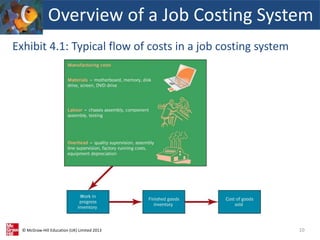

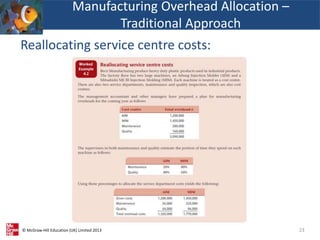

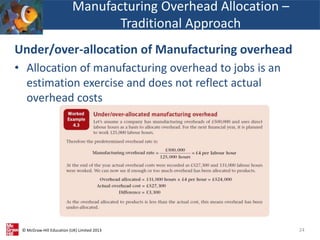

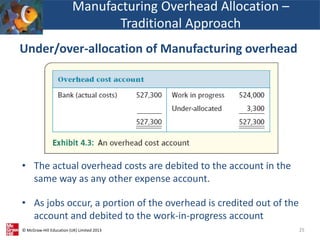

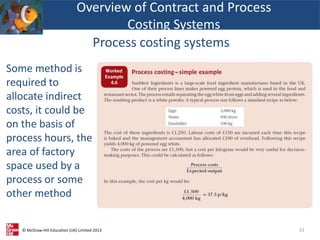

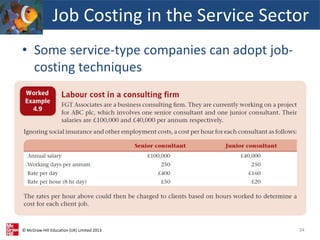

This document provides an overview of different costing systems used in manufacturing and service businesses. It discusses job costing, contract costing, and process costing systems. For each system, it explains how costs such as materials, labor, and manufacturing overhead are traced and allocated to products or contracts. Examples are provided to illustrate calculating overhead rates and assigning costs in job costing, contract costing, and process costing systems.