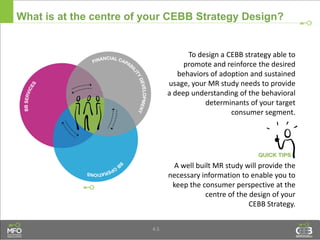

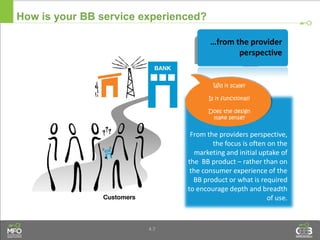

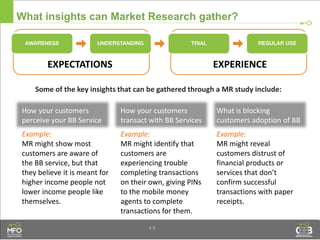

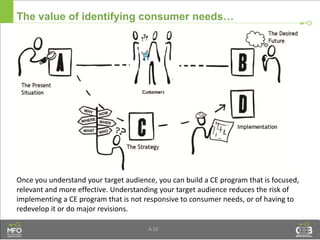

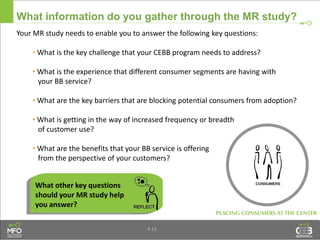

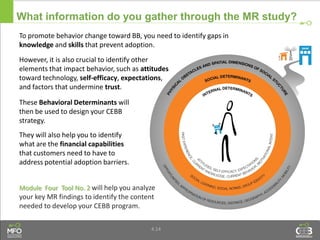

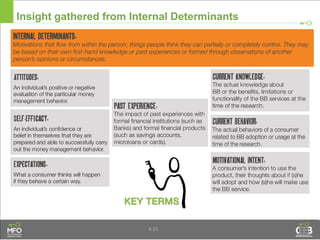

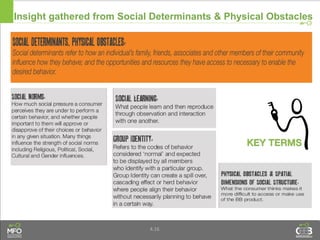

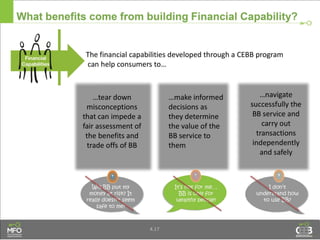

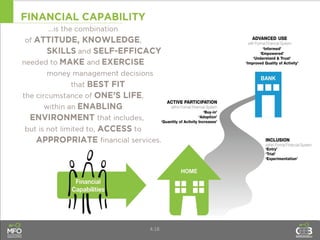

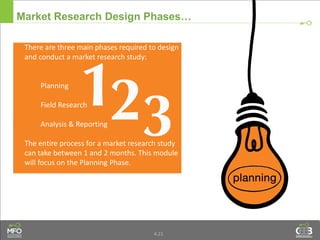

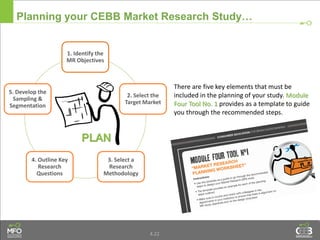

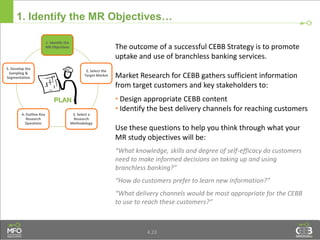

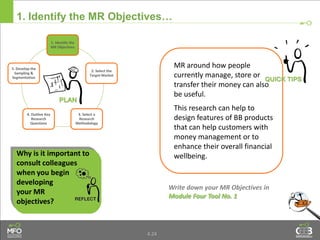

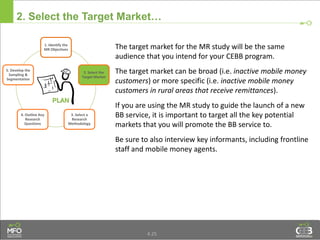

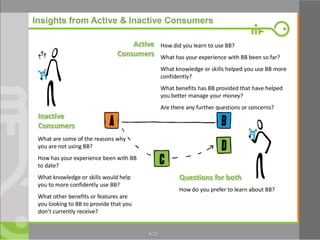

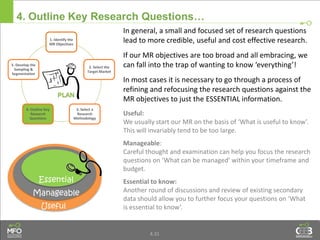

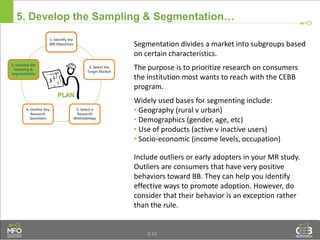

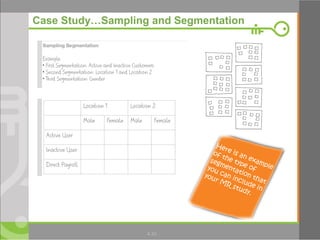

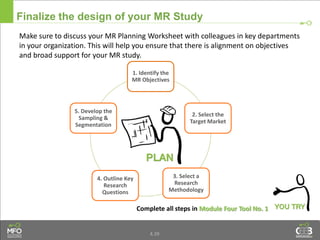

The document discusses planning a market research study to inform the design of a consumer education strategy for branchless banking. It emphasizes the importance of understanding the consumer perspective and experience with branchless banking services. A well-planned market research study should identify barriers preventing adoption, insights on customer expectations and experiences, and behavioral determinants impacting use. The planning process involves defining objectives, selecting a target market, choosing a qualitative research methodology, outlining key questions, and developing sampling and segmentation. Understanding consumers is key to creating an effective strategy to promote uptake and use of branchless banking.