Data calculation of_thesis_2011

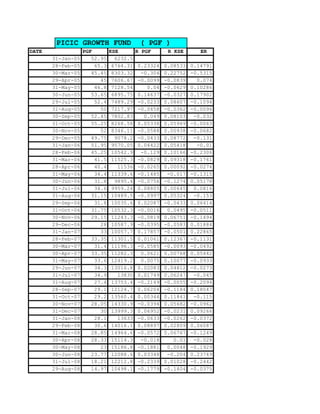

- 1. PICIC GROWTH FUND ( PGF ) DATE PGF KSE R PGF R KSE ER 31-Jan-05 52.95 6232.5 28-Feb-05 65.3 6764.31 0.23324 0.08533 0.14791 30-Mar-05 45.45 8303.32 -0.304 0.22752 -0.5315 29-Apr-05 45 7606.67 -0.0099 -0.0839 0.074 31-May-05 46.8 7128.54 0.04 -0.0629 0.10286 30-Jun-05 53.65 6895.75 0.14637 -0.0327 0.17902 29-Jul-05 52.4 7489.29 -0.0233 0.08607 -0.1094 31-Aug-05 50 7217.97 -0.0458 -0.0362 -0.0096 30-Sep-05 52.45 7802.83 0.049 0.08103 -0.032 31-Oct-05 55.25 8268.58 0.05338 0.05969 -0.0063 30-Nov-05 52 8346.11 -0.0588 0.00938 -0.0682 29-Dec-05 49.75 9078.2 -0.0433 0.08772 -0.131 31-Jan-06 51.95 9570.05 0.04422 0.05418 -0.01 28-Feb-06 45.25 10542.9 -0.129 0.10166 -0.2306 31-Mar-06 41.5 11525.3 -0.0829 0.09318 -0.1761 28-Apr-06 40.4 11536 -0.0265 0.00092 -0.0274 31-May-06 34.4 11339.6 -0.1485 -0.017 -0.1315 30-Jun-06 31.8 9895.4 -0.0756 -0.1274 0.05178 31-Jul-06 34.6 9959.24 0.08805 0.00645 0.0816 31-Aug-06 31.15 10489.5 -0.0997 0.05324 -0.153 29-Sep-06 31.8 10035.6 0.02087 -0.0433 0.06414 31-Oct-06 31.75 10532.3 -0.0016 0.0495 -0.0511 30-Nov-06 29.15 11243.3 -0.0819 0.06751 -0.1494 29-Dec-06 28 10587.9 -0.0395 -0.0583 0.01884 31-Jan-07 33 10057.7 0.17857 -0.0501 0.22865 28-Feb-07 33.35 11301.5 0.01061 0.12367 -0.1131 30-Mar-07 31.4 11196.3 -0.0585 -0.0093 -0.0492 30-Apr-07 33.35 11282.3 0.0621 0.00768 0.05442 31-May-07 33.6 12419.2 0.0075 0.10077 -0.0933 29-Jun-07 34.3 13016.8 0.02083 0.04812 -0.0273 31-Jul-07 34.9 13830 0.01749 0.06247 -0.045 31-Aug-07 27.4 13753.4 -0.2149 -0.0055 -0.2094 28-Sep-07 29.1 12124.7 0.06204 -0.1184 0.18047 31-Oct-07 29.2 13560.4 0.00344 0.11841 -0.115 30-Nov-07 28.05 14330.9 -0.0394 0.05682 -0.0962 31-Dec-07 30 13999.3 0.06952 -0.0231 0.09266 31-Jan-08 28.1 13633 -0.0633 -0.0262 -0.0372 29-Feb-08 30.6 14016.1 0.08897 0.02809 0.06087 31-Mar-08 28.85 14964.6 -0.0572 0.06767 -0.1249 30-Apr-08 28.33 15114.3 -0.018 0.01 -0.028 30-May-08 23 15186.8 -0.1881 0.0048 -0.1929 30-Jun-08 23.77 12088.6 0.03348 -0.204 0.23749 31-Jul-08 18.21 12212.8 -0.2339 0.01028 -0.2442 29-Aug-08 14.97 10498.1 -0.1779 -0.1404 -0.0375

