The document discusses the accounting cycle and financial reporting process. It covers the key steps:

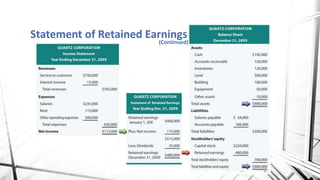

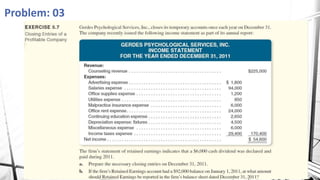

1. Preparing the basic financial statements - the balance sheet, income statement, and statement of retained earnings.

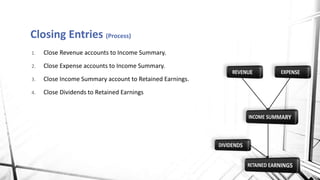

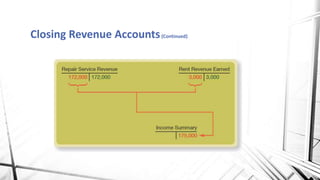

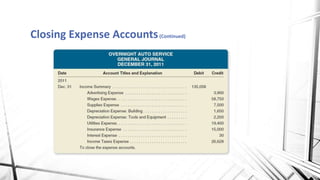

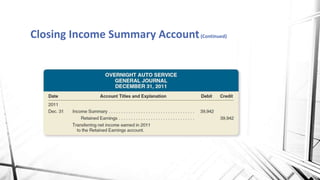

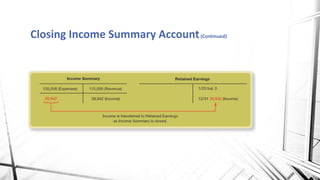

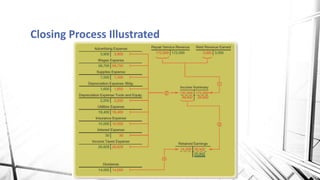

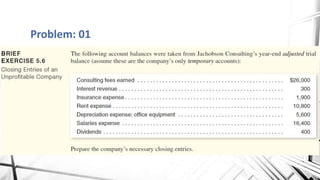

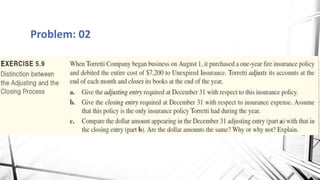

2. Making closing entries to reset temporary accounts to zero at the end of the period. This involves transferring account balances to income summary and then to retained earnings.

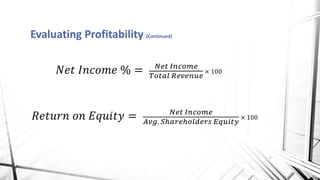

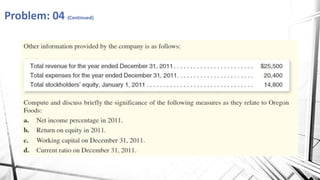

3. Evaluating the business performance using liquidity and profitability ratios calculated from the financial statements.