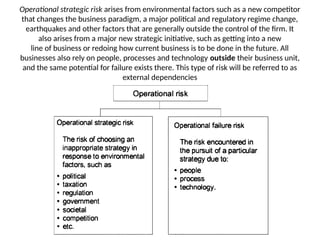

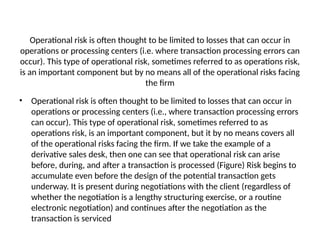

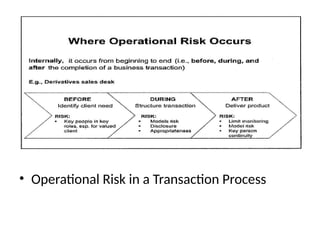

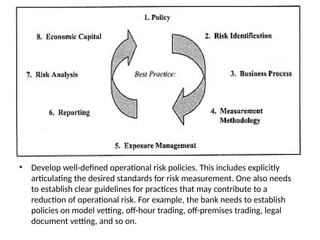

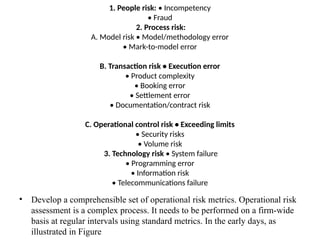

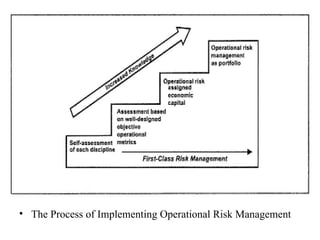

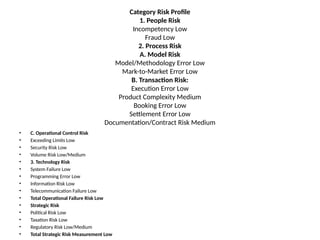

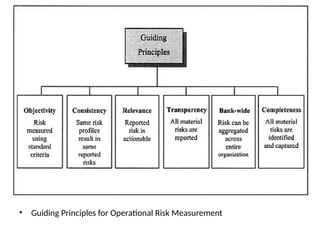

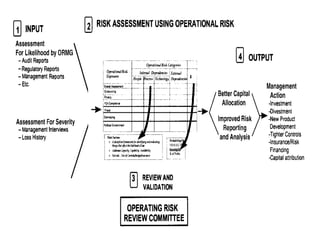

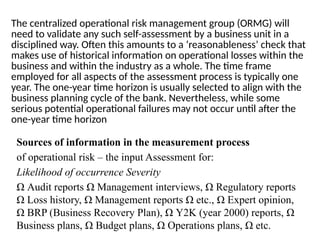

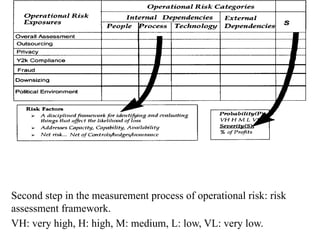

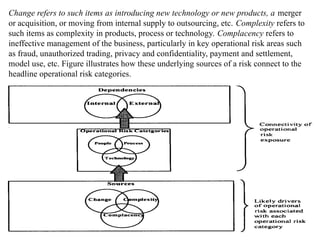

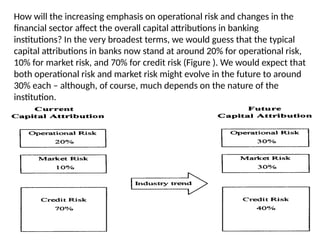

Operational risk refers to potential internal failures in a firm's operations, distinct from market and credit risks, and can arise from people, processes, and technology. It is essential for management to define and assess operational risk, encompassing both operational failure risk and operational strategic risk, while employing methods to quantify and mitigate these risks. A successful operational risk management framework includes clearly defined policies, risk identification through standardized metrics, and coordination across different functions within the organization.