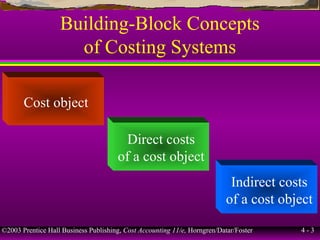

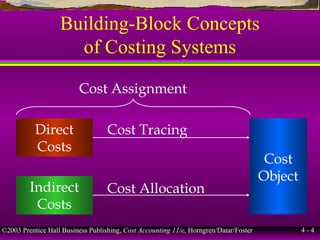

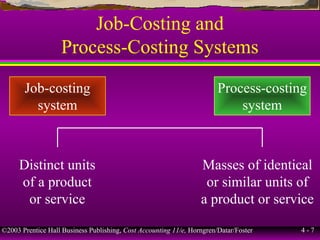

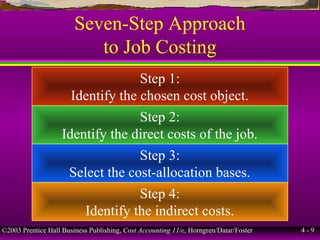

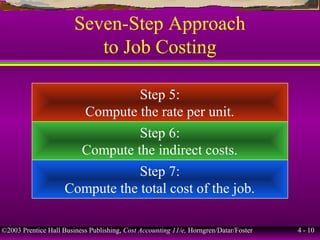

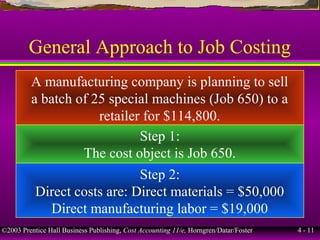

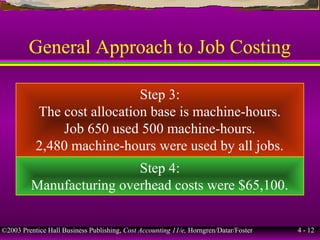

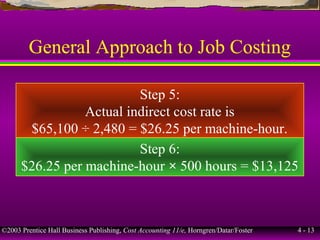

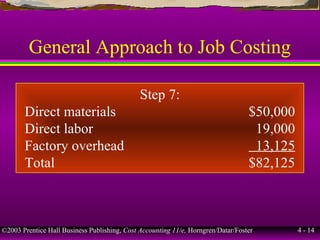

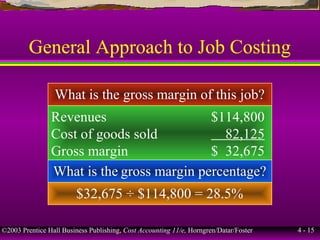

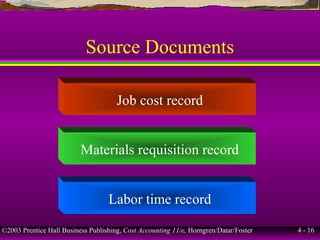

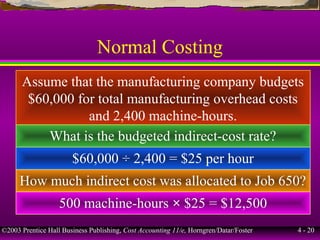

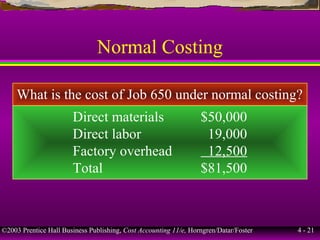

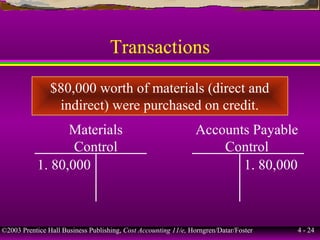

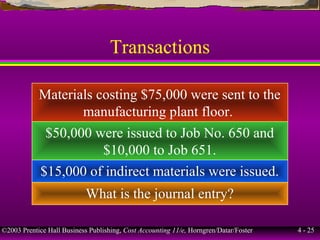

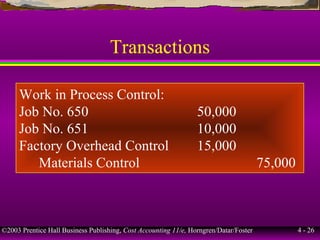

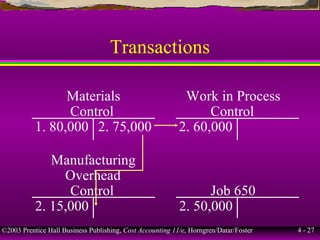

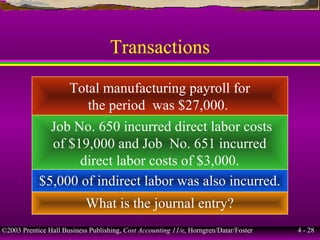

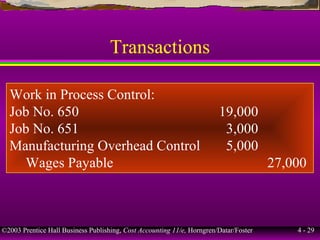

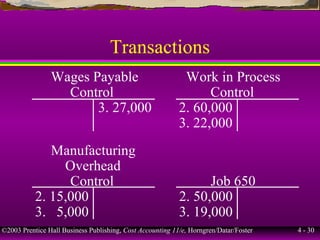

