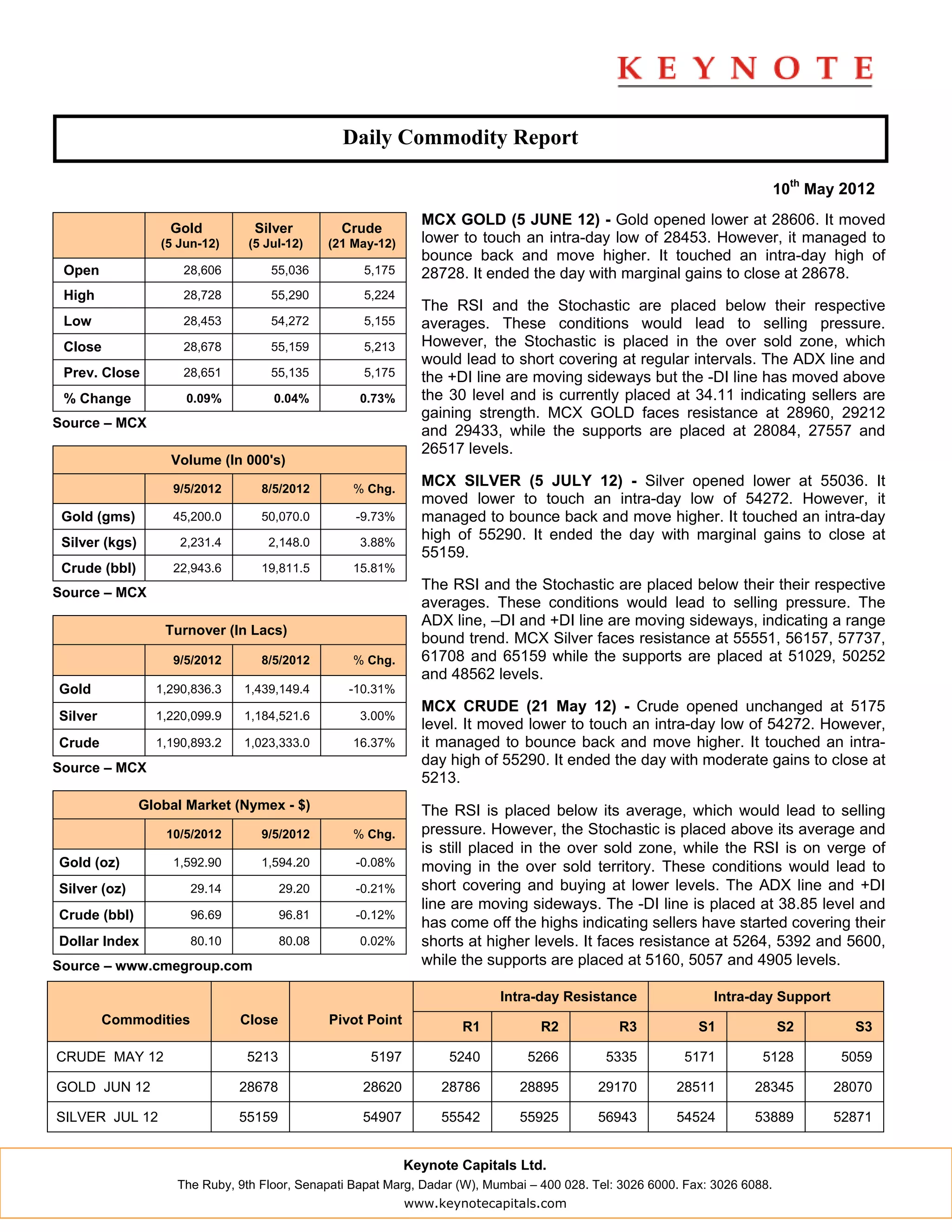

- The daily commodity report summarizes movements in gold, silver, and crude futures contracts on the MCX exchange on May 10th, 2012.

- Gold and silver futures opened lower but recovered to close with small gains, while crude futures gained 0.73%. Technical indicators pointed to potential further selling pressure for gold and silver but short covering for crude.

- The report provides closing prices, daily highs and lows, volume data, and analysis of technical indicators like the RSI and support and resistance levels.