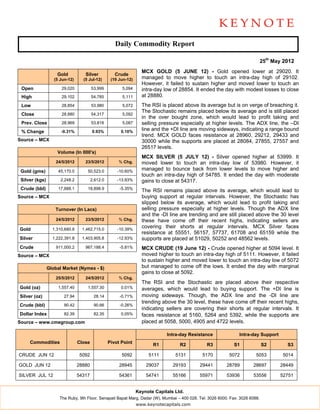

The daily commodity report summarizes prices and trading activity for gold, silver, and crude on the MCX exchange on May 25th, 2012. Gold prices closed slightly lower at 28,880 after reaching an intraday high of 29,102. Silver closed with moderate gains at 54,317 after touching 54,785 intraday. Crude oil closed marginally higher at 5092 after hitting an intraday high of 5111. Technical indicators like the RSI and Stochastic showed signs of potential profit taking. Trading volumes declined for gold and silver compared to the previous day.