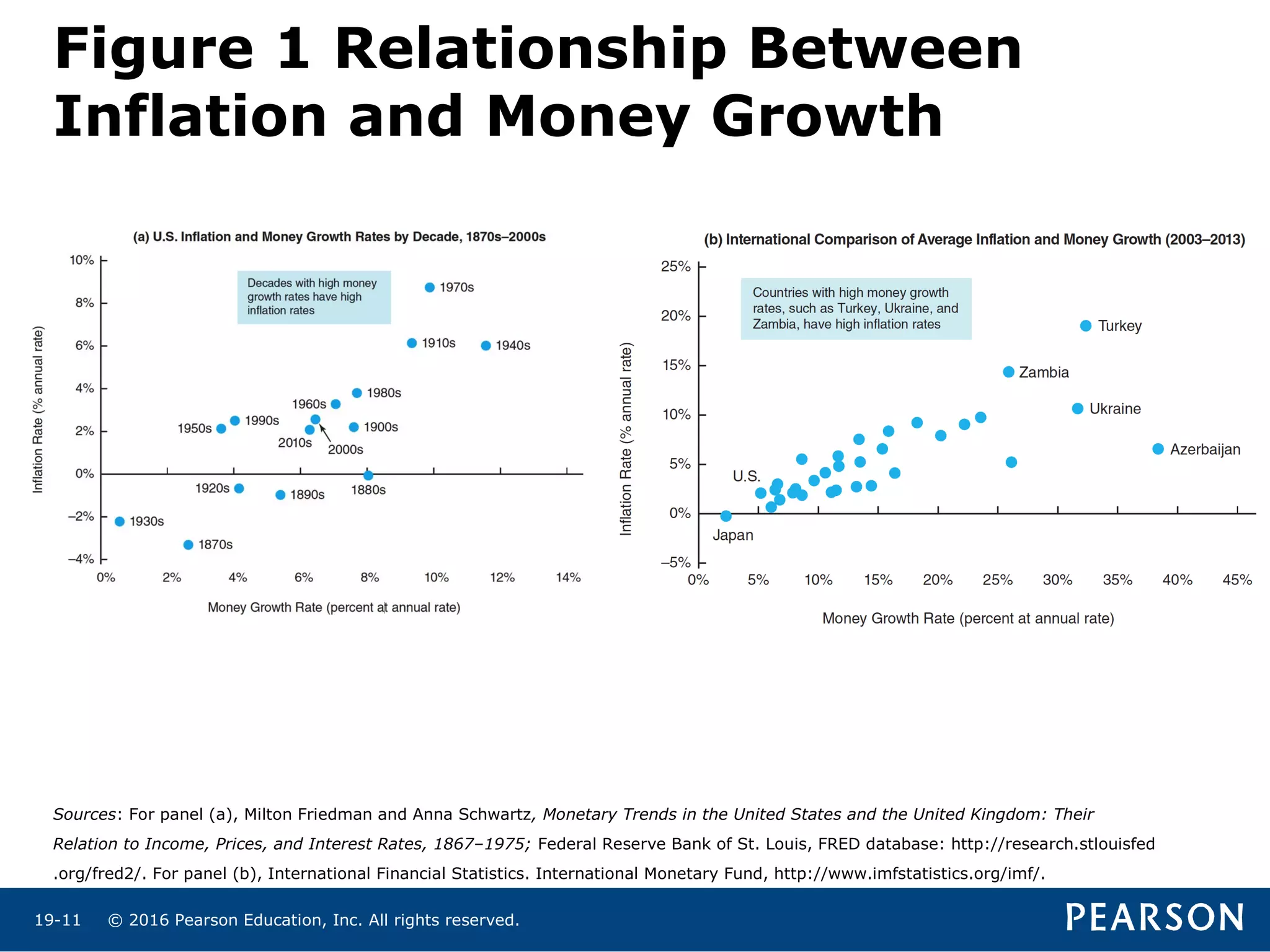

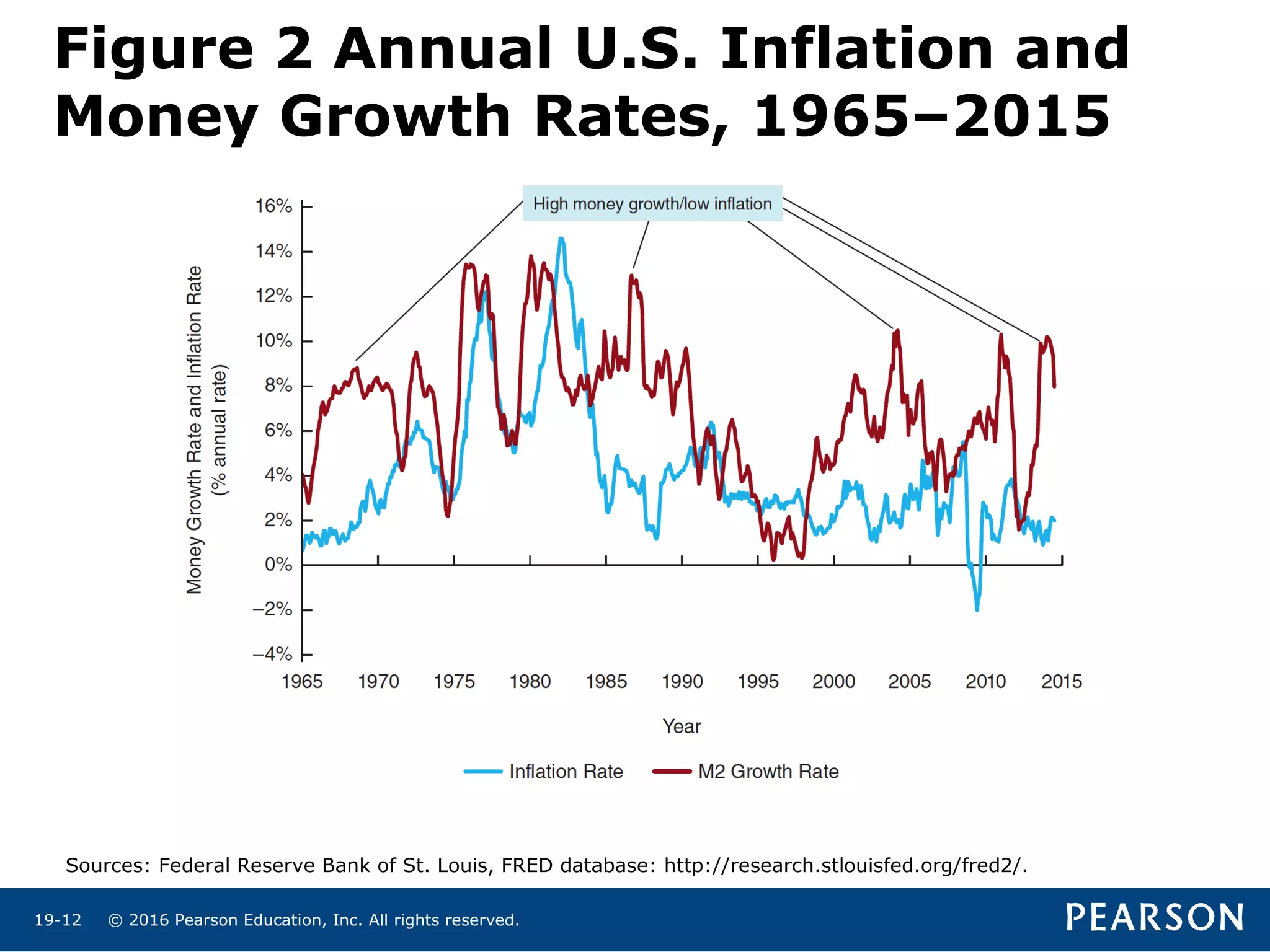

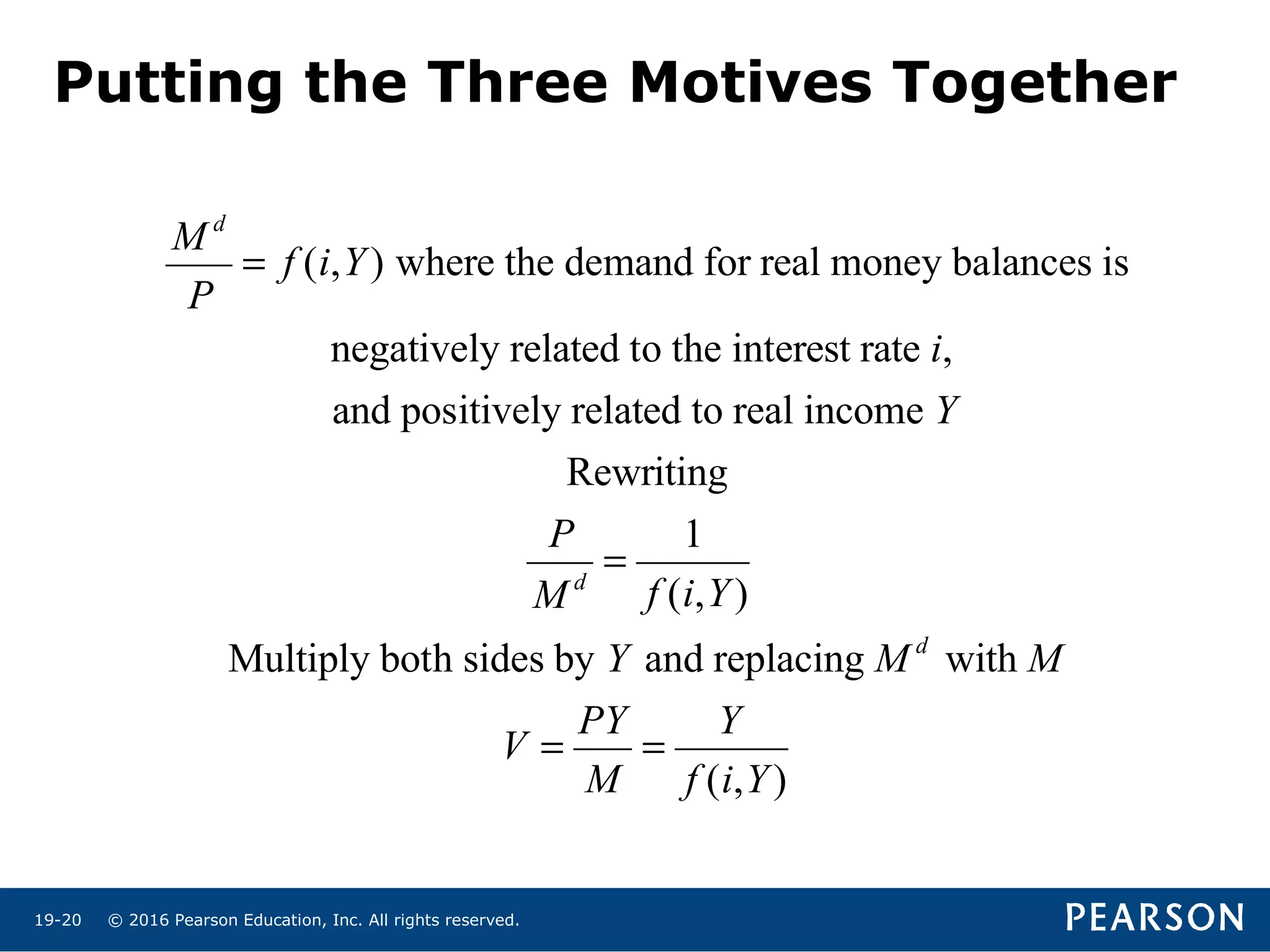

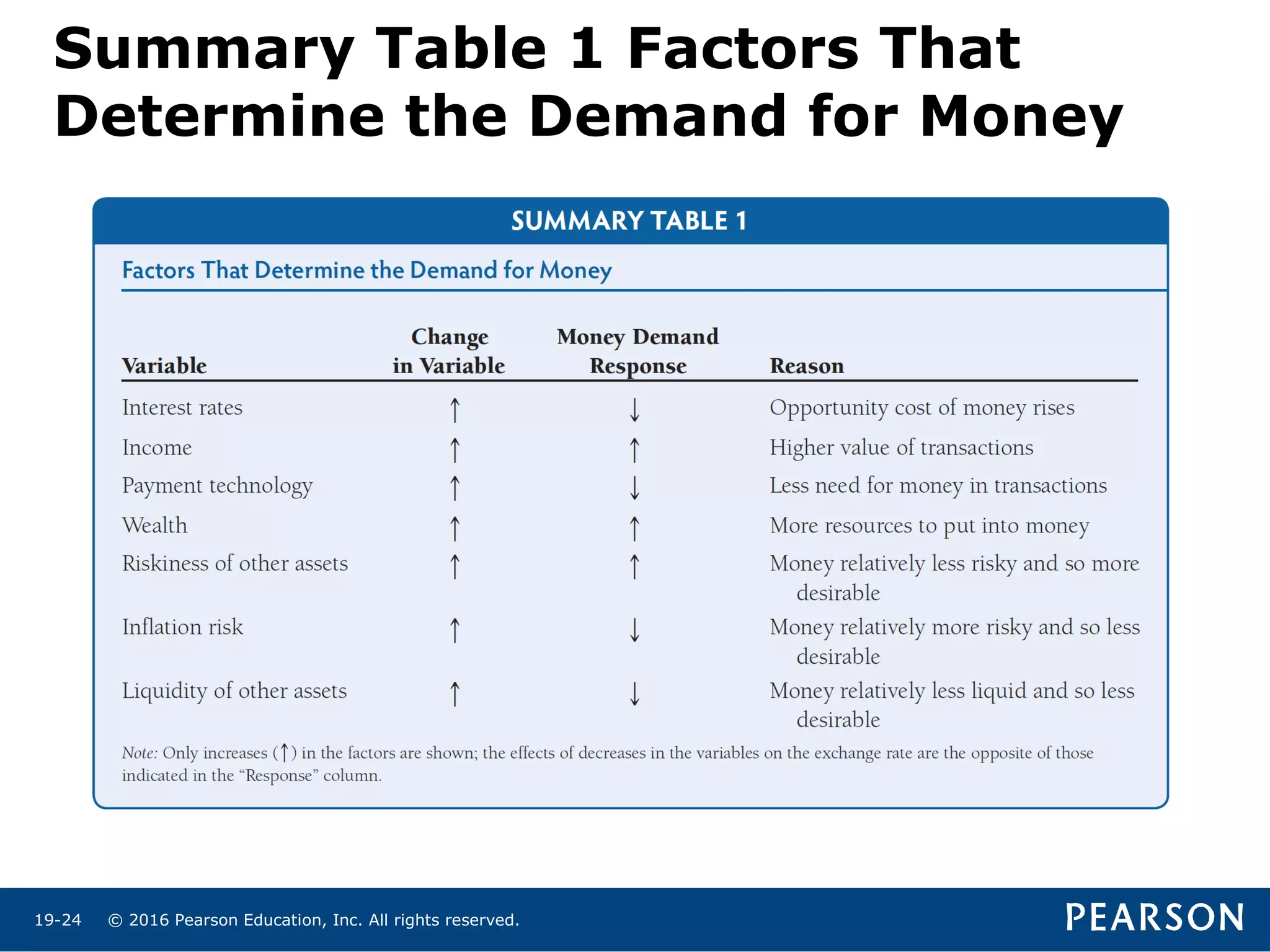

This chapter examines the quantity theory of money and its link to the demand for money. It discusses how the quantity theory implies a relationship between money growth and inflation in the short and long run. It also addresses how budget deficits can lead to inflation if they are financed by increases in the money supply rather than bond holdings. The chapter then summarizes Keynes' liquidity preference theory of money demand and how it incorporates transactions, precautionary, and speculative motives for holding money. Finally, it discusses portfolio theories of money demand and empirical evidence on factors that determine demand for money and the stability of the money demand function.