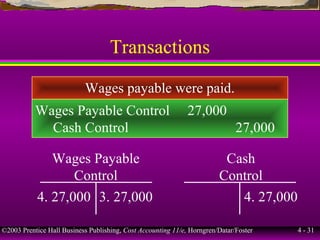

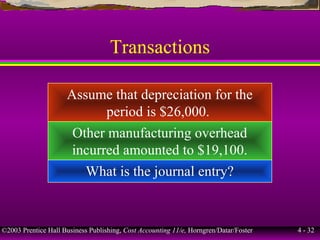

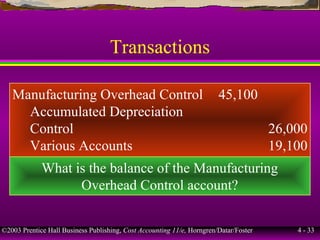

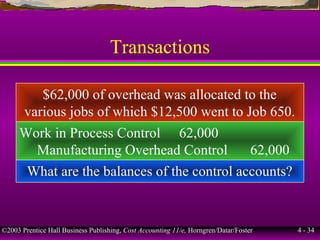

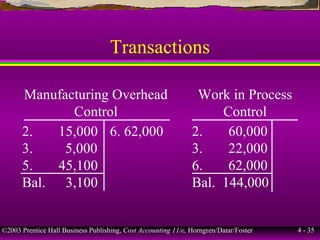

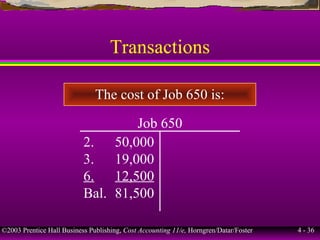

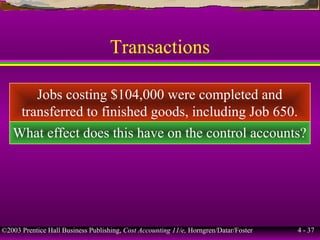

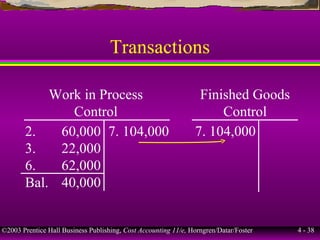

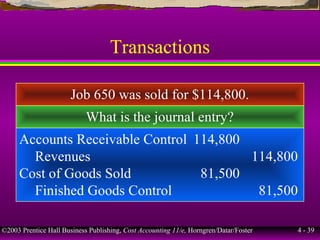

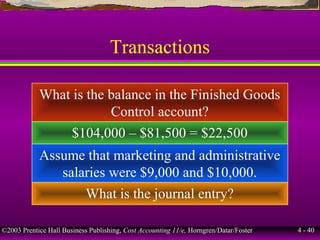

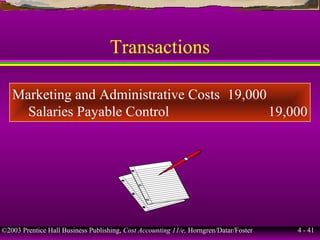

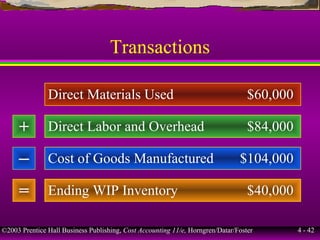

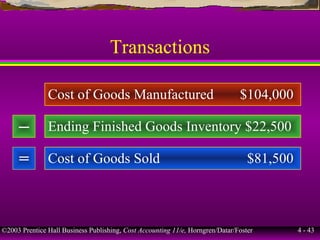

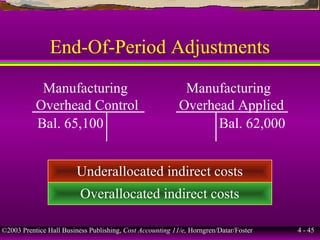

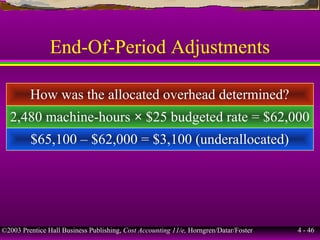

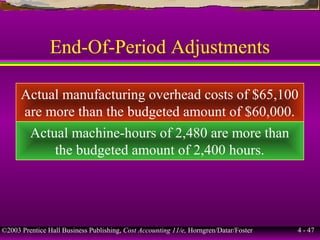

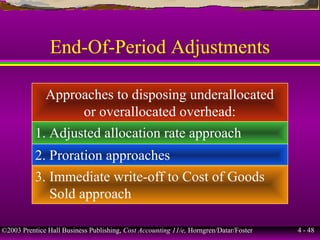

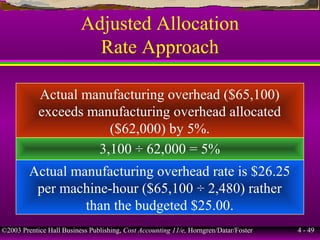

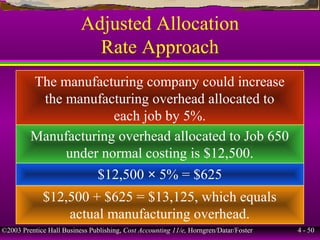

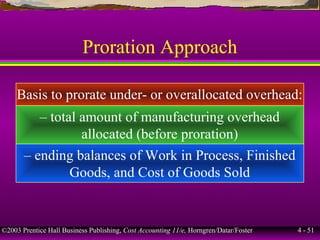

