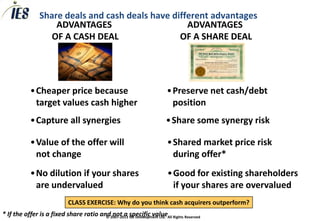

The document discusses various deal structuring considerations for mergers and acquisitions (M&A). It addresses primary deal structures such as whether to purchase assets or shares, and methods of payment like cash or stock. Deferred payments are presented as a way to overcome information asymmetry between the buyer and seller and allow deals to be negotiated when they have different assumptions about future performance. Key details to determine for deferred payment structures include payment timing, amount, and conditions.

![Deferred payments are a tool to overcome the “information

asymmetry” problem and generate “win/win” opportunities

ADVANTAGES OF DEFERRED PAYMENTS

1) Provides some protection to acquirer

[Especially important in China, where legal redress limited, having

the cash in your hand improves your negotiating position if you find

a problem in the company]

2) Enables a deal to be negotiated despite different future

performance assumptions

Any other advantages?

© 2007-2013 IES Development Ltd. All Rights Reserved](https://image.slidesharecdn.com/mandatoolkit-dealstructuring-121229064339-phpapp02/85/Mand-a-toolkit-deal-structuring-7-320.jpg)