- 2. 24-Sep-08 14.97 9207.87 0 -0.1229 0.12291 6-Oct-08 14.97 9179.68 0 -0.0031 0.00306 4-Nov-08 14.97 9182.88 0 0.00035 -0.0004 31-Dec-08 5.36 9187.1 -0.642 0.00046 -0.6424 30-Jan-09 7.25 5753.16 0.35261 -0.3738 0.72639 27-Feb-09 7.19 5373.38 -0.0083 -0.066 0.05774 31-Mar-09 8.8 5730.21 0.22392 0.06641 0.15752 30-Apr-09 9.51 6907.74 0.08068 0.2055 -0.1248 29-May-09 9.19 7222.85 -0.0337 0.04562 -0.0793 30-Jun-09 8.45 7289.14 -0.0805 0.00918 -0.0897 31-Jul-09 10.71 7174.47 0.26746 -0.0157 0.28319 31-Aug-09 11.17 7748.95 0.04295 0.08007 -0.0371 30-Sep-09 14.42 8737.98 0.29096 0.12763 0.16332 30-Oct-09 16.41 9380.49 0.138 0.07353 0.06447 26-Nov-09 14 9182.4 -0.1469 -0.0211 -0.1257 31-Dec-09 14.38 9136.6 0.02714 -0.005 0.03213 AVERAGE RETURN -0.0081 0.01127 STANDARD DEVIATION 0.18745 INFORMATION RATIO -0.1034 ANNULIZED INFORMATION RATIO -0.3583

- 3. ASIAN STOCK FUND LIMITED ( ASFL ) DATE ASFL KSE R ASFL R KSE ER 31-Jan-05 10.5 6232.5 25-Feb-05 10.5 6764.31 0 0.08533 -0.0853 29-Mar-05 8.6 8303.32 -0.181 0.22752 -0.4085 28-Apr-05 8.25 7606.67 -0.0407 -0.0839 0.0432 30-May-05 8.15 7128.54 -0.0121 -0.0629 0.05074 30-Jun-05 10.65 6895.75 0.30675 -0.0327 0.33941 26-Jul-05 10.25 7489.29 -0.0376 0.08607 -0.1236 31-Aug-05 10 7217.97 -0.0244 -0.0362 0.01184 29-Sep-05 11 7802.83 0.1 0.08103 0.01897 19-Oct-05 10.8 8268.58 -0.0182 0.05969 -0.0779 30-Nov-05 9.7 8346.11 -0.1019 0.00938 -0.1112 29-Dec-05 9.95 9078.2 0.02577 0.08772 -0.0619 31-Jan-06 10 9570.05 0.00503 0.05418 -0.0492 24-Feb-06 7.5 10542.9 -0.25 0.10166 -0.3517 8-Mar-06 8 11525.3 0.06667 0.09318 -0.0265 26-Apr-06 9 11536 0.125 0.00092 0.12408 22-May-06 8.95 11339.6 -0.0056 -0.017 0.01147 17-Jun-06 8.95 9895.4 0 -0.1274 0.12736 13-Jul-06 8.95 9959.24 0 0.00645 -0.0065 8-Aug-06 8 10489.5 -0.1062 0.05324 -0.1594 21-Sep-06 7 10035.6 -0.125 -0.0433 -0.0817 9-Oct-06 6 10532.3 -0.1429 0.0495 -0.1924 30-Nov-06 5.8 11243.3 -0.0333 0.06751 -0.1008 29-Dec-06 5.5 10587.9 -0.0517 -0.0583 0.00657 22-Jan-07 4.95 10057.7 -0.1 -0.0501 -0.0499 20-Feb-07 5.9 11301.5 0.19192 0.12367 0.06825 29-Mar-07 6 11196.3 0.01695 -0.0093 0.02626 3-May-07 6 11282.3 0 0.00768 -0.0077 31-May-07 5.05 12419.2 -0.1583 0.10077 -0.2591 28-Jun-07 4.65 13016.8 -0.0792 0.04812 -0.1273 26-Jul-07 4.8 13830 0.03226 0.06247 -0.0302 30-Aug-07 3.1 13753.4 -0.3542 -0.0055 -0.3486 28-Sep-07 4 12124.7 0.29032 -0.1184 0.40874 25-Oct-07 5.35 13560.4 0.3375 0.11841 0.21909 29-Nov-07 5.4 14330.9 0.00935 0.05682 -0.0475 24-Dec-07 7.2 13999.3 0.33333 -0.0231 0.35647 30-Jan-08 6.5 13633 -0.0972 -0.0262 -0.0711 28-Feb-08 5.8 14016.1 -0.1077 0.02809 -0.1358 20-Mar-08 5.75 14964.6 -0.0086 0.06767 -0.0763 21-Apr-08 5.5 15114.3 -0.0435 0.01 -0.0535 19-May-08 5.2 15186.8 -0.0546 0.0048 -0.0594 27-Jun-08 5.7 12088.6 0.09615 -0.204 0.30016 4-Jul-08 5.7 12212.8 0 0.01028 -0.0103 8-Aug-08 5.7 10498.1 0 -0.1404 0.1404