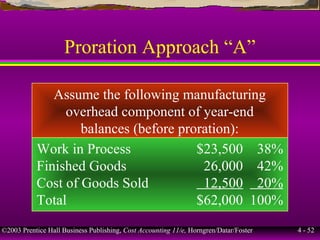

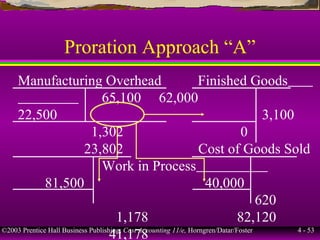

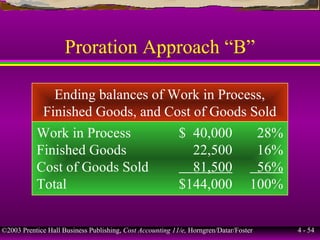

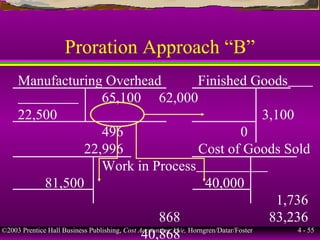

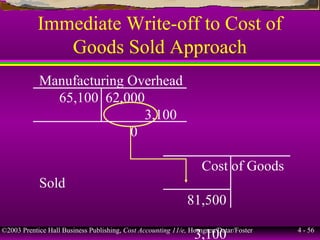

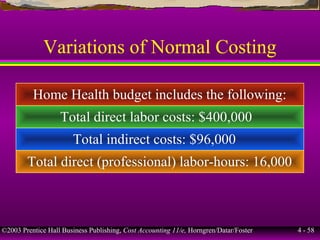

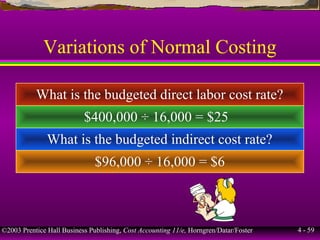

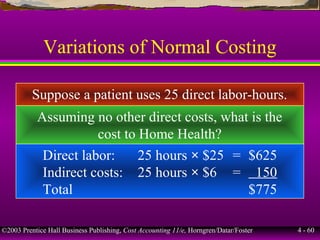

The document discusses concepts and methods in job order costing. It describes building block concepts like cost objects, direct/indirect costs, cost assignment, tracing, allocation and cost pools. It also distinguishes between job costing and process costing, outlines a seven step approach to job costing, and discusses actual versus normal costing. The document provides examples to illustrate tracking costs through a job costing system and accounting for under or overallocated indirect costs at period end.