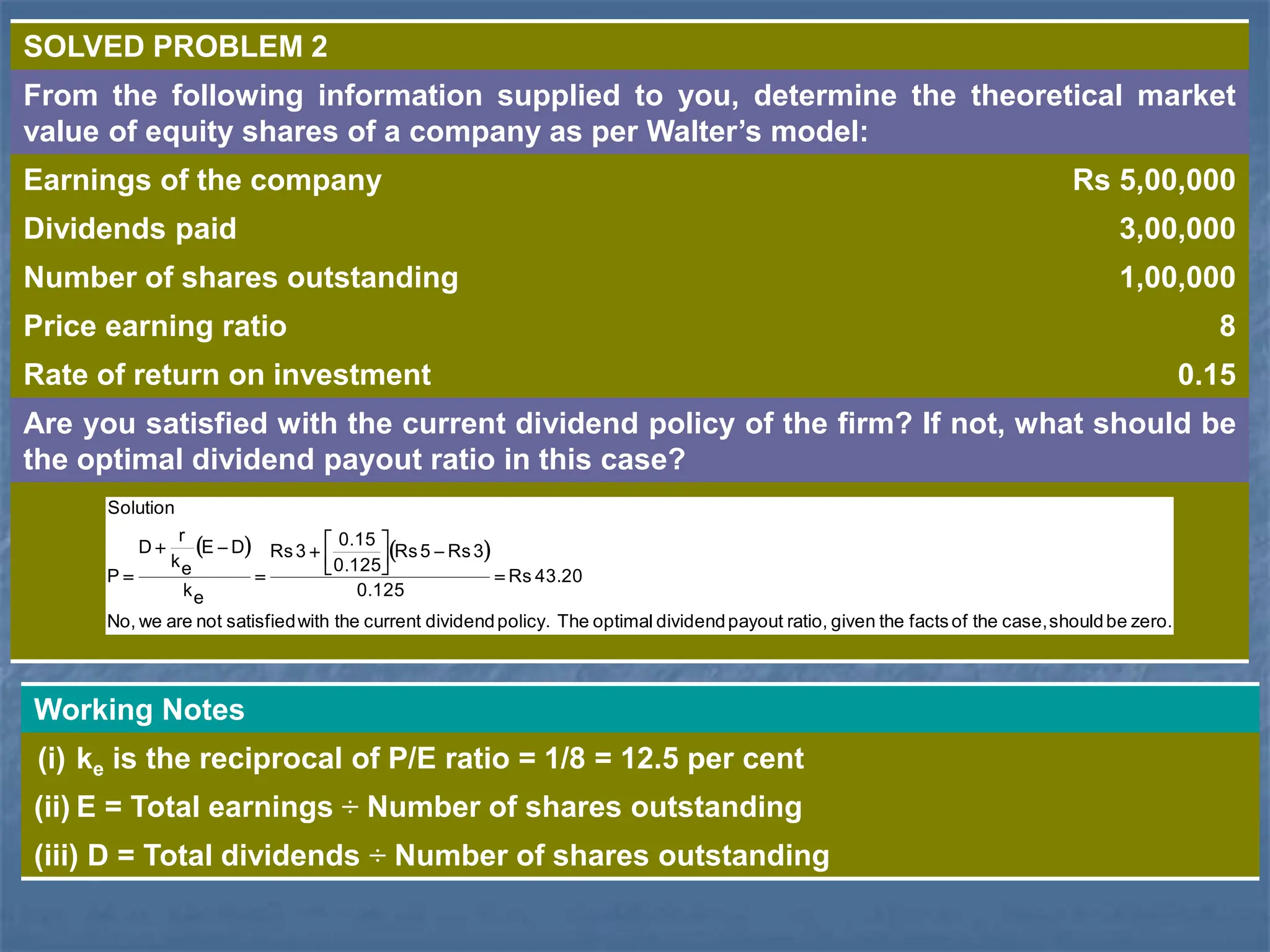

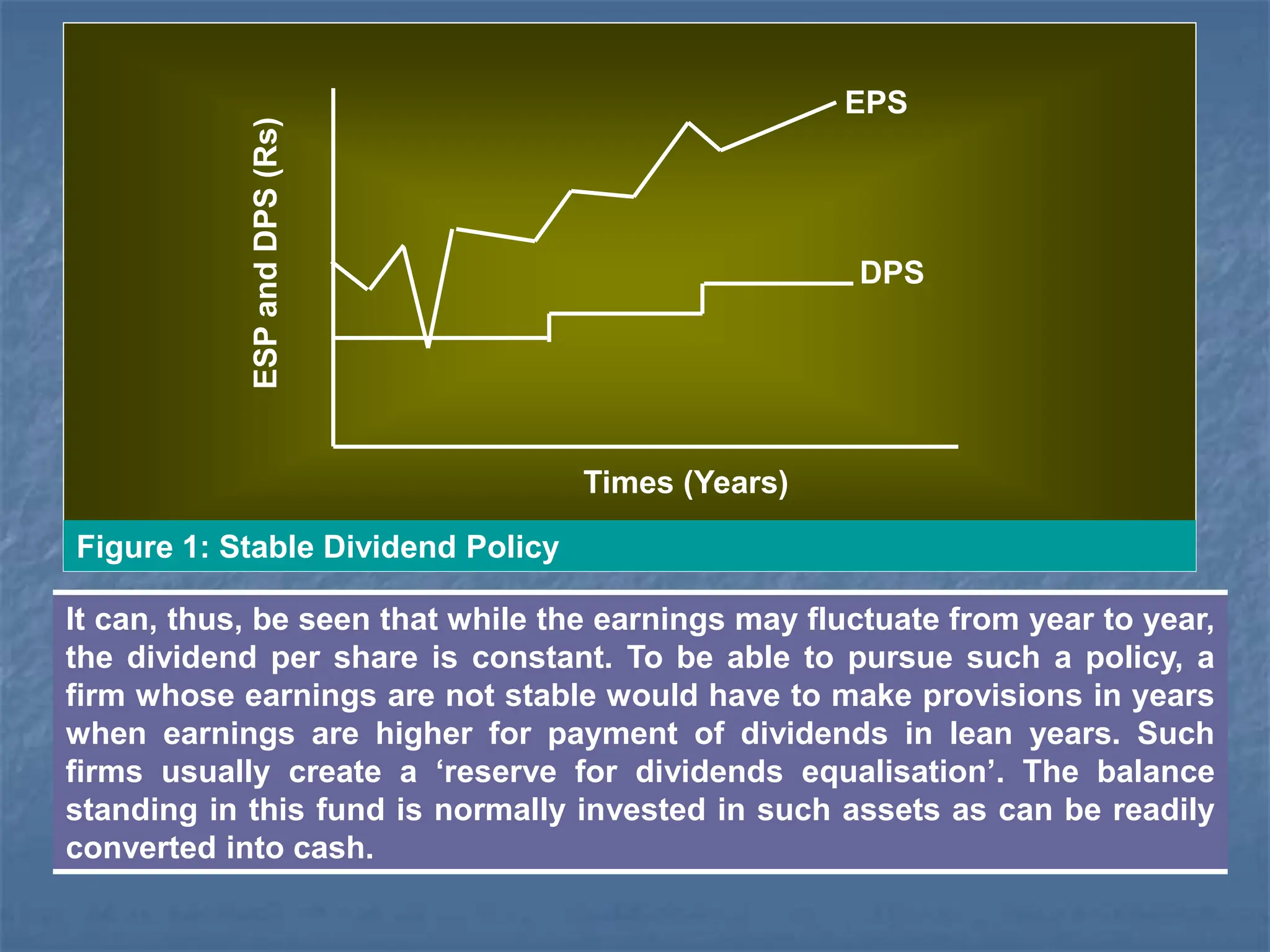

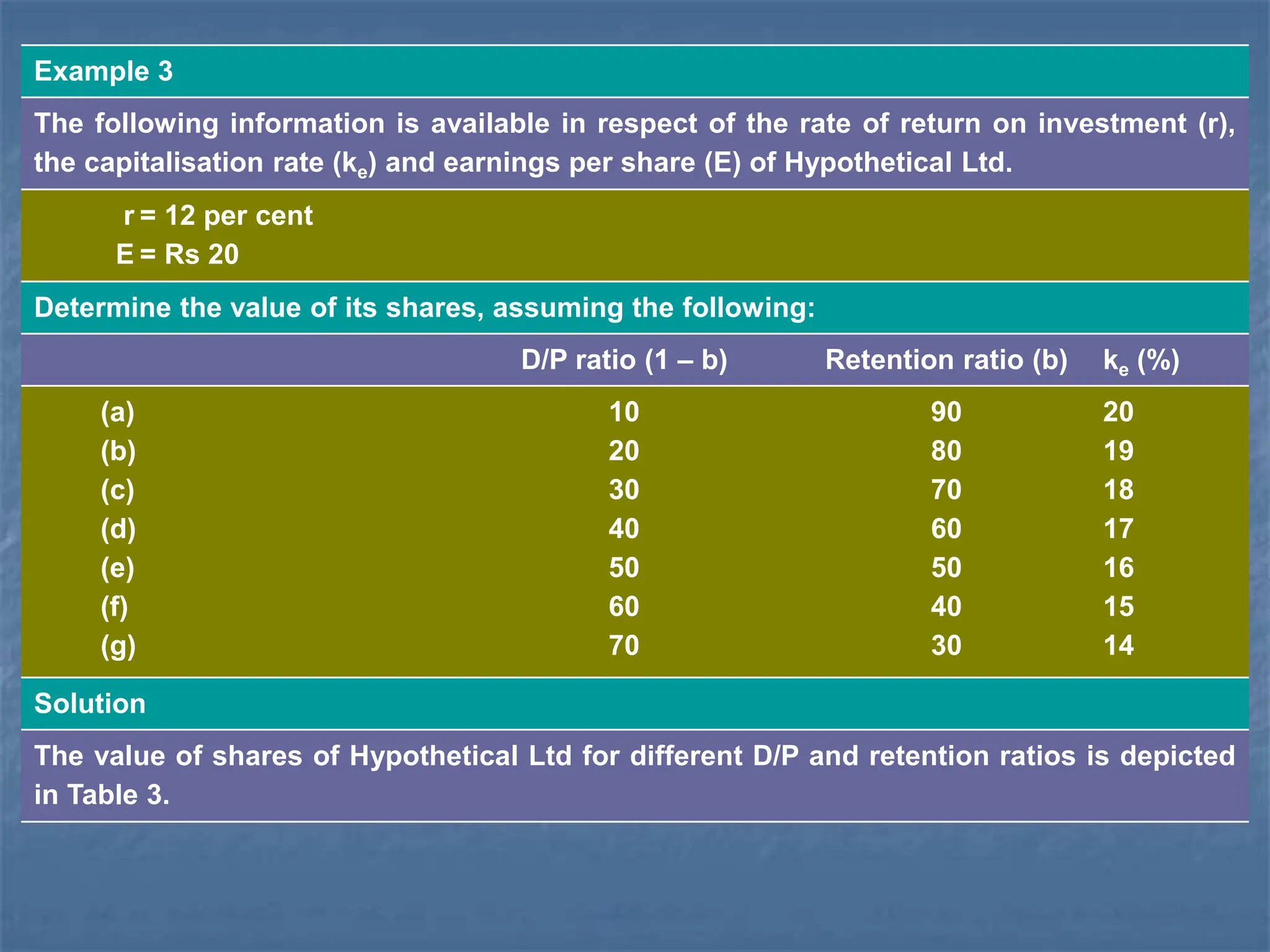

The document outlines critical issues related to dividend policy for management, including how much to distribute, the form of distribution (cash dividends or stock buybacks), and the desired stability of dividends. It discusses factors affecting dividend decisions such as legal and tax constraints, the company's financial situation, and shareholder preferences. Furthermore, it compares the dividend policies of corporate entities in India, indicating trends like a focus on long-term payout ratios and the signaling effect of dividends on market value.