- 4. 13-Sep-08 5.7 9207.87 0 -0.1229 0.12291 21-Oct-08 6.17 9179.68 0.08246 -0.0031 0.08552 24-Nov-08 6.17 9182.88 0 0.00035 -0.0004 28-Dec-08 2.5 9187.1 -0.5948 0.00046 -0.5953 31-Jan-09 2.5 5753.16 0 -0.3738 0.37378 1-Feb-09 2.5 5373.38 0 -0.066 0.06601 31-Mar-09 2.5 5730.21 0 0.06641 -0.0664 1-Apr-09 4.87 6907.74 0.948 0.2055 0.74251 6-May-09 4.87 7222.85 0 0.04562 -0.0456 29-Jun-09 4.87 7289.14 0 0.00918 -0.0092 27-Jul-09 1.92 7174.47 -0.6058 -0.0157 -0.59 31-Aug-09 2.43 7748.95 0.26563 0.08007 0.18555 30-Sep-09 5.19 8737.98 1.1358 0.12763 1.00817 29-Oct-09 2.62 9380.49 -0.4952 0.07353 -0.5687 16-Nov-09 1.83 9182.4 -0.3015 -0.0211 -0.2804 31-Dec-09 3.2 9136.6 0.74863 -0.005 0.75362 AVERAGE RETURN 0.01672 0.01127 STANDARD DEVIATION 0.28525 INFORMATION RATIO 0.01913 ANNULIZED INFORMATION RATIO 0.06627

- 5. SAFEWAY MUTUAL FUND ( SFWF ) SFWF KSE_PRICER_SFWF R_KSE ER 27-Jan-05 23.2 6232.5 24-Feb-05 23 6764.31 -0.0086 0.08533 -0.094 28-Mar-05 19.9 8303.32 -0.1348 0.22752 -0.3623 28-Apr-05 19.8 7606.67 -0.005 -0.0839 0.07888 26-May-05 20.8 7128.54 0.05051 -0.0629 0.11336 30-Jun-05 24.85 6895.75 0.19471 -0.0327 0.22737 21-Jul-05 19 7489.29 -0.2354 0.08607 -0.3215 30-Aug-05 19 7217.97 0 -0.0362 0.03623 27-Sep-05 19.5 7802.83 0.02632 0.08103 -0.0547 21-Oct-05 19.5 8268.58 0 0.05969 -0.0597 30-Nov-05 15.65 8346.11 -0.1974 0.00938 -0.2068 29-Dec-05 16 9078.2 0.02236 0.08772 -0.0654 26-Jan-06 15 9570.05 -0.0625 0.05418 -0.1167 24-Feb-06 15.7 10542.9 0.04667 0.10166 -0.055 30-Mar-06 14.9 11525.3 -0.051 0.09318 -0.1441 27-Apr-06 14 11536 -0.0604 0.00092 -0.0613 30-May-06 13.1 11339.6 -0.0643 -0.017 -0.0473 5-Jun-08 13 9895.4 -0.0076 -0.1274 0.11973 26-Jul-06 12.5 9959.24 -0.0385 0.00645 -0.0449 7-Aug-06 11.95 10489.5 -0.044 0.05324 -0.0972 15-Sep-06 11.95 10035.6 0 -0.0433 0.04327 31-Oct-06 12 10532.3 0.00418 0.0495 -0.0453 17-Nov-06 9.1 11243.3 -0.2417 0.06751 -0.3092 29-Dec-06 6.8 10587.9 -0.2528 -0.0583 -0.1945 31-Jan-07 6.35 10057.7 -0.0662 -0.0501 -0.0161 21-Feb-07 6.55 11301.5 0.0315 0.12367 -0.0922 29-Mar-07 7.5 11196.3 0.14504 -0.0093 0.15435 25-Apr-07 7.75 11282.3 0.03333 0.00768 0.02565 28-May-07 8.05 12419.2 0.03871 0.10077 -0.0621 28-Jun-07 11.15 13016.8 0.38509 0.04812 0.33698 31-Jul-07 13 13830 0.16592 0.06247 0.10345 29-Aug-07 10 13753.4 -0.2308 -0.0055 -0.2252 28-Sep-07 10.5 12124.7 0.05 -0.1184 0.16842 11-Oct-07 10.9 13560.4 0.0381 0.11841 -0.0803 27-Nov-07 9.7 14330.9 -0.1101 0.05682 -0.1669 31-Dec-07 11.5 13999.3 0.18557 -0.0231 0.20871 24-Jan-08 11.5 13633 0 -0.0262 0.02616 27-Feb-08 11.7 14016.1 0.01739 0.02809 -0.0107 10-Mar-08 12.4 14964.6 0.05983 0.06767 -0.0078 24-Apr-08 12.9 15114.3 0.04032 0.01 0.03032 26-May-08 12 15186.8 -0.0698 0.0048 -0.0746 27-Jun-08 11.9 12088.6 -0.0083 -0.204 0.19567 29-Jul-08 12.2 12212.8 0.02521 0.01028 0.01493 30-Aug-08 12.5 10498.1 0.02459 -0.1404 0.16499

