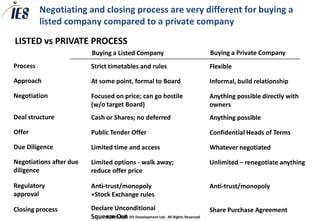

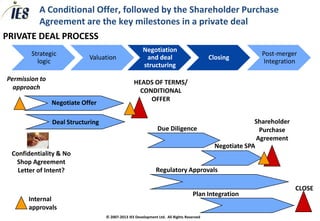

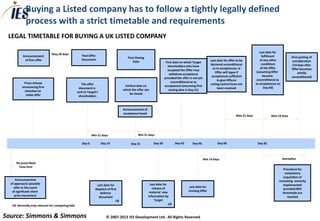

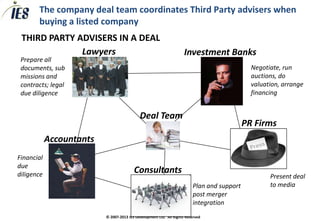

The document provides an overview of the key differences between acquiring a listed company versus a private company. It notes that buying a listed company has a strict defined legal process and timetable that must be followed, including requirements for public tender offers, limited negotiation timelines, and regulatory approvals. In contrast, acquiring a private company allows for a more flexible informal process, with unlimited potential to renegotiate terms. It also outlines the major third party advisors involved in M&A deals and the substantial costs that can be incurred, even for failed acquisition attempts.