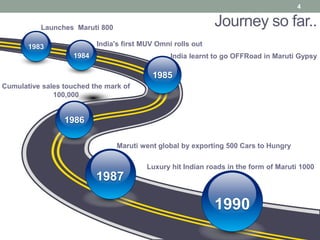

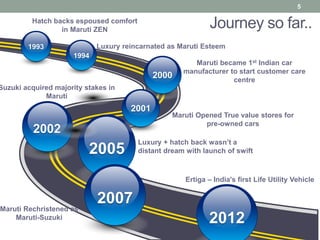

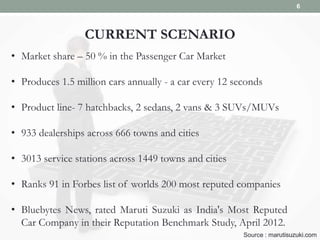

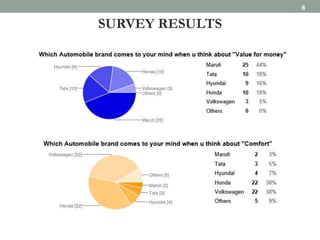

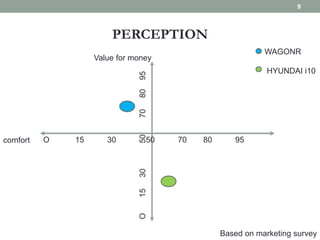

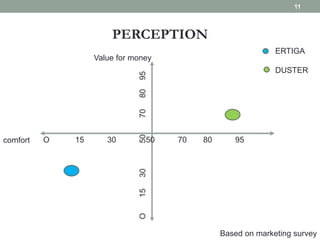

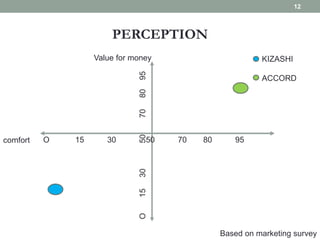

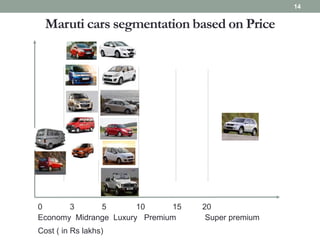

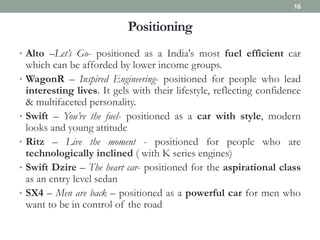

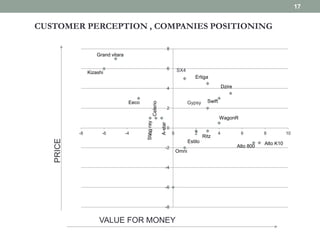

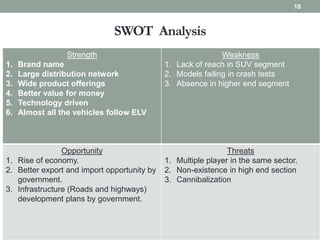

The document outlines the history and market positioning of Maruti Suzuki in the Indian car industry, detailing its evolution since 1980, significant milestones, and current market share of 50%. It highlights customer perception, product segmentation, targeting strategies, and a SWOT analysis pointing out strengths, weaknesses, opportunities, and threats. Additionally, the document discusses challenges faced by Maruti Suzuki, including competition and market demand, while hinting at future plans.