- 6. 10-Sep-08 13 9207.87 0.04 -0.1229 0.16291 15-Oct-08 13 9179.68 0 -0.0031 0.00306 30-Nov-08 12.6 9182.88 -0.0308 0.00035 -0.0311 12-Dec-08 12 9187.1 -0.0476 0.00046 -0.0481 15-Jan-09 11.5 5753.16 -0.0417 -0.3738 0.33211 6-Feb-09 11 5373.38 -0.0435 -0.066 0.02253 2-Mar-09 10.5 5730.21 -0.0455 0.06641 -0.1119 17-Apr-09 9.6 6907.74 -0.0857 0.2055 -0.2912 28-May-09 8.75 7222.85 -0.0885 0.04562 -0.1342 29-Jun-09 9.75 7289.14 0.11429 0.00918 0.10511 29-Jul-09 8.9 7174.47 -0.0872 -0.0157 -0.0715 31-Aug-09 5.5 7748.95 -0.382 0.08007 -0.4621 30-Sep-09 8.28 8737.98 0.50546 0.12763 0.37782 29-Oct-09 6.31 9380.49 -0.2379 0.07353 -0.3115 26-Nov-09 5.04 9182.4 -0.2013 -0.0211 -0.1802 31-Dec-09 6.02 9136.6 0.19444 -0.005 0.19943 AVERAGE RETURN -0.0126 0.01127 STANDARD DEVIATION 0.17276 INFORMATION RATIO -0.1379 ANNUALIZED INFORMATION RATIO -0.4778

- 7. INTERFUND MOD ( FIFM ) FIFM KSE R_FIFM R_KSE ER 31-Jan-05 1.1 6232.5 28-Feb-05 1.1 6764.31 0 0.08533 -0.08533 28-Mar-05 1.2 8303.32 0.09091 0.22752 -0.13661 27-Apr-05 1 7606.67 -0.1667 -0.0839 -0.08277 31-May-05 1.2 7128.54 0.2 -0.0629 0.262857 23-Jun-05 0.55 6895.75 -0.5417 -0.0327 -0.50901 15-Jul-05 0.75 7489.29 0.36364 0.08607 0.277563 30-Aug-05 0.55 7217.97 -0.2667 -0.0362 -0.23044 19-Sep-05 1 7802.83 0.81818 0.08103 0.737153 12-Oct-05 0.7 8268.58 -0.3 0.05969 -0.35969 16-Nov-05 0.5 8346.11 -0.2857 0.00938 -0.29509 29-Dec-05 1 9078.2 1 0.08772 0.912284 4-Jan-06 0.7 9570.05 -0.3 0.05418 -0.35418 10-Feb-06 0.9 10542.9 0.28571 0.10166 0.184057 25-Mar-06 0.5 11525.3 -0.4444 0.09318 -0.53763 4-Apr-06 0.5 11536 0 0.00092 -0.00092 7-May-06 0.55 11339.6 0.1 -0.017 0.117021 19-Jun-06 0.95 9895.4 0.72727 -0.1274 0.854634 7-Jul-06 0.7 9959.24 -0.2632 0.00645 -0.26961 1-Aug-06 0.8 10489.5 0.14286 0.05324 0.089616 13-Sep-06 0.5 10035.6 -0.375 -0.0433 -0.33173 26-Oct-06 0.5 10532.3 0 0.0495 -0.04949 12-Nov-06 0.6 11243.3 0.2 0.06751 0.132492 5-Dec-06 0.25 10587.9 -0.5833 -0.0583 -0.52504 4-Jan-07 0.7 10057.7 1.8 -0.0501 1.850078 7-Feb-07 0.35 11301.5 -0.5 0.12367 -0.62367 13-Mar-07 0.9 11196.3 1.57143 -0.0093 1.580741 16-Apr-07 0.9 11282.3 0 0.00768 -0.00768 21-May-07 0.55 12419.2 -0.3889 0.10077 -0.48966 24-Jun-07 0.95 13016.8 0.72727 0.04812 0.679154 23-Jul-07 0.5 13830 -0.4737 0.06247 -0.53616 29-Aug-07 1.65 13753.4 2.3 -0.0055 2.305538 9/21/2007 0.8 12124.7 -0.5152 -0.1184 -0.39673 5-Oct-07 0.2 13560.4 -0.75 0.11841 -0.86841 30-Nov-07 0.3 14330.9 0.5 0.05682 0.443178 17-Dec-07 0.9 13999.3 2 -0.0231 2.023139 30-Jan-08 0.85 13633 -0.0556 -0.0262 -0.02939 14-Feb-08 0.85 14016.1 0 0.02809 -0.02809 4-Mar-08 0.8 14964.6 -0.0588 0.06767 -0.1265 21-Apr-08 0.75 15114.3 -0.0625 0.01 -0.0725 29-May-08 0.3 15186.8 -0.6 0.0048 -0.6048 12-Jun-08 0.2 12088.6 -0.3333 -0.204 -0.12933 17-Jul-08 0.4 12212.8 1 0.01028 0.989724 21-Aug-08 0.45 10498.1 0.125 -0.1404 0.265399

