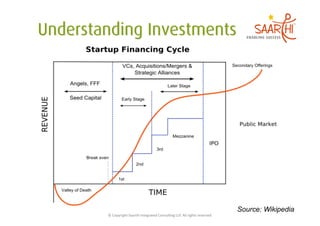

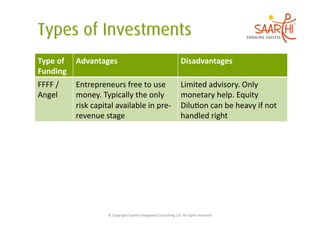

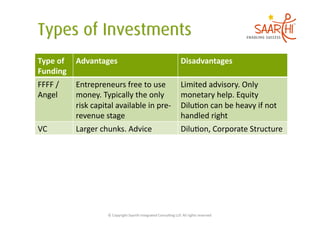

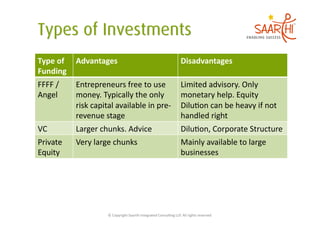

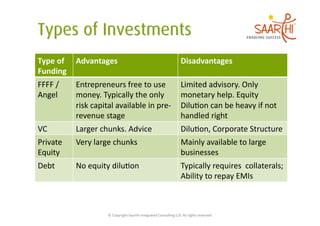

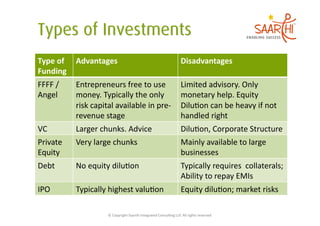

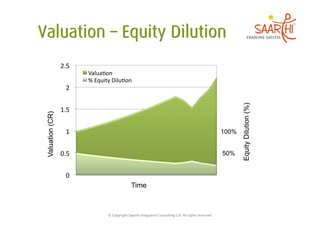

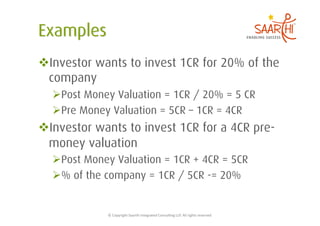

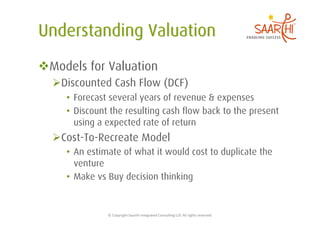

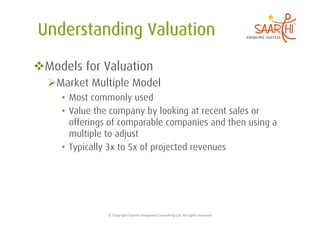

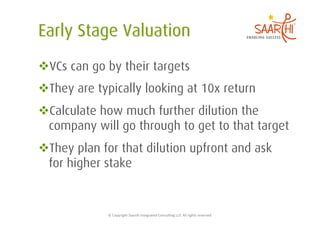

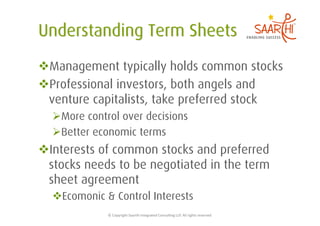

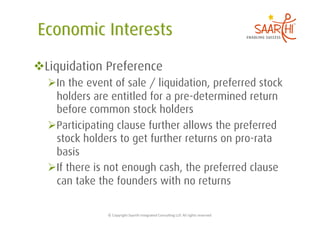

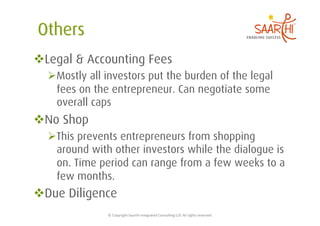

The document discusses various modes of funding available for businesses, including angel investing, venture capital, private equity, debt, and IPOs. It outlines the advantages and disadvantages of each type of funding. The document also covers topics like company valuations, dilution, term sheets, and negotiating preferences between common and preferred stockholders.