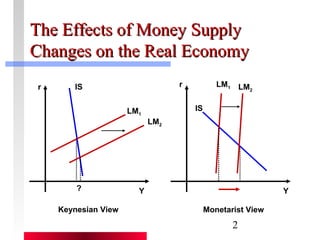

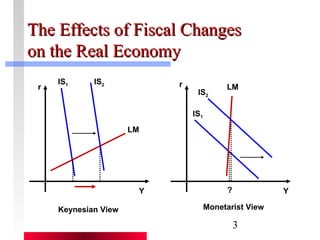

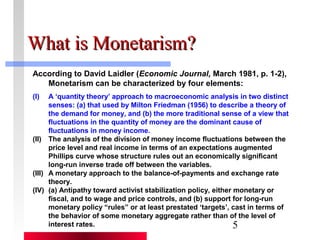

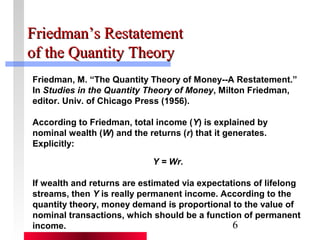

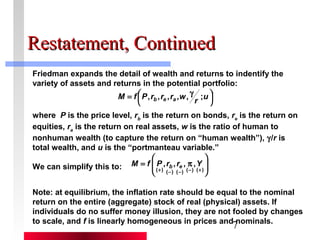

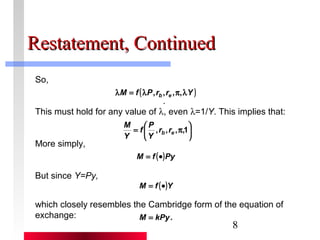

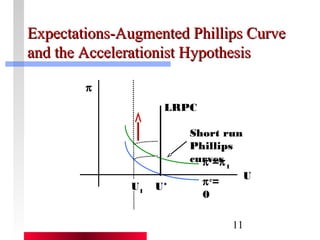

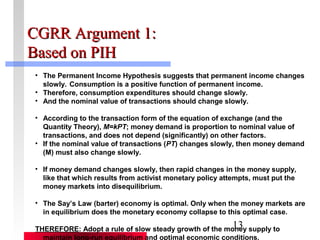

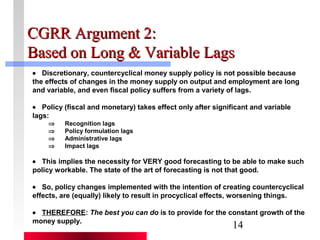

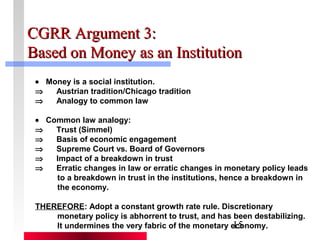

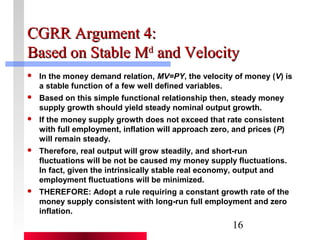

The document provides an overview of monetarism and Milton Friedman's restatement of the quantity theory of money. It discusses four key aspects of monetarism: (1) that fluctuations in the money supply are the dominant cause of fluctuations in real output; (2) monetarism's use of an expectations-augmented Phillips curve; (3) a monetary approach to exchange rates; and (4) support for monetary policy rules over discretionary policies. It also summarizes Friedman's restatement of the quantity theory and three arguments for adopting a rule-based monetary policy of steady money supply growth.