1. The document provides an introduction to management accounting, discussing its development and differences from financial accounting.

2. Management accounting aims to provide quantitative information to internal management for planning, controlling and decision making, while financial accounting reports to external stakeholders on the overall financial performance and position of a business.

3. Key differences include management accounting having a broader scope beyond monetary transactions, focusing on performance analysis, non-financial factors, and future projections to support internal management needs.

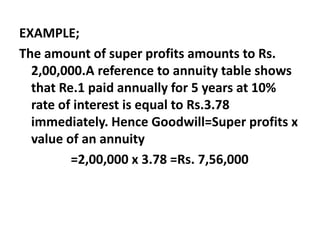

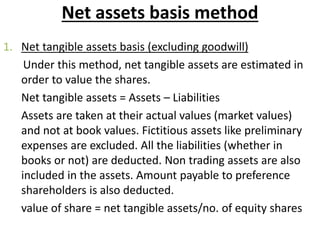

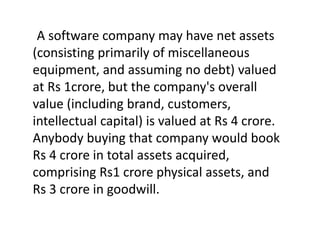

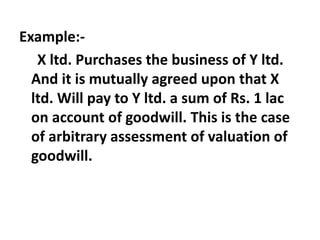

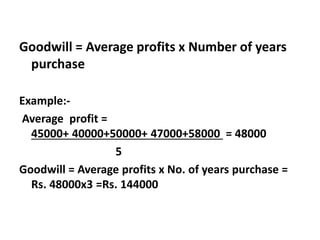

![EXAMPLE;

X Ltd. is running its business with a capital of Rs. 20,00,000.on

the basis of previous records , it is expected that the

company will earn Rs. 5,00,000 in future. The normal rate of

return is 15%. The super normal profits of X Ltd. Will be

calculated as;

Profits expected in future RS.5,00,000

LESS: Normal profits = [20,00,00 x15%]

= Rs.3,00,000

Super profits = Rs.2,00,000

Goodwill= 2,00,000 x 5 =Rs.10,00,000](https://image.slidesharecdn.com/management-accounting-230725173643-51fed113/85/Management-Accounting-pdf-77-320.jpg)