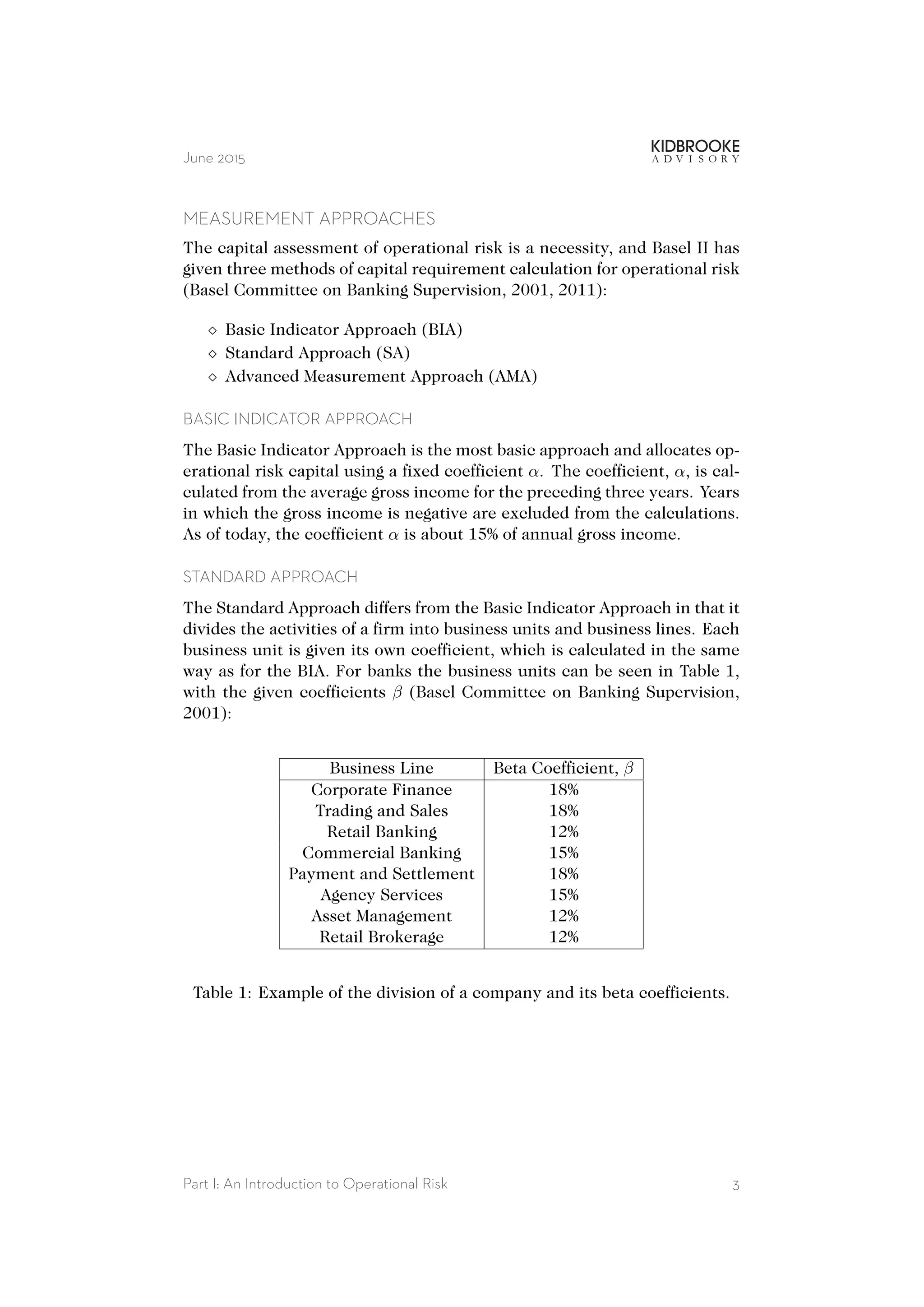

The document provides an overview of operational risk, tracing its significance from the collapse of Barings Bank in 1995 to recent financial regulatory frameworks like Basel II and III. It defines operational risk as the potential for loss due to failed internal processes, people, or systems, and outlines three main approaches for calculating capital requirements: Basic Indicator Approach (BIA), Standard Approach (SA), and Advanced Measurement Approach (AMA). The discussion underscores the importance of quantifying and managing operational risk within financial institutions to mitigate potential failures.