Embed presentation

Download as PDF, PPTX

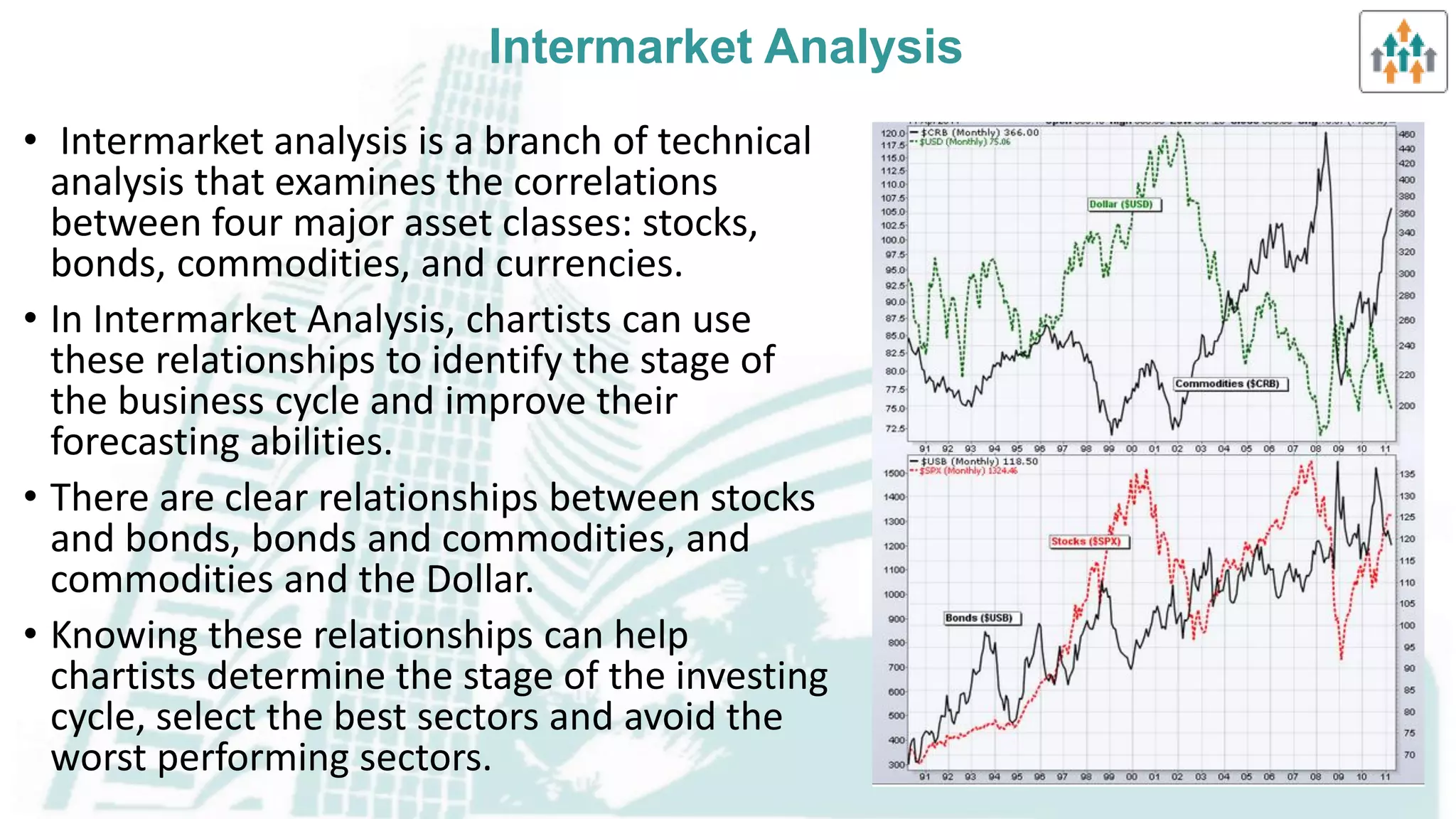

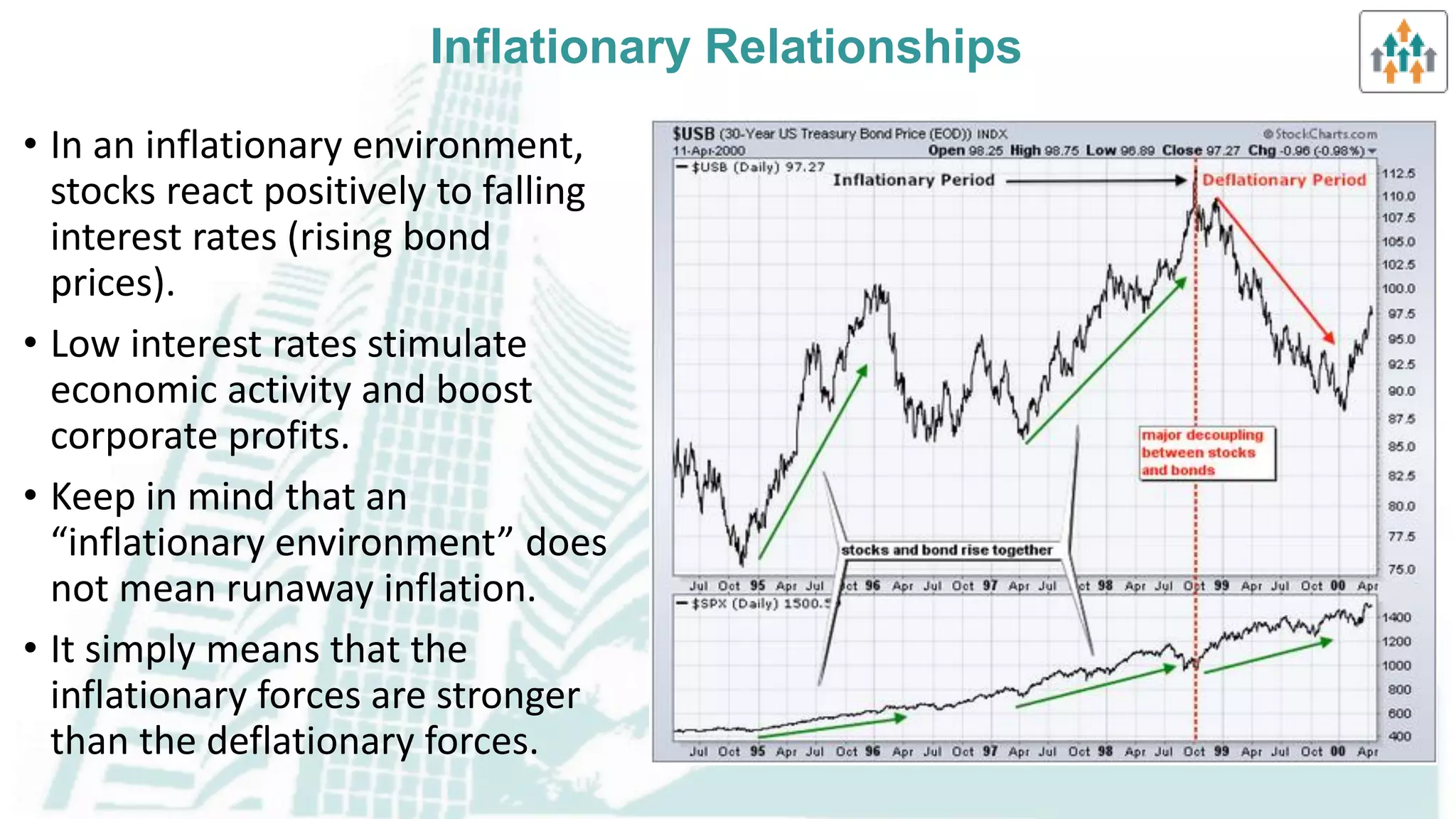

