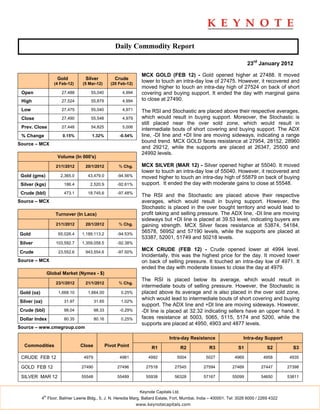

- The daily commodity report summarizes movements in gold, silver, and crude oil futures contracts on the MCX exchange on January 23rd, 2012.

- Gold futures ended the day with a marginal gain after recovering from intraday losses. Silver futures gained moderately and crude oil futures fell with moderate losses.

- Technical indicators for gold and silver, such as the RSI and stochastic, signaled potential buying support, while crude oil's technical signals pointed to potential further selling pressure.