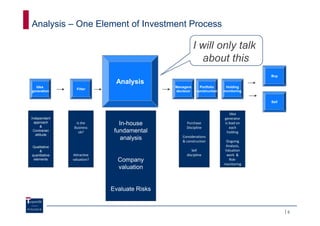

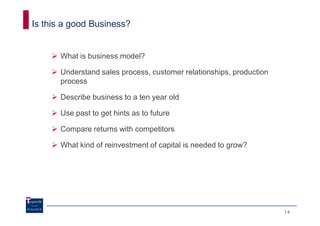

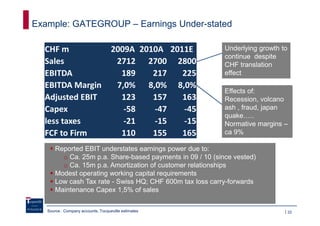

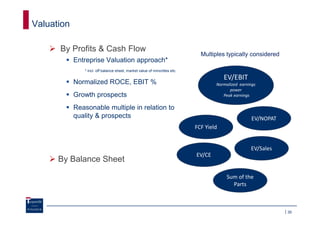

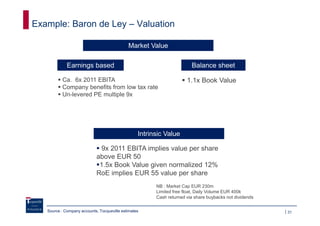

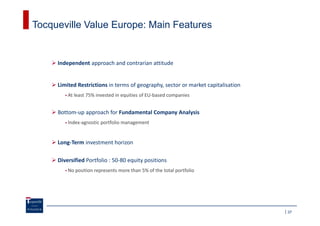

The document provides an overview of a common sense approach to value investing. It discusses analyzing businesses by understanding the business model, industry dynamics, competitive advantages, financials, management and risks. Key steps include understanding the business, industry, sources of competitive advantage, profitability, cash flows, management quality and identifying risks. Examples provided include analyzing a Spanish winemaker, cement industry, Norwegian furniture maker, airline catering company and assessing their business quality, industry dynamics, competitive advantages and risks. The goal is to invest in well-run companies that are undervalued after understanding all aspects of the business.