![

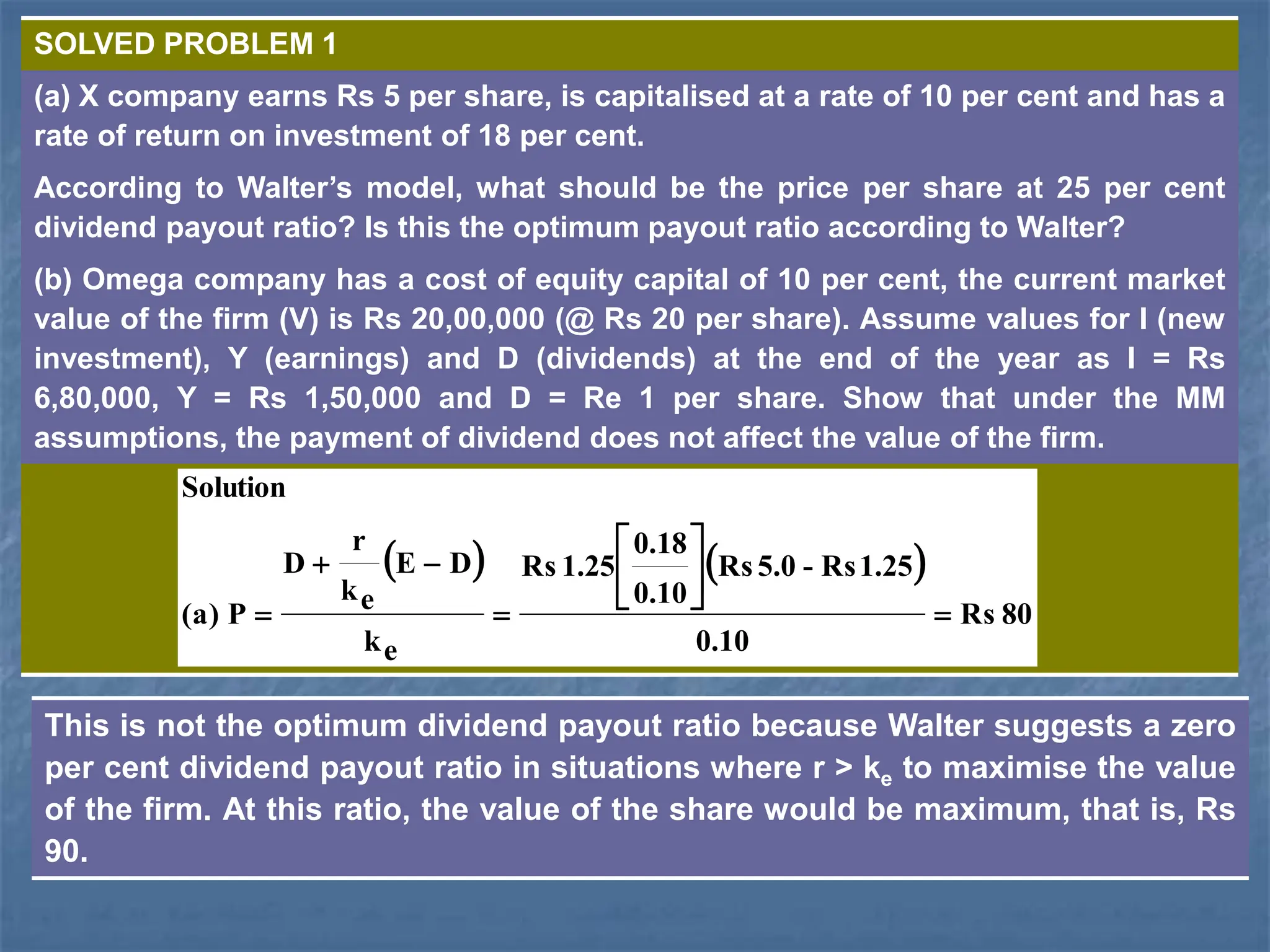

6,30,000

Rs

1,00,000)

Rs

1,50,000

(Rs

6,80,000

Rs

)

1

nD

-

(Y

I

:

financing

new

for

required

(ii)Amount

1

P

21

Rs

1

P

20

Rs

1

P

21

Rs

1.10

1

Re

1

P

20

Rs

1

D

1

P

e

k

1

1

0

P

:

year

the

of

end

the

at

share

the

of

price

(i)Market

:

s)

assumption

(MM

paid

are

dividends

when

firm,

the

of

(b)Value

10

.

1

1

Re

20,00,000

1.10

1,00,000

Rs

1,50,000

Rs

6,80,000

Rs

21

Rs

30,000

1,00,000

1,00,000

Rs

nD1]

-

Y

I

-

1

ΔΔn)

(n

1

[nD

e

k

1

1

:

firm

the

of

(iv)Value

shares

30,000

21

Rs

6,30,000

Rs

:

issued

be

to

shares

of

r

(iii)Numbe

](https://image.slidesharecdn.com/dipk202tcorporatefinanceunit4ppt-240715065334-3e72aa98/75/DIPK202T_Corporate-Finance_Unit-4-PPT-ppt-56-2048.jpg)

![5,30,000

Rs

1,50,000

Rs

-

6,80,000

Rs

)

1

nD

-

(Y

-

I

:

financing

new

for

required

(ii)Amount

1

P

22

Rs

,

1.10

Zero

1

P

20

Rs

:

year

the

of

end

the

at

share

the

of

price

(i)Market

:

paid

not

are

dividends

when

firm

the

of

(c)Value

firm

the

of

value

the

affect

not

does

dividend

paid,

not

are

dividends

when

and

paid

are

dividends

when

situations

the

both

in

20,00,000,

Rs

is

firm

the

of

value

the

Since

20,00,000

Rs

1.10

1,50,000

Rs

6,80,000

Rs

-

22

Rs

22

5,30,000

1,00,000

]

Y

I

-

1

Dn)P

[(n

e

k

1

1

:

firm

the

of

(iv)Value

shares

22

Rs

5,30,000

Rs

issued

be

to

shares

new

of

Number

(iii)

](https://image.slidesharecdn.com/dipk202tcorporatefinanceunit4ppt-240715065334-3e72aa98/75/DIPK202T_Corporate-Finance_Unit-4-PPT-ppt-57-2048.jpg)