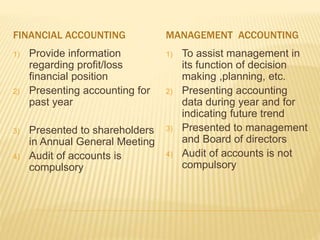

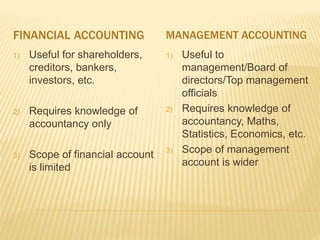

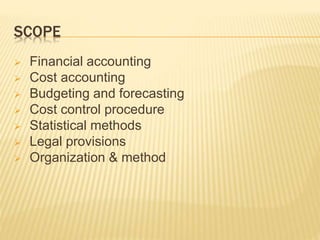

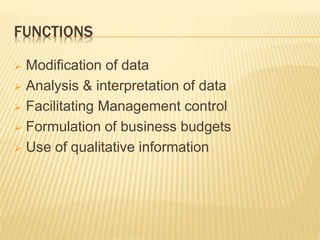

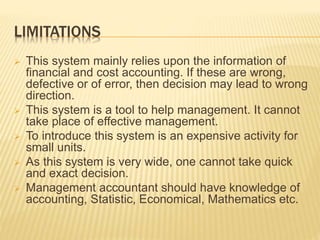

Management accounting provides accounting information to assist management in decision making, planning, and controlling business operations. It differs from financial accounting in that management accounting focuses on internal reporting for management rather than external reporting for shareholders and regulators. Management accounting collects, analyzes, and interprets accounting data to help management with functions like planning, controlling, decision making, and policy formulation.