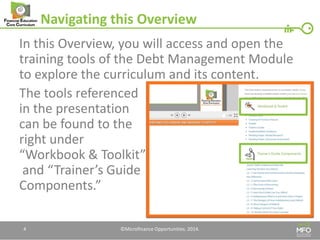

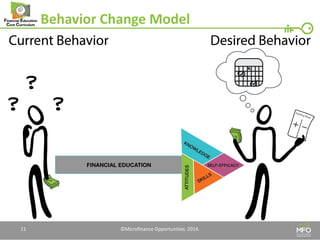

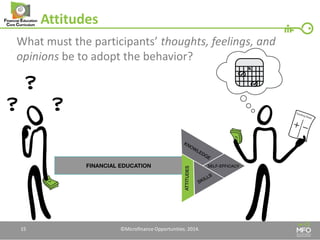

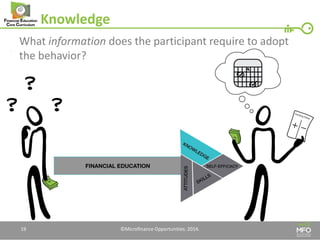

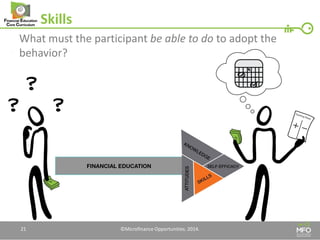

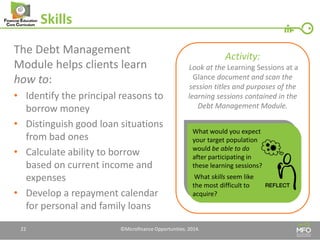

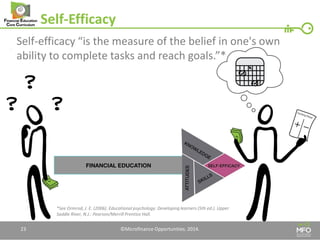

This document provides an overview of the Debt Management Module curriculum for financial education. It discusses how the module aims to change consumers' debt management behaviors by addressing their attitudes, knowledge, skills, and self-efficacy. It reviews the objectives and content of the module, including exploring common consumer debt behaviors, desired new behaviors, and how the learning sessions incorporate activities and adult learning principles to build skills and confidence in participants. The overview encourages users to consider how to apply the module most effectively in their local communities.