- 8. 25-Sep-08 0.9 9207.87 1 -0.1229 1.122905 30-Oct-08 0.9 9179.68 0 -0.0031 0.003062 13-Nov-08 0.06 9182.88 -0.9333 0.00035 -0.93368 4-Dec-08 0.06 9187.1 0 0.00046 -0.00046 4-Jan-09 0.05 5753.16 -0.1667 -0.3738 0.207112 5-Feb-09 0.05 5373.38 0 -0.066 0.066012 25-Mar-09 0.06 5730.21 0.2 0.06641 0.133593 9-Apr-09 0.06 6907.74 0 0.2055 -0.2055 9-May-09 0.06 7222.85 0 0.04562 -0.04562 8-Jun-09 0.06 7289.14 0 0.00918 -0.00918 4-Jul-09 0.06 7174.47 0 -0.0157 0.015732 25-Aug-09 0.06 7748.95 0 0.08007 -0.08007 20-Sep-09 0.06 8737.98 0 0.12763 -0.12763 16-Oct-09 0.06 9380.49 0 0.07353 -0.07353 11-Nov-09 0.06 9182.4 0 -0.0211 0.021117 7-Dec-09 0.1 9136.6 0.66667 -0.005 0.671654 AVERAGE RETURN 0.12635 0.01127 STANDARD DEVIATION 0.656189 INFORMATION RATIO 0.17538 ANNULIZED INFORMATION RATIO 0.60752

