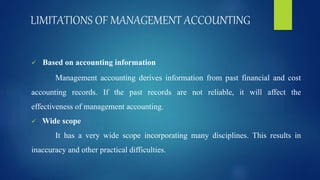

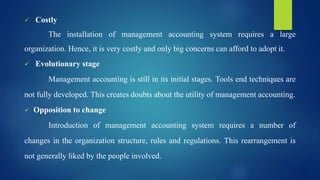

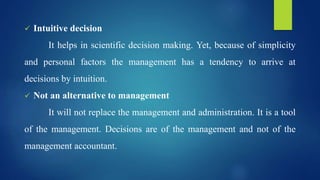

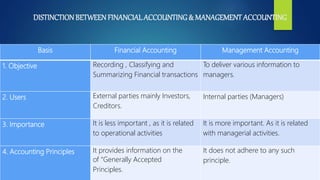

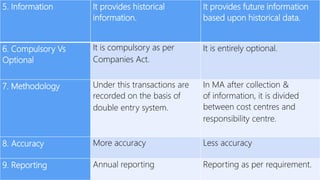

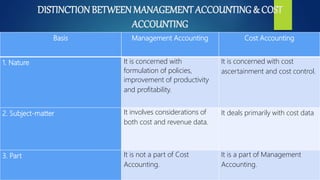

Management accounting focuses on providing essential information to assist management in policy formulation and daily operations. Its objectives include promoting efficiency, preparing budgets, analyzing transactions, and interpreting financial statements. The scope covers areas such as financial accounting, cost accounting, and reporting, while also presenting advantages and limitations, including the need for reliable data and the high cost of implementation.