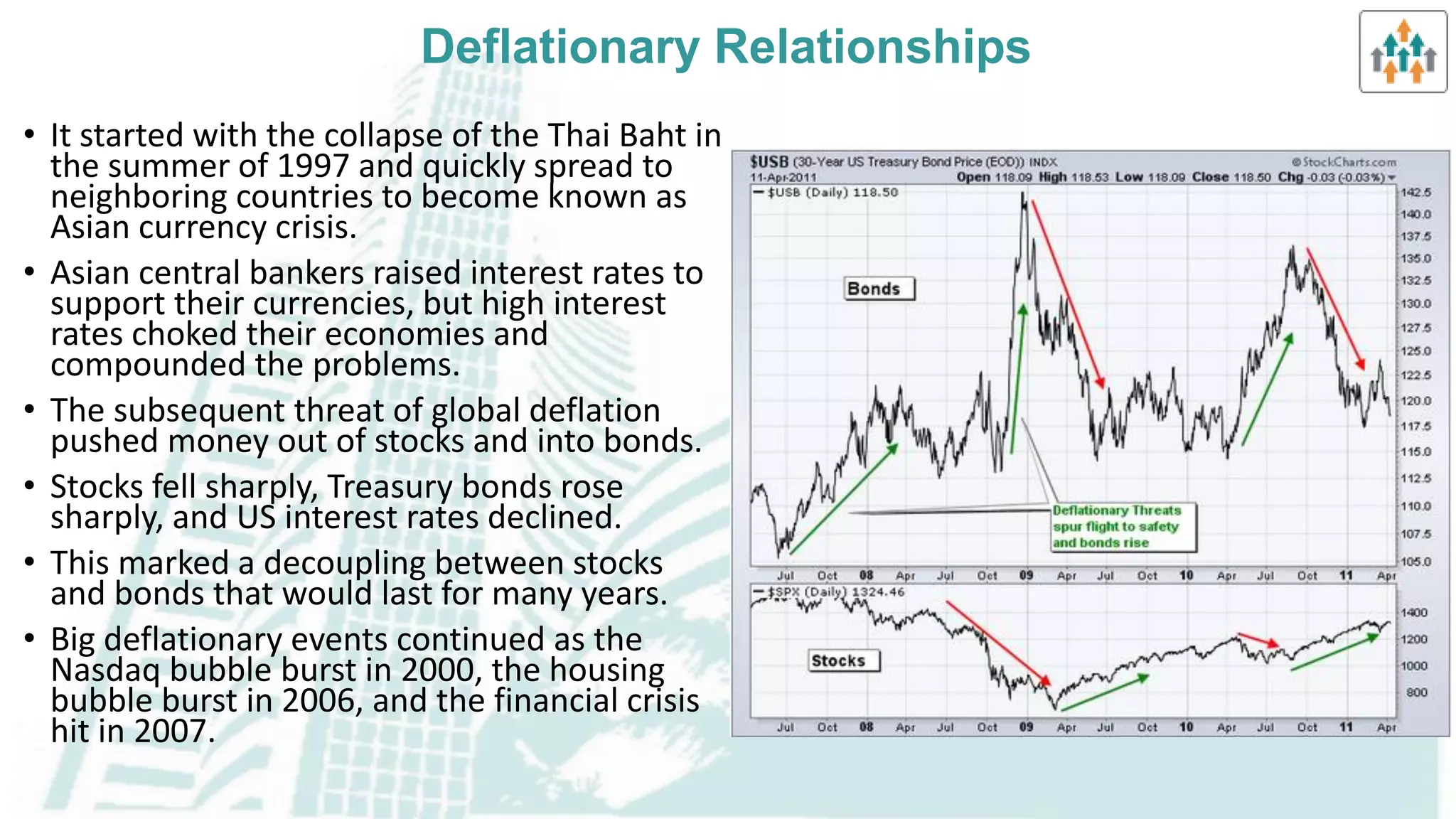

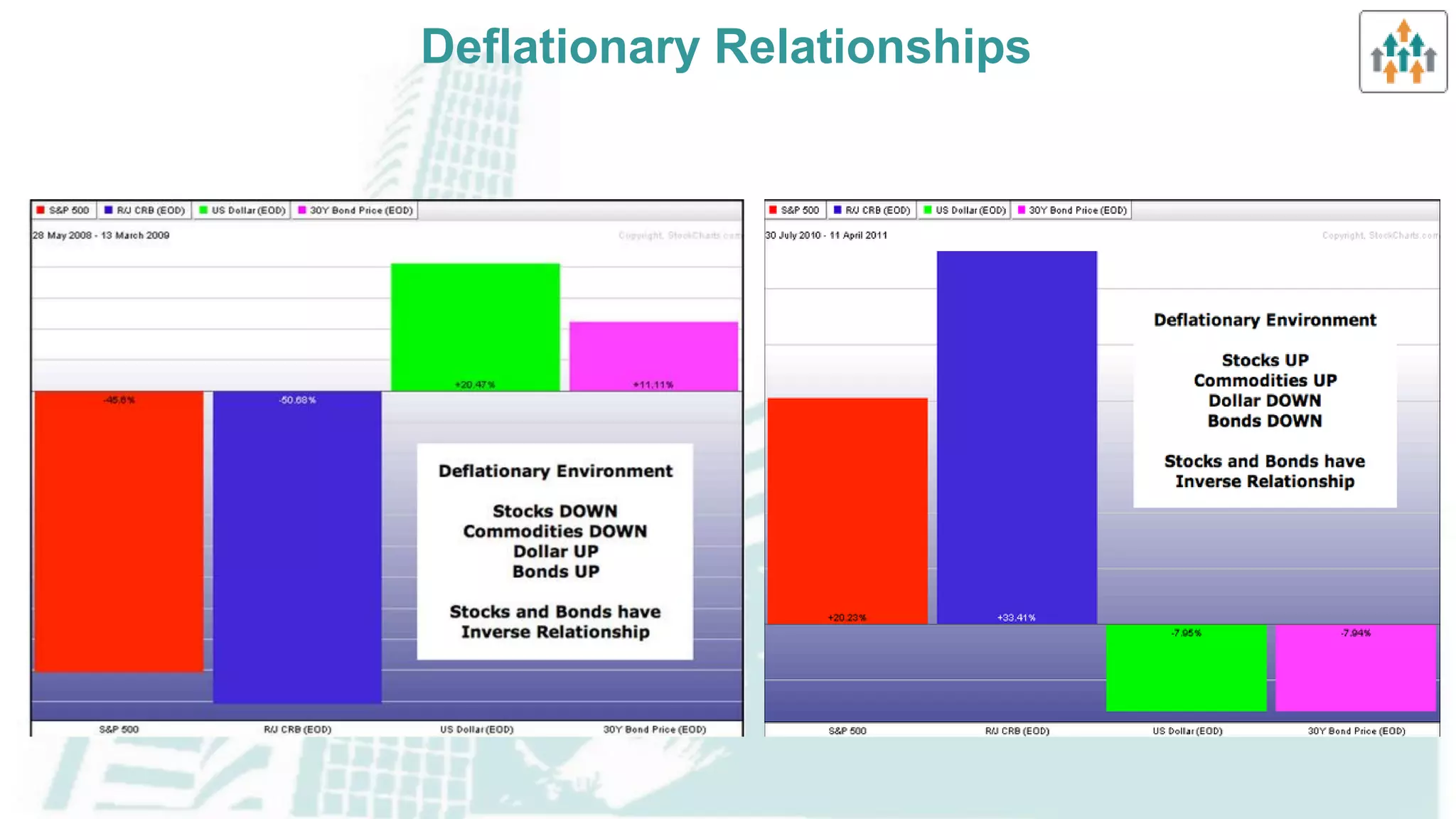

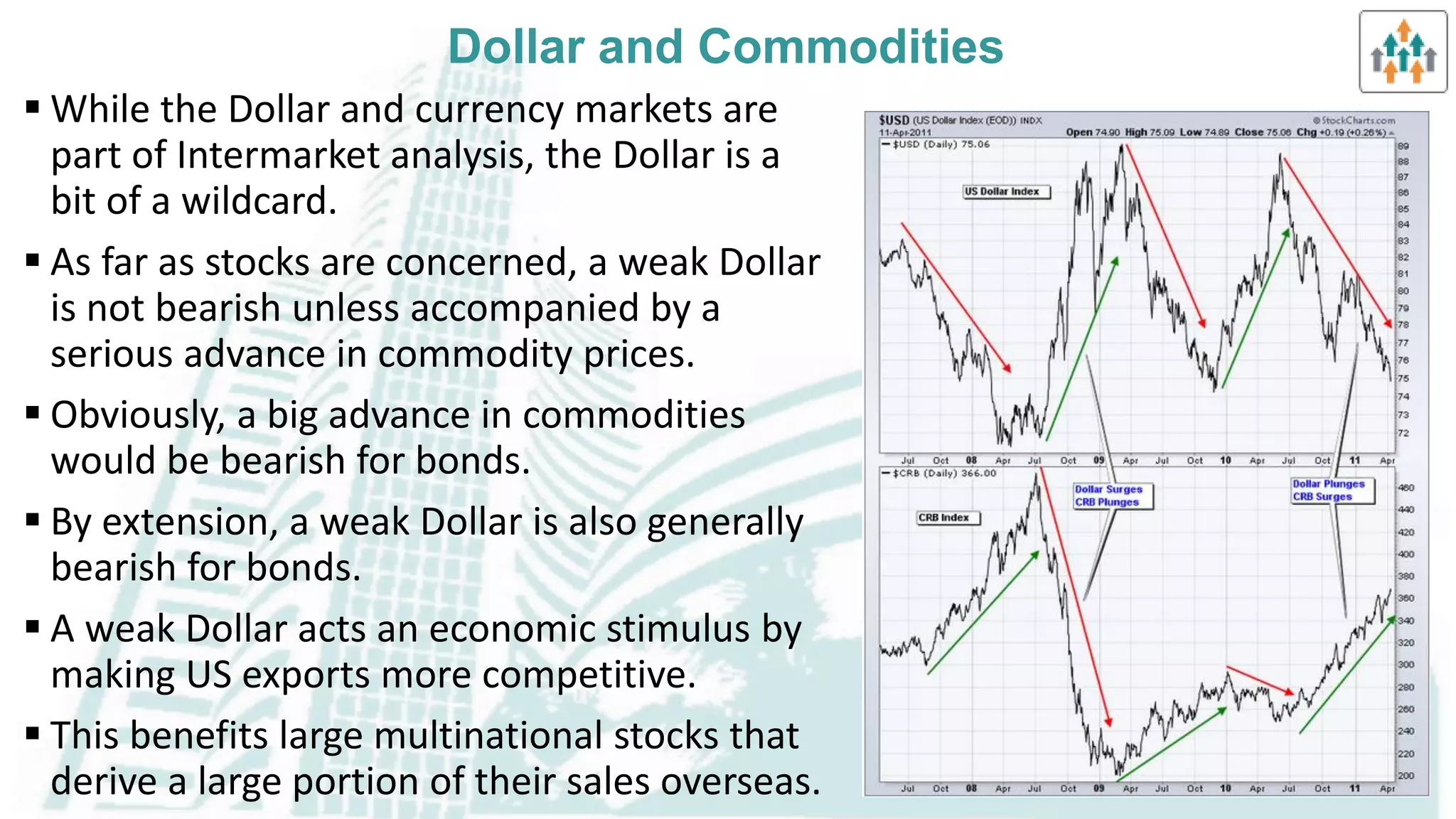

