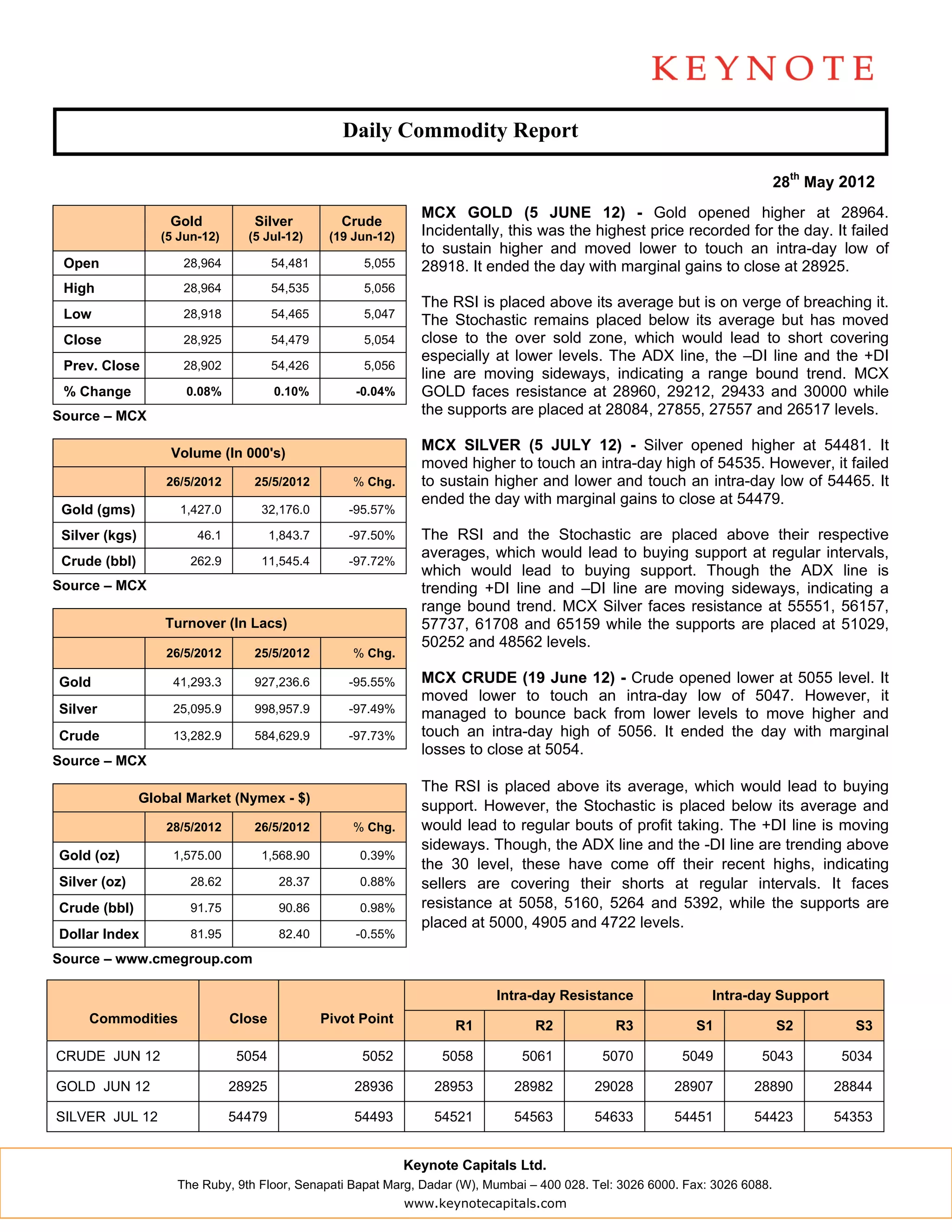

- Gold opened higher at its highest price of the day but failed to sustain gains and closed with a marginal increase.

- Silver also opened higher but moved lower intraday before closing with a small gain.

- Crude oil opened lower, reached a daily low, but recovered slightly to close with a minor loss.

- Technical indicators show mixed signals for gold and silver, suggesting a range-bound trend, while crude oil indicators point to continued buying support.