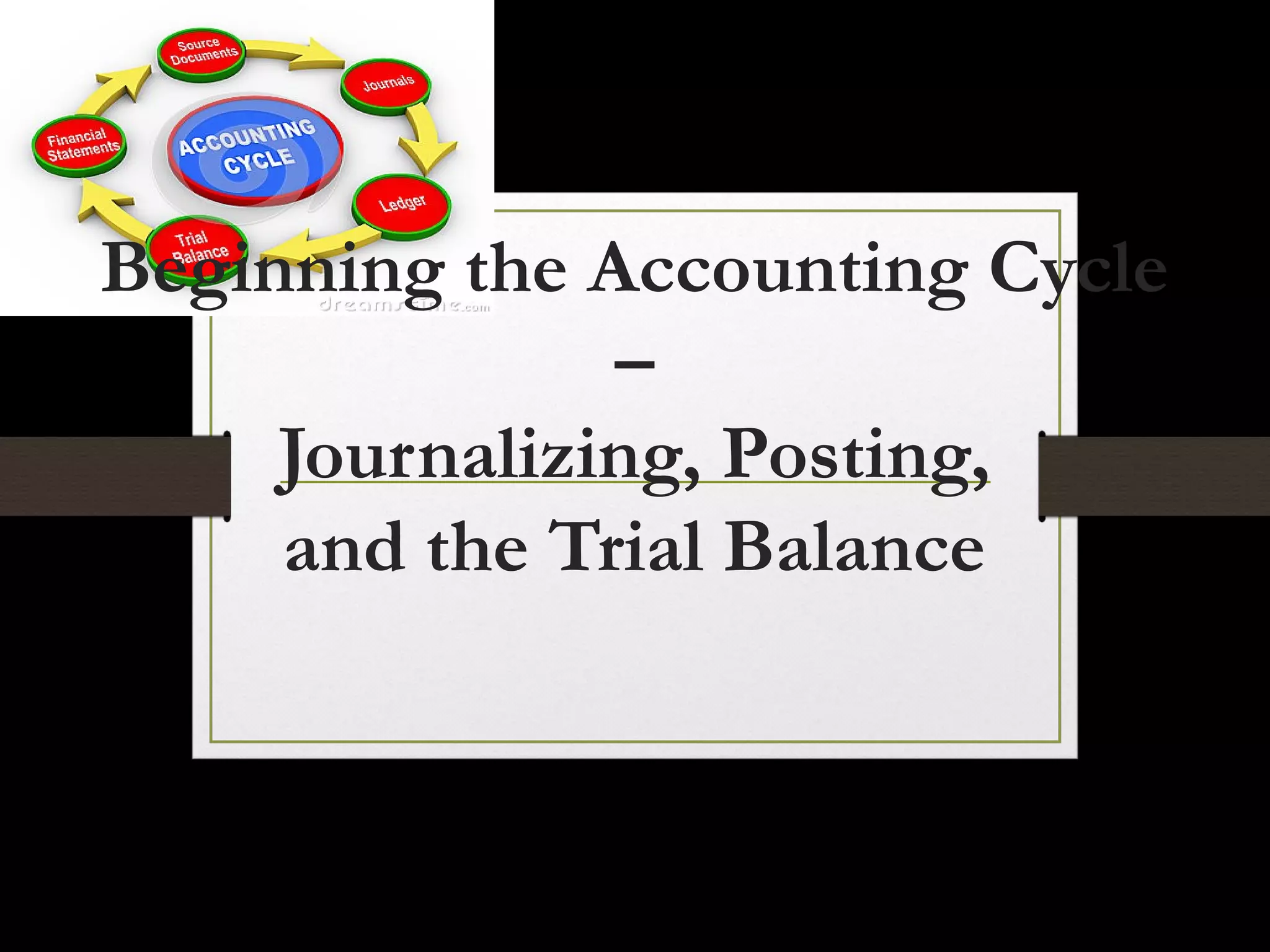

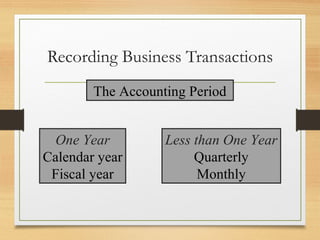

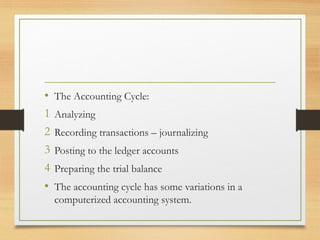

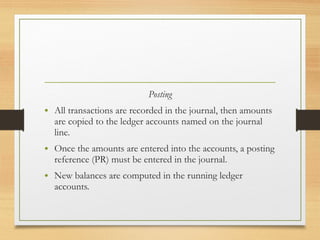

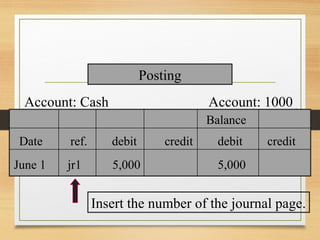

This document discusses the key steps in the accounting cycle, including journalizing transactions, posting to ledger accounts, and preparing a trial balance. It explains that accounting analyzes, records, classifies, summarizes, reports, and interprets financial information over an accounting period, usually 12 months. The accounting cycle involves journalizing transactions, posting to ledger accounts to update balances, and preparing a trial balance to check for errors.