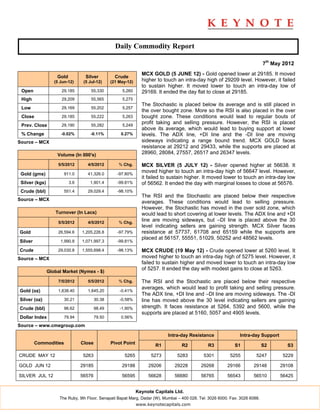

The document provides a daily commodity report for gold, silver, and crude on the MCX exchange for May 7th, 2012. It summarizes the opening, high, low, and closing prices. The technical indicators like RSI, stochastic, and ADX are discussed and signal a range-bound trend. Resistance and support levels are provided. Volume and turnover saw large declines compared to the previous day. The report also includes international commodity prices and the upcoming US economic calendar.