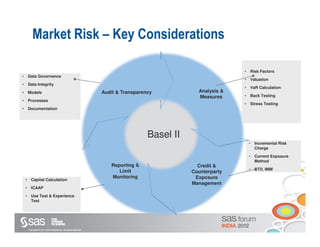

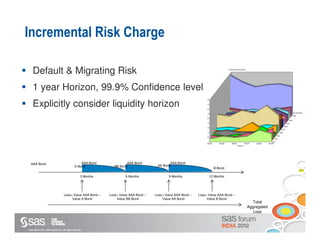

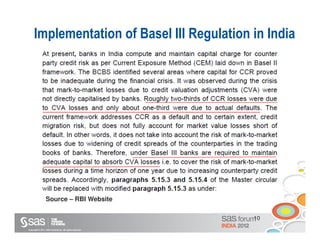

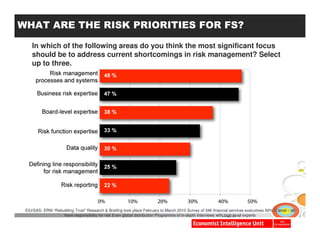

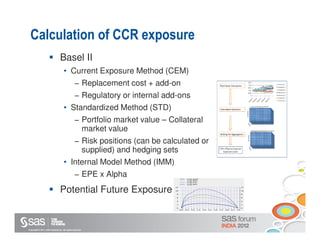

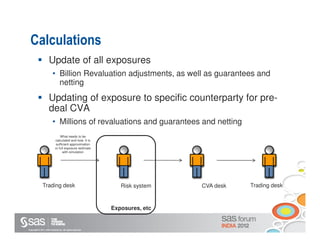

The document discusses key considerations in market risk and the implementation of Basel III regulations, including counterparty exposure management, risk factors, and methodologies for calculating exposures and collateral. It emphasizes the importance of data governance, model validation, stress testing, and reporting requirements for effective risk management in financial services. Additionally, it highlights the need for improved risk prioritization and advanced modeling techniques to address the challenges posed by market volatility and counterparty risks.