- 9. AL MEEZAN MUTUAL FUND ( AMMF ) DATE PRICE KSE_PRICER_AMMF R_KSE ER 1/7/2005 12.95 6232.5 2/8/2005 13 6764.31 0.00386 0.08533 -0.0815 3/1/2005 14.6 8303.32 0.12308 0.22752 -0.1044 4/11/2005 10.5 7606.67 -0.2808 -0.0839 -0.1969 5/2/2005 10.05 7128.54 -0.0429 -0.0629 0.02 6/10/2005 10.7 6895.75 0.06468 -0.0327 0.09733 7/4/2005 10.35 7489.29 -0.0327 0.08607 -0.1188 8/1/2005 10.5 7217.97 0.01449 -0.0362 0.05072 9/8/2005 10.05 7802.83 -0.0429 0.08103 -0.1239 10/7/2005 10.9 8268.58 0.08458 0.05969 0.02489 11/8/2005 11.65 8346.11 0.06881 0.00938 0.05943 12/1/2005 12.45 9078.2 0.06867 0.08772 -0.0191 1/9/2006 13.9 9570.05 0.11647 0.05418 0.06229 2/1/2006 15 10542.9 0.07914 0.10166 -0.0225 3/9/2006 14.3 11525.3 -0.0467 0.09318 -0.1399 4/19/2006 15.65 11536 0.09441 0.00092 0.09348 5/8/2006 15.65 11339.6 0 -0.017 0.01702 6/7/2006 15 9895.4 -0.0415 -0.1274 0.08583 7/3/2006 14.9 9959.24 -0.0067 0.00645 -0.0131 8/4/2006 14.85 10489.5 -0.0034 0.05324 -0.0566 9/5/2006 15.15 10035.6 0.0202 -0.0433 0.06347 10/2/2006 12.1 10532.3 -0.2013 0.0495 -0.2508 11/6/2006 12.35 11243.3 0.02066 0.06751 -0.0469 12/5/2006 12.3 10587.9 -0.0041 -0.0583 0.05424 1/3/2007 12.85 10057.7 0.04472 -0.0501 0.09479 2/9/2007 12.35 11301.5 -0.0389 0.12367 -0.1626 3/6/2007 11.6 11196.3 -0.0607 -0.0093 -0.0514 4/4/2007 12.8 11282.3 0.10345 0.00768 0.09577 5/10/2007 13 12419.2 0.01563 0.10077 -0.0851 6/1/2007 14.75 13016.8 0.13462 0.04812 0.0865 7/10/2007 14.95 13830 0.01356 0.06247 -0.0489 8/1/2007 15.4 13753.4 0.0301 -0.0055 0.03564 9/6/2007 11.15 12124.7 -0.276 -0.1184 -0.1576 10/5/2007 12.7 13560.4 0.13901 0.11841 0.0206 11/12/2007 12.85 14330.9 0.01181 0.05682 -0.045 12/3/2007 12.95 13999.3 0.00778 -0.0231 0.03092 1/4/2008 12.95 13633 0 -0.0262 0.02616 2/11/2008 12.6 14016.1 -0.027 0.02809 -0.0551 3/7/2008 12.85 14964.6 0.01984 0.06767 -0.0478 4/11/2008 12.8 15114.3 -0.0039 0.01 -0.0139 5/2/2008 13.05 15186.8 0.01953 0.0048 0.01473 6/4/2008 12.05 12088.6 -0.0766 -0.204 0.12738 7/4/2008 13.7 12212.8 0.13693 0.01028 0.12665 8/7/2008 8 10498.1 -0.4161 -0.1404 -0.2757

- 10. 9/5/2008 8.15 9207.87 0.01875 -0.1229 0.14166 10/8/2008 8 9179.68 -0.0184 -0.0031 -0.0153 16-Nov-08 7 9182.88 -0.125 0.00035 -0.1254 12/17/2008 6 9187.1 -0.1429 0.00046 -0.1433 1/6/2009 5.09 5753.16 -0.1517 -0.3738 0.22211 2/18/2009 4.19 5373.38 -0.1768 -0.066 -0.1108 3/17/2009 3.9 5730.21 -0.0692 0.06641 -0.1356 4/3/2009 5.29 6907.74 0.35641 0.2055 0.15092 5/4/2009 4.9 7222.85 -0.0737 0.04562 -0.1193 6/8/2009 4.85 7289.14 -0.0102 0.00918 -0.0194 7/1/2009 5.2 7174.47 0.07217 -0.0157 0.0879 8/11/2009 5.3 7748.95 0.01923 0.08007 -0.0608 9/3/2009 6.24 8737.98 0.17736 0.12763 0.04972 10/7/2009 6.24 9380.49 0 0.07353 -0.0735 11/13/2009 7.15 9182.4 0.14583 -0.0211 0.16695 12/4/2009 6.4 9136.6 -0.1049 -0.005 -0.0999 AVERAGE RETURN -0.0042 0.01127 STANDARD DEVIATION 0.10538 INFORMATION RATIO -0.147 ANNULIZED INFORMATION RATIO -0.5091

- 11. FINDINGS FINDINGS RANKING OF MUTUAL FUND R R Square ANNULIZED INFORMATION d % MUTUAL FUND INFORMATION RATIO RANKING Squared RATIO 1 AMMF -0.14697 -0.5091 5 0.283797 28.30% 2 SFWF -0.13972 -0.4778 4 0.000286 0.03% 3 PGF -0.1344 -0.3583 3 0.019655 1.96% 4 FIFM 0.17535 0.60752 1 0.002561 0.25% 5 ASFL 0.019129 0.06627 2 0.025562 2.25%

- 12. FINDINGS RANKING BASED ON R SQUARED VALUES R Squared Ranking Criteria Ranking 80% and above 4 28.30% 1 60%_80% 0 0.03% 2 40%_60% 5 1.96% 3 20%_40% 0 0.25% 4 1%_20% 5 2.25% 5 _ 0% and below 0 _