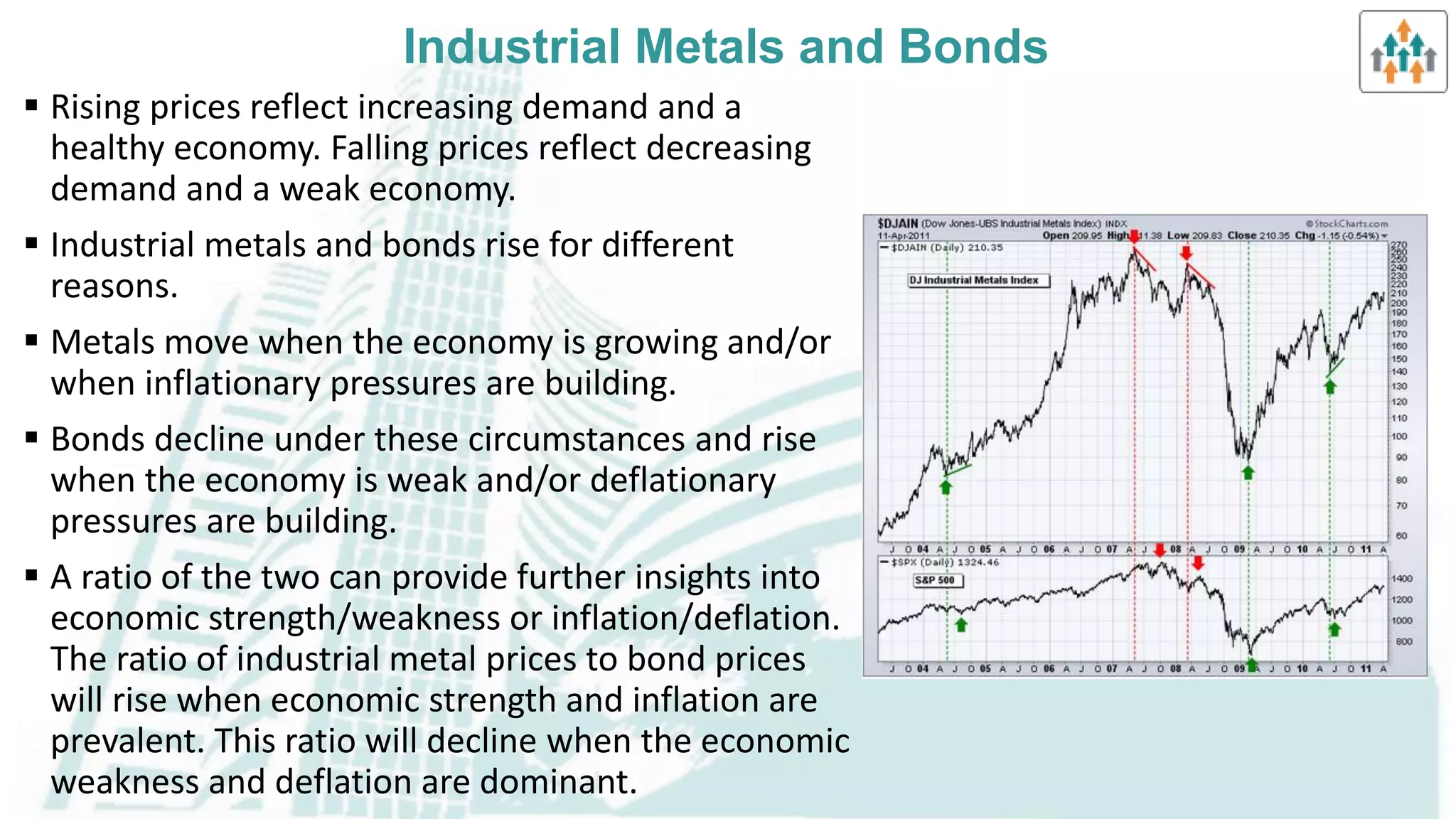

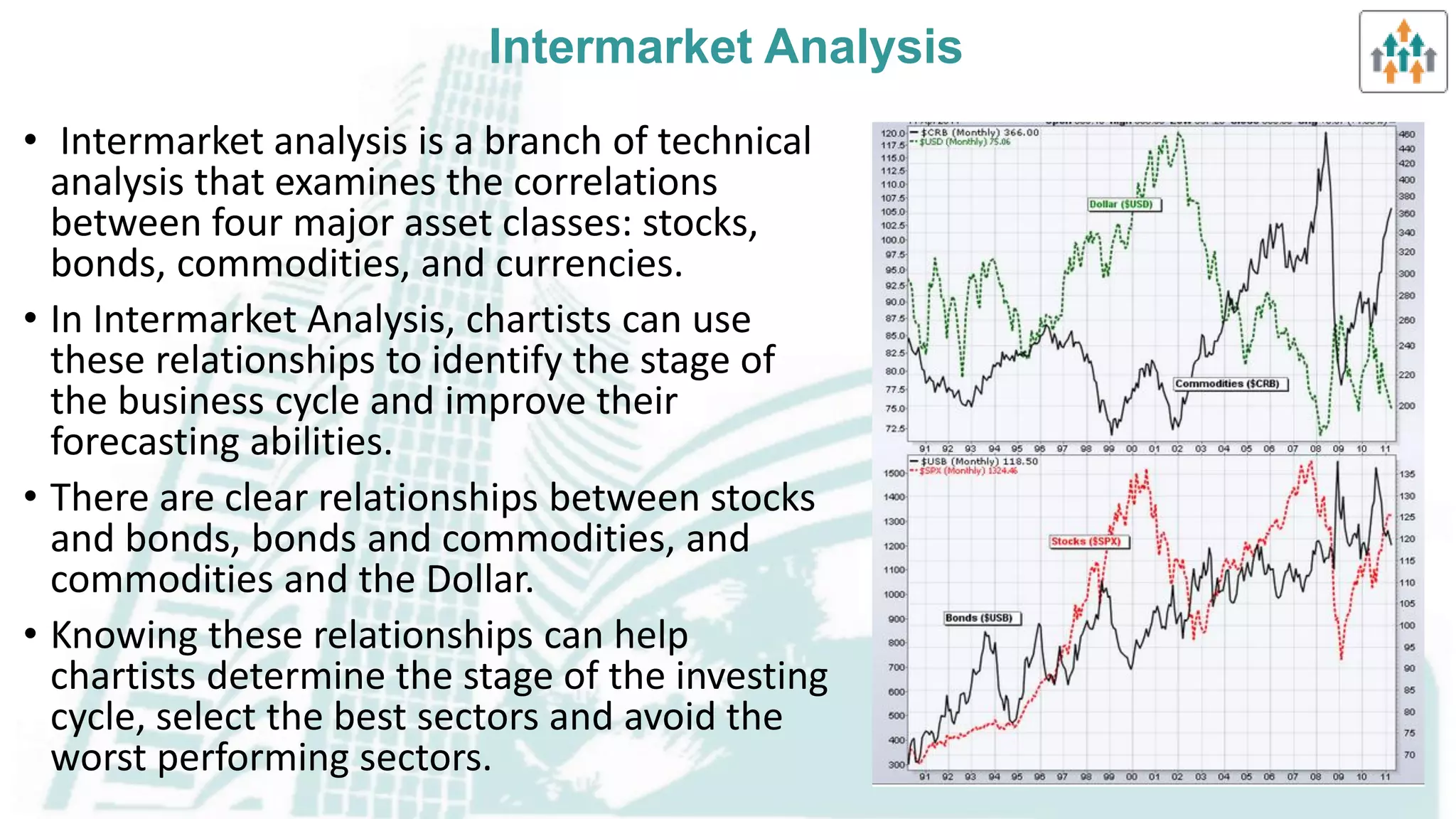

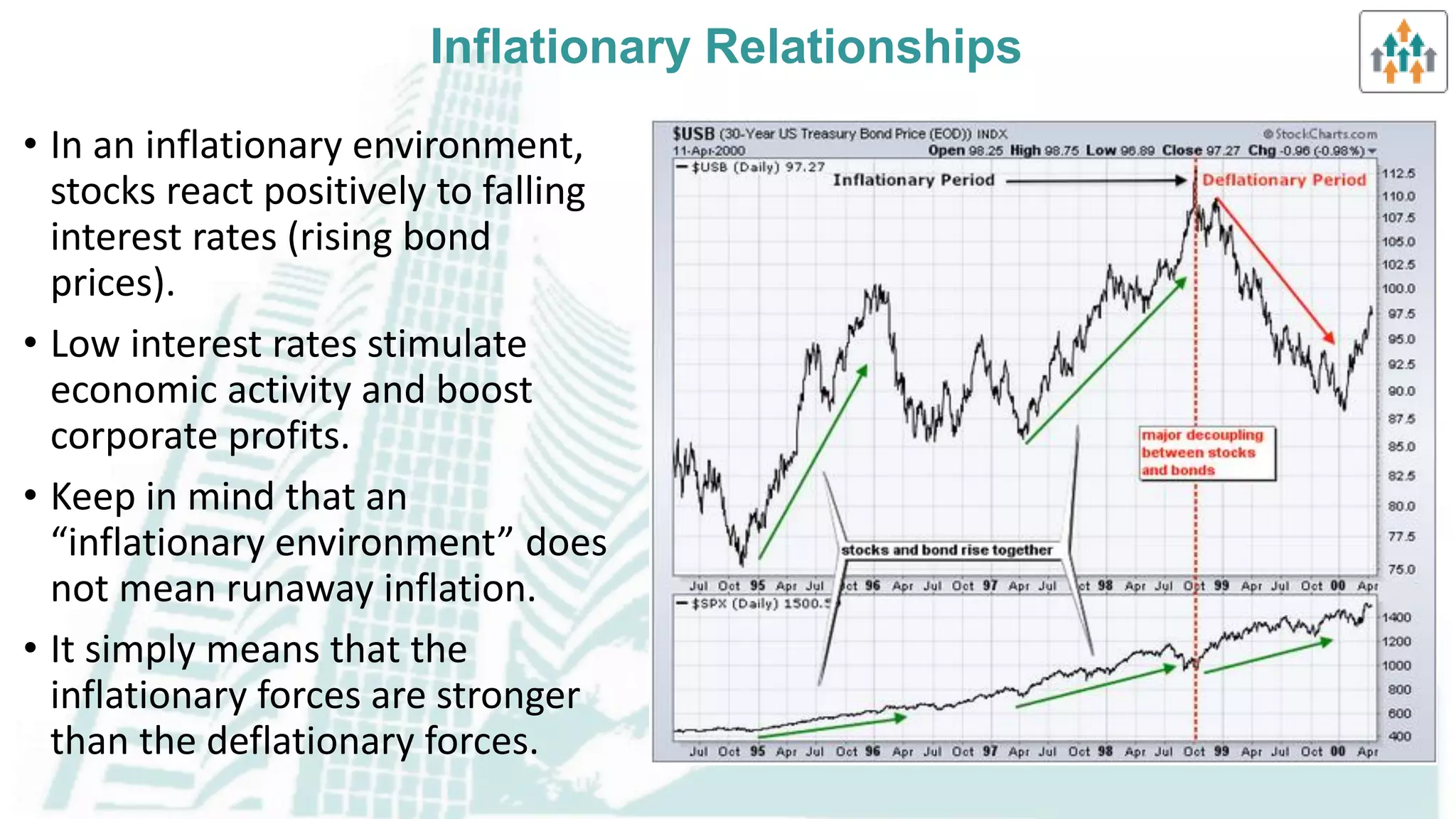

