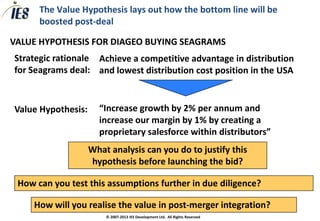

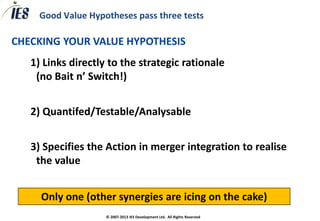

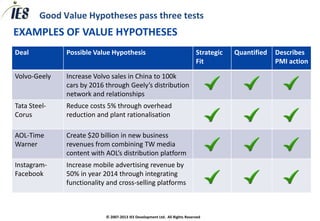

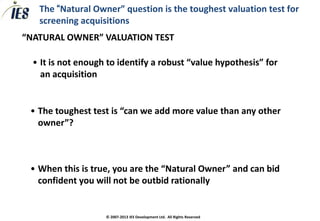

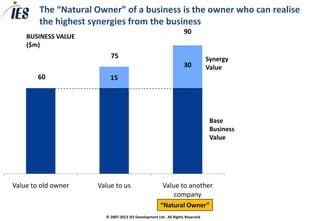

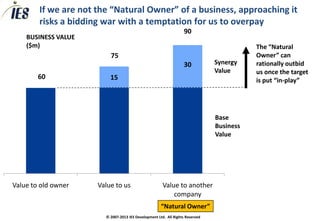

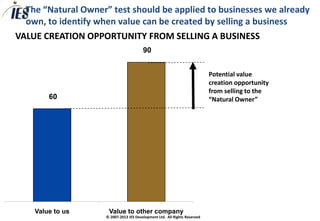

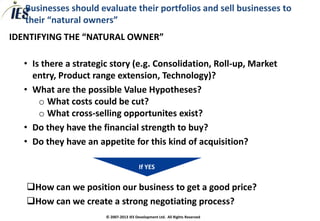

The document discusses strategic fit and value hypotheses in mergers and acquisitions (M&A). It provides examples of ways to create value through M&A, including undervalued targets, synergies from cost reductions and revenue increases, and financial engineering. It emphasizes that the value hypothesis should quantify and specify how value will be realized through post-merger integration. The "natural owner" concept is introduced as the potential buyer that can realize the highest synergies from a target.