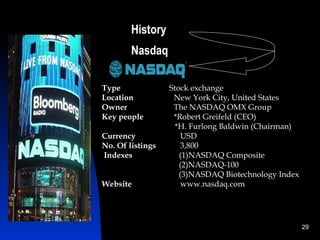

The document provides information about the differences between the New York Stock Exchange (NYSE) and the NASDAQ stock market. It begins with an executive summary that outlines the key differences in their operations and the types of stocks that trade on each exchange. It then provides more detailed sections on the history, trading mechanisms, listings requirements and roles of market makers for both the NYSE and NASDAQ.