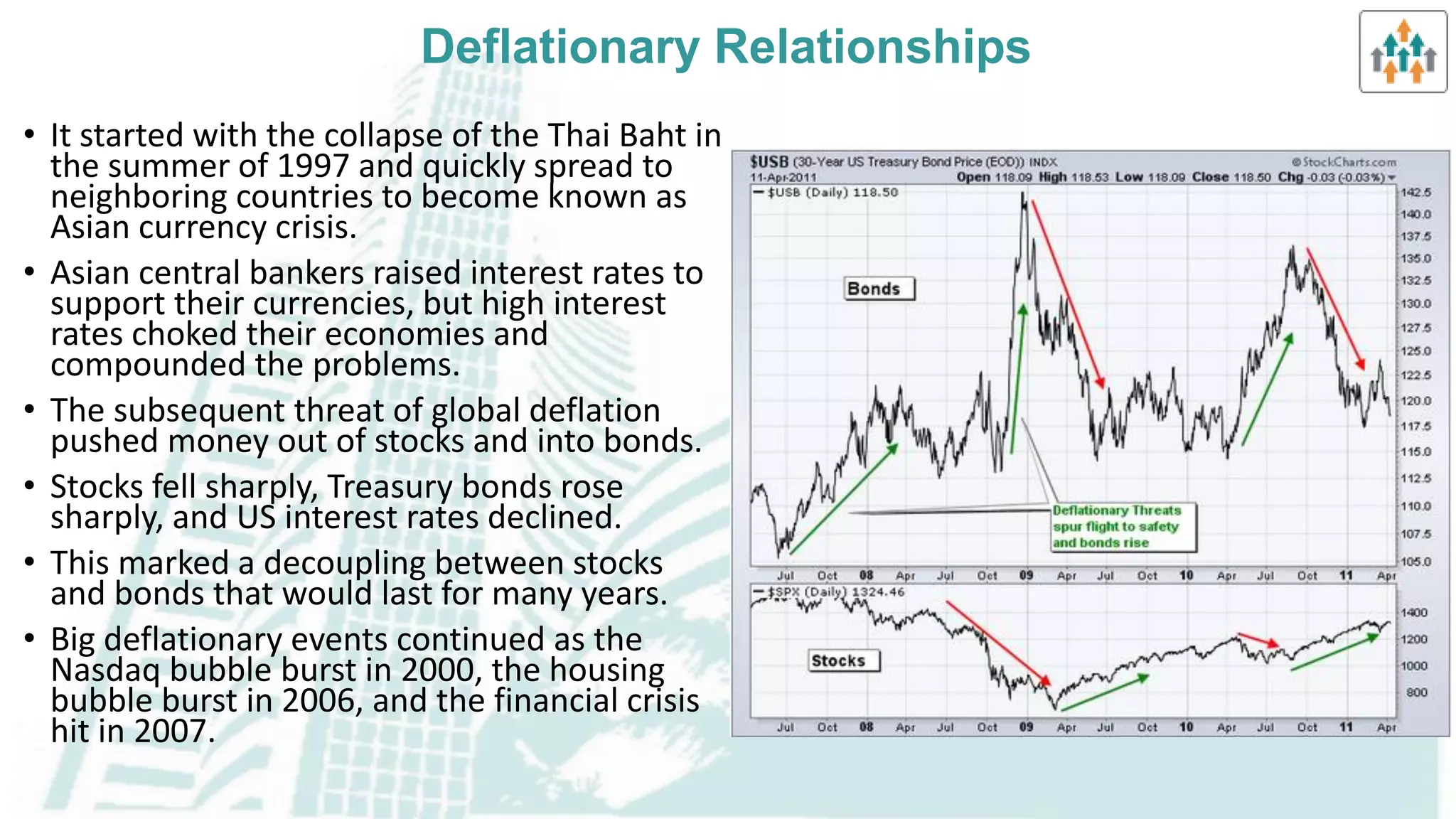

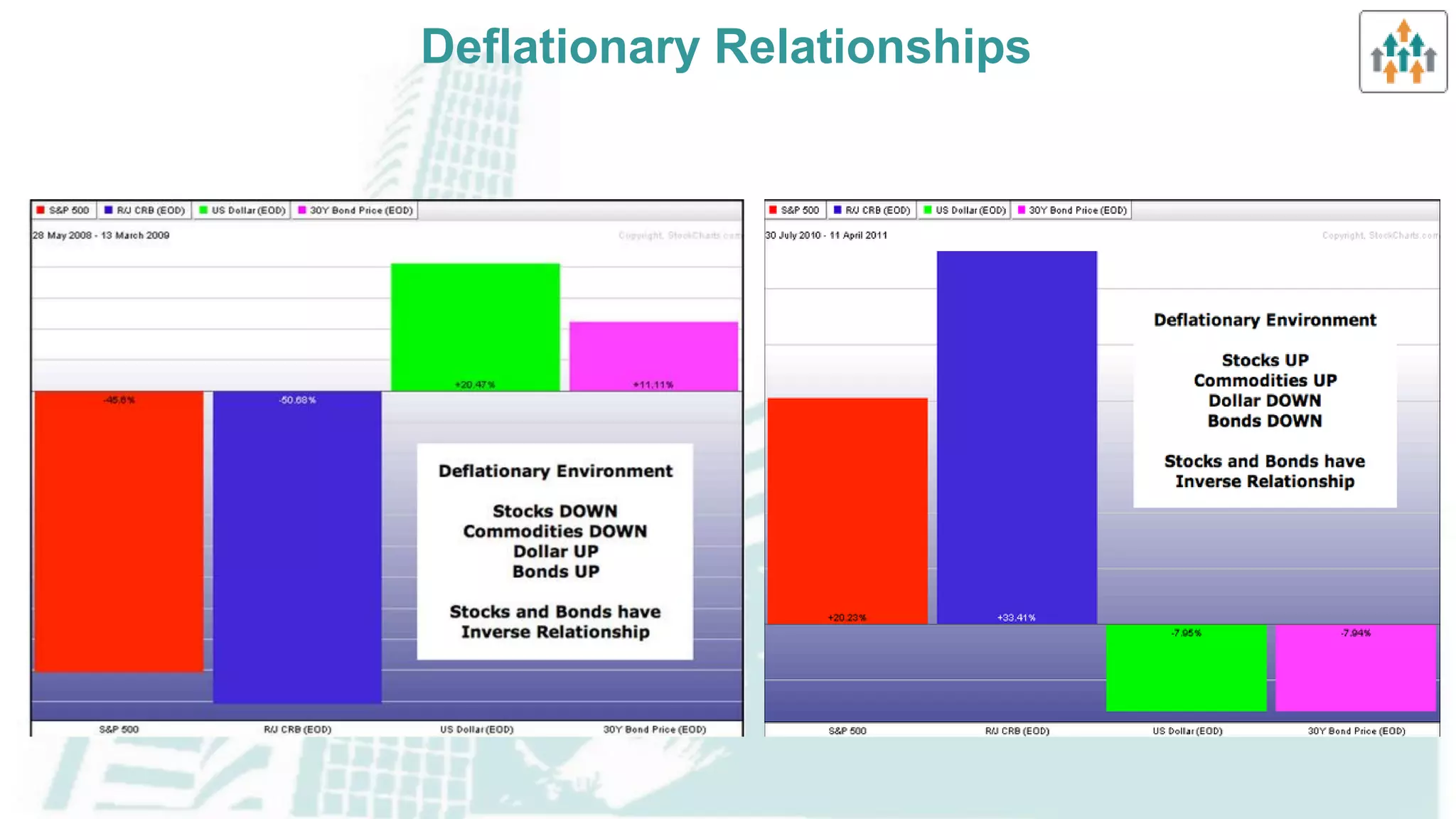

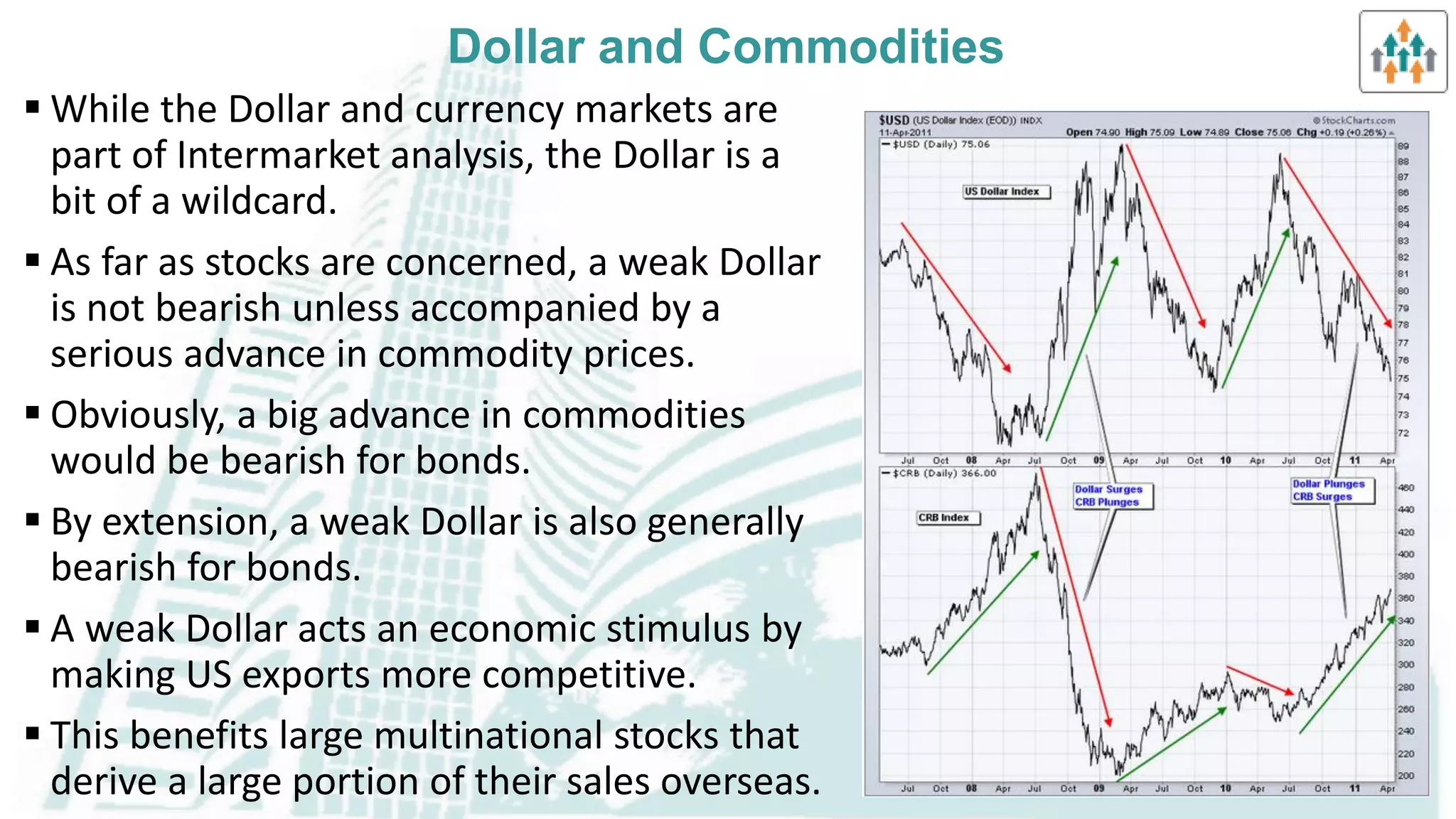

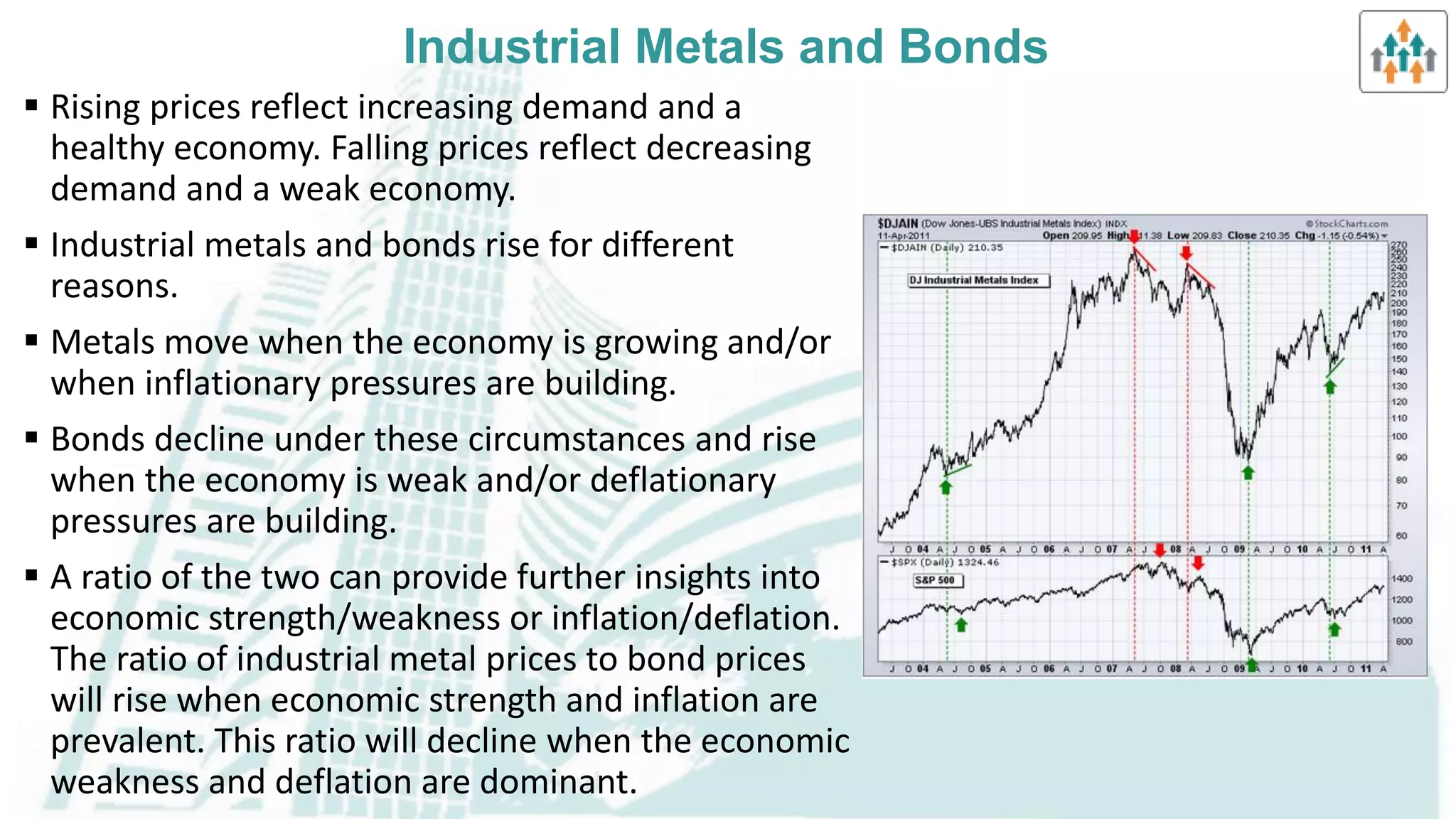

The document discusses intermarket analysis, which examines the correlations between stocks, bonds, commodities, and currencies. In inflationary environments, stocks and bonds are positively correlated, while bonds and commodities and the US dollar and commodities are inversely correlated. In deflationary environments, stocks and bonds become inversely correlated. Understanding these intermarket relationships can help analysts determine the stage of the economic cycle and select appropriate sectors to invest in.