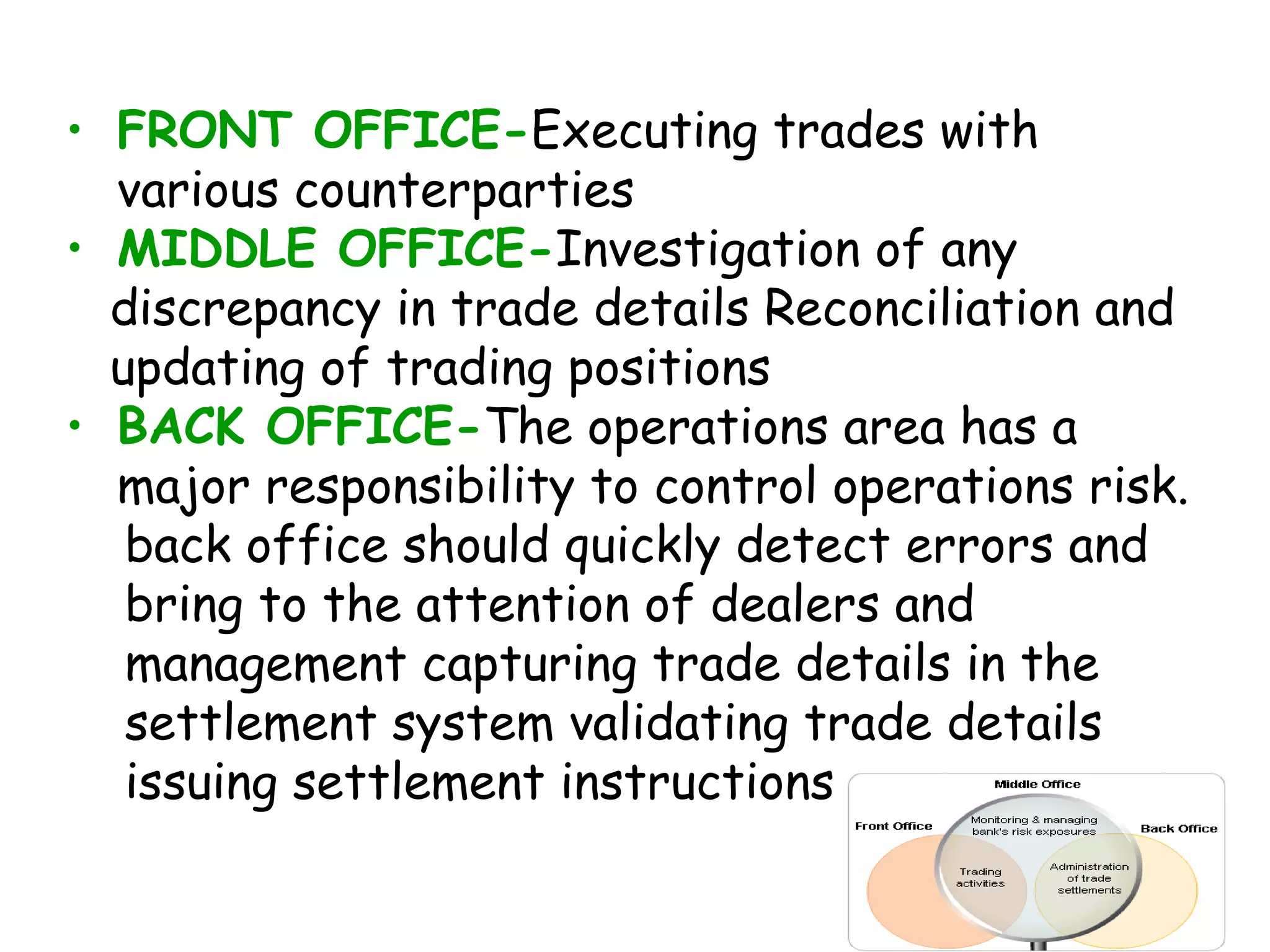

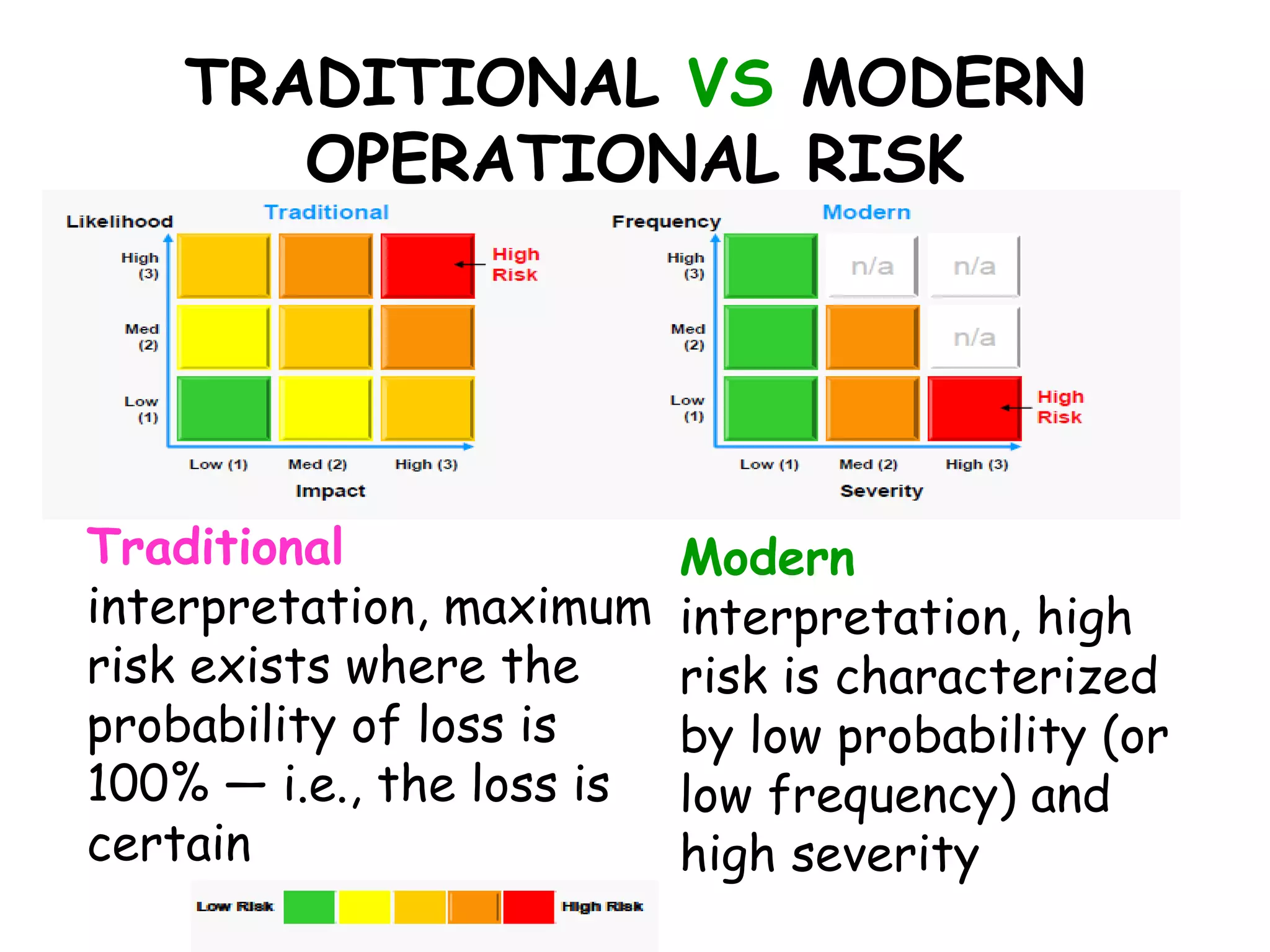

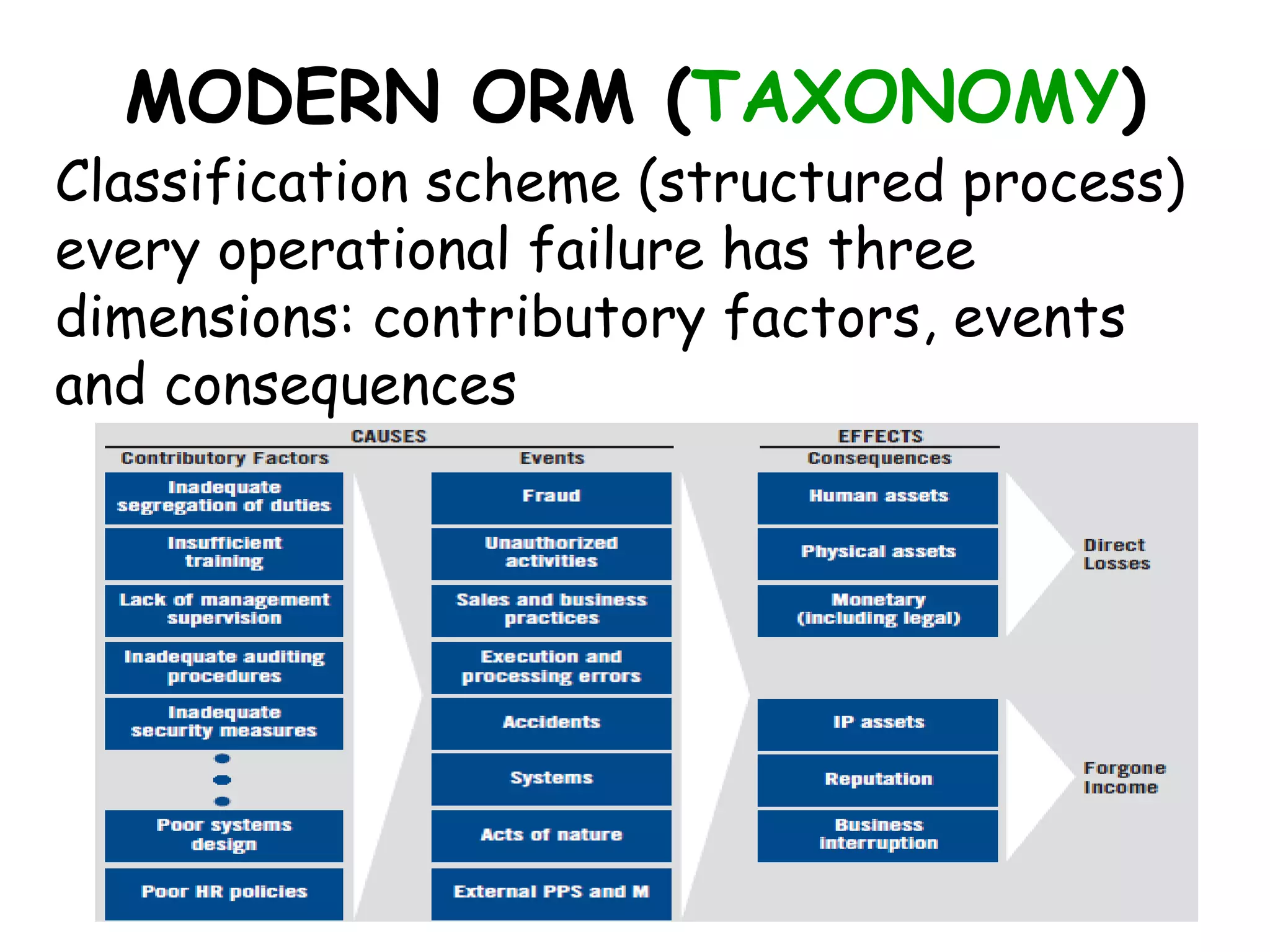

The document discusses traditional and modern approaches to operational risk management (ORM). Under the traditional approach, risk is defined as the probability of a loss occurring, while the modern approach defines risk as a measure of exposure to loss at a level of uncertainty. The modern ORM framework uses a multidimensional approach that incorporates cost-benefit analysis to optimize risk-reward, risk controls, and risk transfer. It also uses a taxonomy to classify operational failures according to contributory factors, events, and consequences.