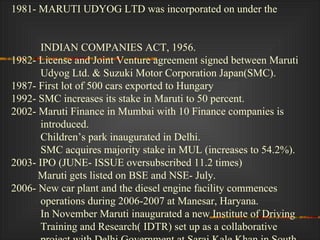

Maruti Suzuki India Ltd. is a automobile company that was incorporated in 1981 through a joint venture between the Government of India and Suzuki Motor Corporation of Japan. Some key highlights include it becoming the largest car manufacturer in India, producing over 1 million vehicles annually by 2009 through its plants in Gurgaon and Manesar. It offers a wide range of vehicles led by popular models like Alto, WagonR, Swift, SX4 and Omni.